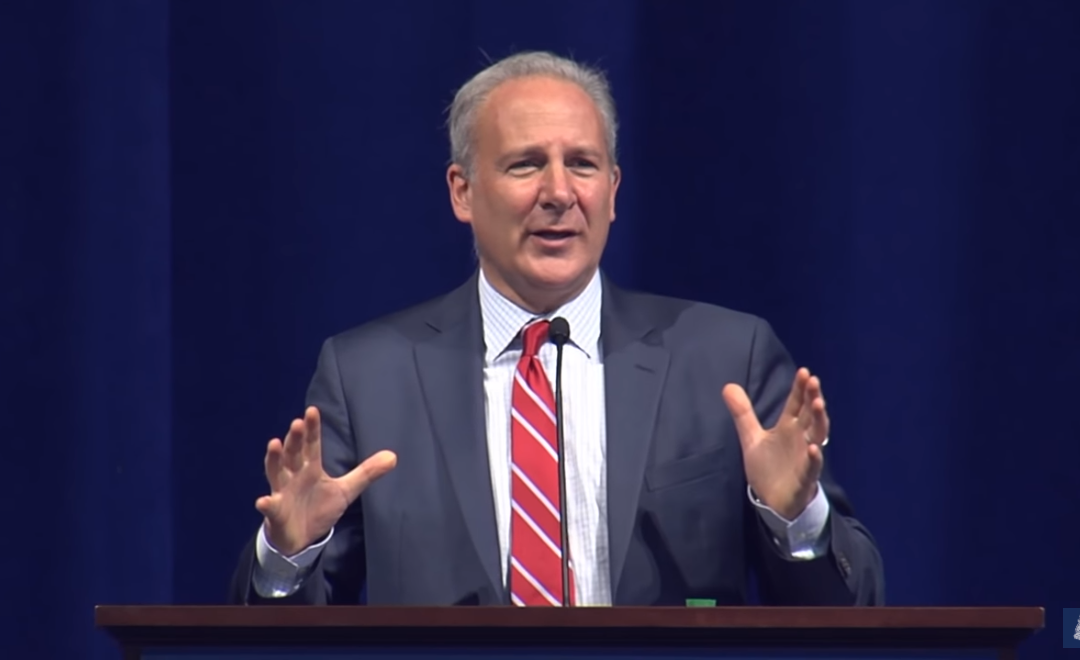

With another Federal Open Market Committee meeting past and the approval of another interest rate cut, all of the pundits are weighing in. And economist Peter Schiff is again wondering when the market is going to wake up to the “con” he says the U.S. economy is.

The Fed voted to cut its benchmark interest rate another 0.25% on Wednesday, down to the 1.5% and 1.75% range. It was the third cut since July and first three cuts since 2008. The problem most pundits see is that it is highly unusual for the Fed to cut rates while the economy is “the greatest in American history,” if you’re buying what President Donald Trump is selling.

Schiff, a libertarian, is clearly not buying it.

Yeah right, and Trump Steaks were the greatest steaks in the world. You are too smart to actually believe a statement that dumb. You can’t help make America great again in the future if you have no conception of just how great America was in the past!

— Peter Schiff (@PeterSchiff) October 30, 2019

Trump went on to voice his displeasure with the Fed only cutting a quarter-point, but Schiff argues that Fed Chief Jerome Powell himself doesn’t believe the economy is strong or he wouldn’t be cutting rates.

Powell said that American households are in great shape, and that he does not see any problems with excess leverage. I guess a key job requirement for being Fed chairman is being completely blind to any obvious debt problems that result from overly accommodative monetary policy!

— Peter Schiff (@PeterSchiff) October 30, 2019

If Powell agreed with Trump’s assessment that the current U.S. economy is the greatest in history he would not have cut interest rates to 1.5%,with inflation, even as measured by the CPI in excess of 2%, and the Fed would not be expanding its balance sheet to rescue the economy!

— Peter Schiff (@PeterSchiff) October 30, 2019

Schiff also asked on his latest podcast why Powell is accommodating the strongest economy in the history of our country, particularly because he said last year the Fed would continue raising rates through 2019.

“And they said this with a straight face,” Schiff said, “and everybody believed them.”

Now, Schiff said, the Fed is trying to “keep rates artificially low to suppress the cost of borrowing to help out all the debtors so they can make payments on their debt, and keep the stock market elevated, to keep real estate prices elevated.”

He went on to say the Fed has restarted quantitative easing but is refusing to call it that because it doesn’t want to admit “the economy needs it.”

“Well, if everything is good, why do we need the emergency monetary policy when everything wasn’t good?” he asked. “When we were trying to get the economy out of a bad place, we did QE. And if it’s now in a good place, why are we doing it again? So, that’s why he wants to deny he’s doing it.

“The only key is when is the market going to wake up to this game, this con. When are they going to realize the box the Fed has put itself in? That it is completely impotent when it comes to inflation-fighting? That it is all bark and no bite, and it basically, it’s not even barking yet? It’s only talking about the prospect of barking in the future, but it will never bite. And when the markets figure this out, the bottom is going to drop out of the dollar. Gold is going to absolutely go through the roof.”

Editor’s note: Schiff has been bearish on the Fed and economy for quite a while now but he makes a good point. Why do you think the Fed is cutting rates and restarting QE (even though it won’t call it that) while the economy is booming? Share your thoughts below.