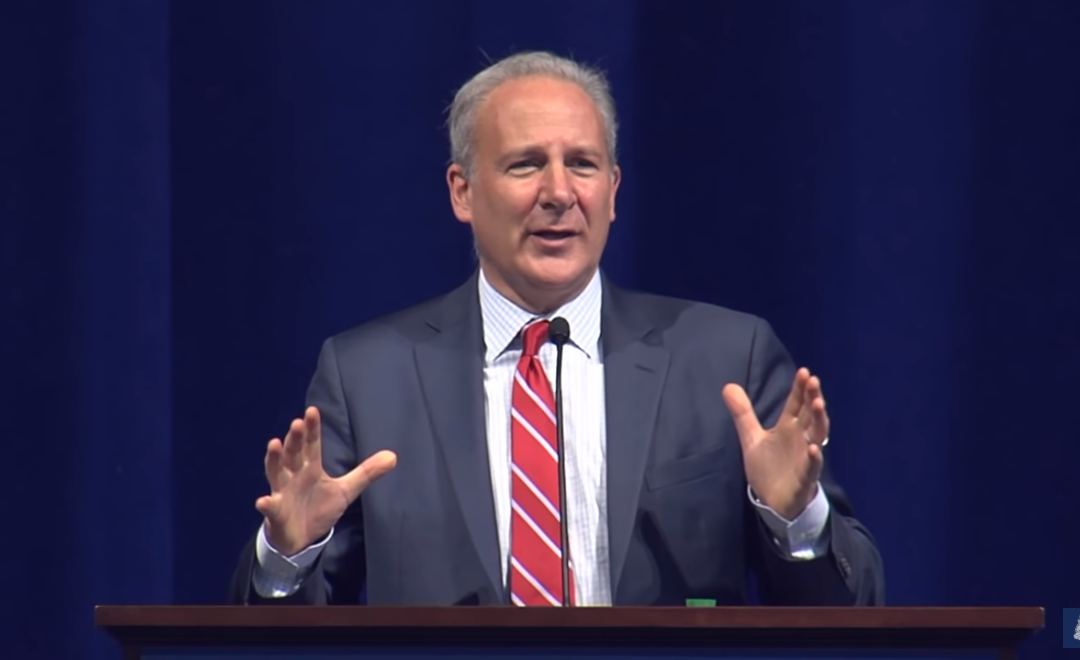

Euro Pacific Capital CEO Peter Schiff thinks the U.S. government’s lackadaisical approach to lending and spending is driving the dollar to a collapse no one will be able to stop.

“And these large deficits, budget deficits and trade deficits, were here long before we elected Donald Trump.”

Schiff recently appeared on RT, a Russian international TV network, alongside former Pentagon official Michael Maloof, to discuss the world’s waning patience with the U.S. and its tendency to be an economic bully to other countries with sanctions and tariffs, according to SchiffGold.com.

What’s worse, Schiff argues, is that America’s tendency to throw money around is going to tank the dollar’s value.

“The real issue for the dollar and what’s going to sink the dollar is our own fiscal profligacy,” Schiff said. “And these large deficits, budget deficits and trade deficits, were here long before we elected Donald Trump.”

Schiff believes the world has enabled America to “live beyond its means” by using the U.S. dollar as a primary reserve currency and loaning money to the U.S., but it’s all “going to come to an end.”

“I think we’re going to see a collapse in the value of the dollar, and when the dollar does collapse, America’s power is going to dissipate,” Schiff said.

The precious metals guru and economist believes the dollar’s collapse is inevitable because the only way anything changes is in the event of a crisis — like a recession.

“It’s going to be a dollar crisis. It’s going to be a sovereign debt crisis. It should have already happened,” Schiff said. “We’ve been able to kick the can down the road for many, many years. But the problem with all the can kicking is the underlying problems have gotten so much worse.”

Schiff pointed to the situation in Iran as an example of America “flexing muscle we really shouldn’t be flexing.” He argues that sanctions against the Middle Eastern country are backfiring because Iran is now turning to China for aid in exchange for oil.

“We’re in effect biting the hands that have been feeding us, and now they’re questioning whether or not they should continue to do that,” Schiff said. “And so we’ve accelerated the process of the dollar’s demise by antagonizing so many of the nations around the world that we really need to continue to hold the dollar.”

And speaking of China, Schiff doesn’t agree with Trump’s assertions that the Chinese are powerless in their trade war with the U.S. because America has “far more to lose.”

“The Chinese simply lose a customer that doesn’t pay, that they have to vendor finance,” Schiff said. “But we lose a banker, we lose a supplier. The Chinese have been propping up the U.S. economy.”

As further evidence of confidence lost in the U.S. dollar, Schiff goes to his wheelhouse, the gold market. He believes the rising cost of the precious metal is “showing an underlying weakness in the dollar that the FOREX markets aren’t showing yet.”