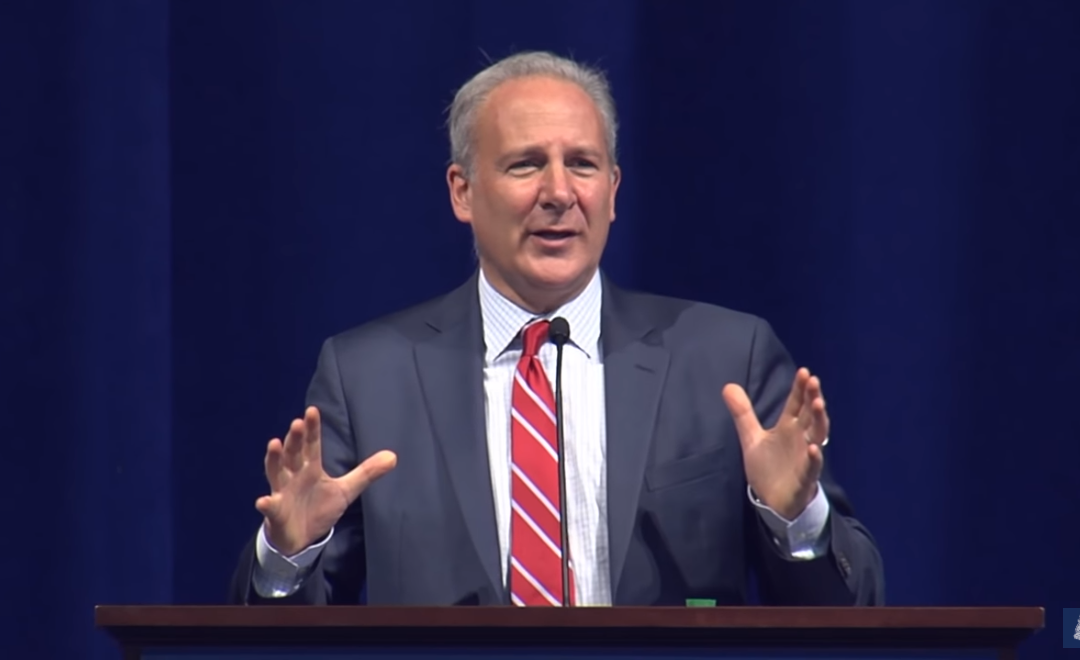

Libertarian economist and gold expert Peter Schiff has become more than a little bearish on the handling of the trade war with China by President Donald Trump, who he says has greatly underestimated the leverage and will wielded in Beijing by President Xi Jinping.

So much so that Schiff likened Trump charging into the trade war to General George Custer charging into the Battle of the Little Bighorn — also known as Custer’s Last Stand — where he and 210 of his troops were slaughtered by embedded Native American forces.

“By mistaking the real nature of international trade, the costs of tariffs, the effects of currency movements, and the supposed ease with which the United States could quickly re-establish itself as a low-cost manufacturer, Trump risks shredding the safety nets that have undergirded the U.S. economy for decades and plunging us into a war we are ill-equipped to fight,” Schiff wrote on his blog at SchiffGold.com.

Schiff notes that while a trade war hurts both sides, many argue that due to its smaller economy, more volatile stock market and need for U.S. consumers, China is in a weaker position, even though the U.S. will feel short-term pain.

“But President Trump goes much further, and asserts that a trade war itself, not just the results that may flow from it, will be a boon to America. He believes that tariffs are currently boosting growth and are restoring our manufacturing prowess,” Schiff wrote. “Based on his rhetoric, it’s hard to imagine why we would ever want a trade war to end. CNBC’s Jim Cramer went one step further, arguing that tariffs may place a small burden on U.S. consumers but Chinese manufacturers will cut prices in order to preserve U.S. market share. In other words, China will throw itself on a grenade meant for us by bearing the cost of the tariffs, and their expenditures will flow directly into U.S. coffers.”

Schiff then questioned the motivation behind Trump’s rhetoric on trade and whether he really wants a deal at all, and that the endgame is is to force the Fed’s hand on an interest rate cut.

“For weeks, he has been saying that the Chinese have been dragging their feet because ‘they were being beaten so badly’ in the negotiations. Basic tactics would suggest that a way to get your adversaries to agree to a deal that is not in their interest is to convince them that it is in their interest,” Schiff wrote. “By saying loudly that the deal favors the U.S., Trump is not exactly pushing them over the finish line. In my mind, Trump may not want the agreement. He may just want the war instead. More importantly, the economic uncertainty could force the Federal Reserve to cut interest rates, which may be his most desired outcome.”

While it is true that China has illegally stolen U.S. tech and intellectual property, Schiff says the U.S. has come out ahead because without cheap goods imported from China, U.S. consumers would pay more for key products. Interest rates also would be higher without China buying so much U.S. debt, which is hard to quantify how beneficial this is because the U.S. economy has been driven by borrowing and spending for decades now.

Trump believes tariffs are a weapon, but that weapon is only hurting U.S. consumers, Schiff says, because it forces your consumers to pay higher prices for goods.

“Trump downplays these fears by saying it would be very easy for Americans to avoid higher prices by bringing manufacturing back home, where tariffs won’t apply,” Schiff writes. “He seems to believe American firms that have relied on foreign production for decades can just start producing domestically.

“This is a fantasy.”

Schiff uses Nike as an example. Based in Oregon, Nike employs 70,000 U.S. workers but its shoes are mass-manufactured in China and other Southeast Asia countries like Vietnam. In order to start producing goods in the U.S., it would need to build facilities, which would take years to do, and it would have to come up with the money to do so.

“It might have to cancel its share buybacks, or issue new share offerings to raise money to fund the capital expenditures,” Schiff writes. “If this were to happen at a time of falling profits, its share price might drop. If all U.S. companies now relying on imports did likewise, what impact might that have on the stock market?”

Contrary to prevailing theory that China won’t start dumping U.S. Treasurys, Schiff said he thinks China will do just that.

Selling Treasuries could push up long-term interest rates in the U.S. and weaken the dollar, possibly generating inflation and slowing the economy. Americans would face much higher prices for goods and would have to pay more to borrow to buy homes and cars, or to build businesses. This might force the Fed to deliver greater monetary stimulus as the economy slowed, further weakening the dollar, and putting the U.S. into a possibly dangerous inflationary spiral. The countless benefits that accrue to Americans as a result of a strong dollar would be lost.

Conversely, dumping its cache of more than $1 trillion in Treasuries could strengthen the RMB. But a strong currency is precisely what China needs to drive domestic consumption and lessen its “dependence” on exports. This has been its stated economic goal anyway. A cheap currency may help exports, but a strong currency empowers domestic consumption. Such a move could help China mature into a healthier and more balanced economy.”

But it’s not just China that could dump Treasuries and enjoy the possible twin benefits of increased purchasing power and domestic investment, but the rest of the world as well, particularly South East Asia. That entire region might witness the benefits if local trade, investment, and consumption all rose. Countries might no longer compete to debase their currencies to preserve market share in the U.S., but allow their currencies to rise, engendering the possibility for increased domestic investment and consumption.

So not only does Trump risk blowing America’s great deal with China, but with the entire world. The dollar’s role as the reserve currency could be lost, as would the artificially high living standards it has produced. Americans would finally be forced to live within their highly diminished means. Borrowing would have to be financed from the shallow pool of domestic savings, and consumption would be limited by domestic production, as imports would have to be paid for with exports of real products rather than mere paper dollars.

While Custer believed blindly in his own invincibility, in the end, he was only a general with about 300 unlucky cavalrymen under his command. But his defeat was just a temporary setback, as the weight of the American economy ultimately overwhelmed the Native Americans’ ability to defend their traditional way of life. While Trump’s blunder will be equally as foolish as Custer’s, this time it’s the modern American way of life that may be lost.

Editor’s note: Schiff is correct when he says it’s “fantasy” for U.S. companies to all of a sudden start producing their goods here in the states because the infrastructure (facilities, availability and shipping of materials, etc.) isn’t in place. But do you think he’s underestimating the strength of the U.S.’s position in regards to China and the trade war, and what is he missing? Share your thoughts in the comments below.