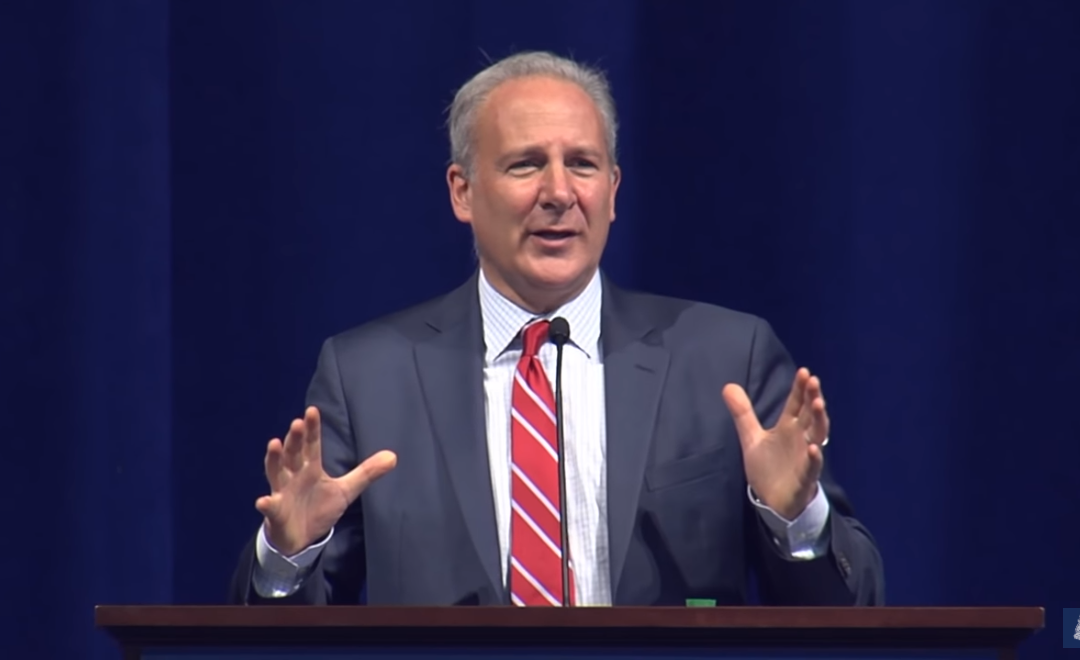

Economist Peter Schiff said in December that the incoming Federal Reserve interest rate hike would be the last for a long while, and the next step would more likely be a rate cut, not a hike.

Fed Chair Jerome Powell spoke Tuesday, bringing that Schiff prediction closer to reality when he dropped the word “patient” and flat out said the central bank was monitoring the stock markets and will be ready to act if things go too far south due to U.S. President Donald Trump’s trade wars.

“We do not know how or when these issues will be resolved,” Powell said in his remarks. “We are closely monitoring the implications of these developments for the U.S. economic outlook and, as always, we will act as appropriate to sustain the expansion.”

Appearing on the Fox Business show “Countdown to the Closing Bell,” Schiff said the rate cut he predicted is coming.

“I don’t think that Powell would even open the door to the possibility of a rate cut if he wasn’t prepared to walk through it,” Schiff said.

He knew December’s rate hike would be the last because the stock market collapsed during the fourth quarter of 2018, and a rate cut was “all they’ve got left in their quiver” to stop the fall.

The host then pointed out that the market pops at the mere suggestion of a rate cut.

“Exactly,” Schiff said. “But I think people are wrong if they think it’s going to work again. The Fed was able to inflate an enormous bubble with QE one, two and three, and keeping rates at zero for as long as they did. But the next time, it’s not going to work.”

Schiff noted that bond traders are anticipating a recession, betting the Fed will cut rates.

“They’re right. But they’re wrong on the outcome. We’re going to have stagflation. It’s inflation that’s going to be the problem,” he said. “And the economy is headed into recession, but the Fed should not be cutting rates because it’s stoking the inflation fire.”

The host then pointed out something Powell mentioned in his speech Tuesday: Inflation is below the Fed’s current 2% target, so why would it suddenly shoot up?

“We’re not way below. We’re barely below the 2% number,” Schiff said. “But that’s just the way government measures it. Of course, in reality, prices rise faster than what the CPI reveals.”

Schiff then said the Fed is going back to zero interest rates and reinstituting quantitative easing (QE4), which will be bigger than the first three rounds combined.

“The Fed is going to go back to QE. They are going to do whatever they can to try to stop the bear market and to try to prevent the recession,” he said. “But they’re going to fail. They are going to make it worse this time.”

Powell noted that QE is no longer unconventional policy, calling it “business as usual.” Schiff said this new “business as usual” is going to cause the dollar collapse. The only reason it didn’t last time was because everyone thought it was temporary in the aftermath of the Great Recession and that the Fed would eventually normalize rates and reduce its bond holdings.

“But when the markets realize what they should have realized from the beginning — that this is a permanent expansion of the balance sheet — this is debt monetization, that there is no end in sight, that it’s going to be zero percent forever,” he said, “then the bottom is going to drop out of the dollar and then we’re going to get all the inflation that we should have had, only more.”

The solution? Being the precious metals expert that he is, Schiff said to buy gold.

“Remember, we got as high as $1,900 back in 2011 when people were actually worried about QE,” he said. “Well, they were right to worry. The mistake was in thinking that everything was OK. So when we go back to QE and zero percent interest rates, gold is not stopping at $1,900. We’re going to $5,000 to $10,000.”