Money & Markets Week Ahead for the week of February 1, 2021: Pharmaceutical earnings should tell us more about how profitable COVID-19 vaccine efforts have been.

It was an interesting week on Wall Street last week, with some of the biggest companies reporting quarterly earnings.

However, one company that found itself in a battle between large, institutional hedge funds and retail investors drove financial news headlines.

Short squeezing aside, there’s another big IPO and several large companies reporting earnings this week. Here’s what to look for in the week ahead on Wall Street:

On the IPO Front

There are a few initial public offerings (IPO) to watch.

Telus International Inc., which expects to price its IPO on Wednesday or Thursday, may be the biggest launch to watch.

What is it? Telus International Inc. is a Canadian-based telecommunications company that provides customer experience consulting and software implementation services.

Its clients include more than 600 companies within the technology, games, communications, media, e-commerce, fintech, health care, travel and hospitality industries.

Cisco Systems Inc., Salesforce.com Inc. and Google Cloud are among that long list.

The company has 50,000 employees in 50 locations scattered across 20 countries.

Over the last three years, the company has increased its top-line revenue by more than 36%.

In 2018, Telus reported its total revenue at $834.6 million. For the nine months ending September 30, 2020, that total revenue was already at $1.14 billion.

The company said it expects its full-year total revenue for 2020 to be between $1.57 billion and $1.58 billion.

Telus’ net income jumped from $41.7 million in 2019 to $81.9 million in 2020 — minus the fourth quarter.

Its operating margin dropped from 11.2% in 2019 to just 7% for the nine months ending September 30, 2020.

The company has around $139 million in cash to go along with around $1.8 billion in total liabilities, according to its registration statement.

The offering. Telus intends to trade on both the New York Stock Exchange and the Toronto Stock Exchange.

It will trade on the NYSE under the ticker TIXT.

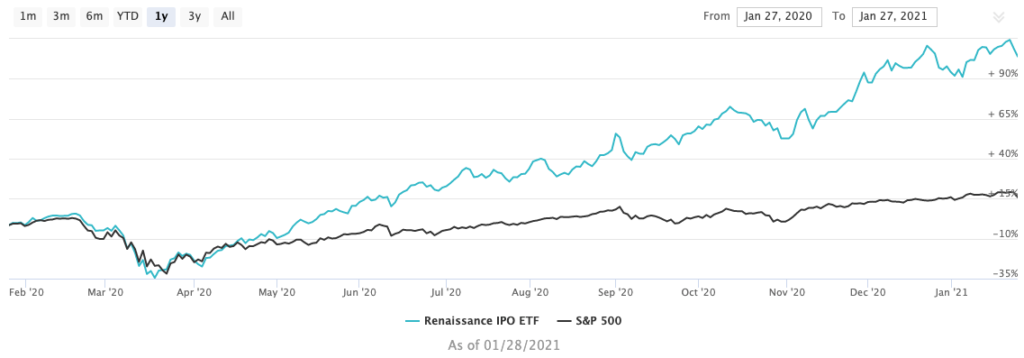

It comes at a time when the Renaissance Capital IPO ETF (NYSE: IPO) is up 103% over the last 12 months compared to an increase of just 16% for the S&P 500.

The exchange-traded fund tracks the performance of IPOs across the market.

Renaissance IPO ETF Up Triple Digits Since January 2020

Telus is planning to sell 21.93 million shares in the IPO, and existing shareholders are selling another 11.4 million for a total of 33.33 million shares.

The IPO price range is between $23 and $25 per share.

It’s looking to raise as much as $833 million from the IPO, which would give the company a valuation of close to $7 billion.

Of note. According to Reuters, the Telus IPO could be one of the largest in recent history in Canada. Waste management firm GLF Environmental Inc. raised nearly $1.4 billion in its 2019 IPO.

The company said it will use the $493.9 million it plans to keep from proceeds to pay down debt, including debt incurred to acquire other companies.

It recently acquired data annotation company Lionbridge AI.

JPMorgan and Morgan Stanley are the lead bookrunners on Telus’ IPO.

Deeper Dive: Pfizer Inc. Earnings

This is another big week of quarterly earnings for the market.

A lot of companies are reporting, with pharmaceuticals leading the charge.

Several big pharma companies will report, including:

- Vertex Pharmaceuticals Inc. (Nasdaq: VRTX).

- Pfizer Inc. (NYSE: PFE).

- AbbVie Inc. (NYSE: ABBV).

- GlaxoSmithKline PLC (NYSE: GSK).

- Merck & Co. Inc. (NYSE: MRK).

- Bristol Myers Squibb Co. (NYSE: BMY).

- Sanofi (Nasdaq: SNY).

- Regeneron Pharmaceuticals Inc. (Nasdaq: REGN).

Today, I want to focus on Pfizer Inc.’s (NYSE: PFE) expected earnings.

I talked about Pfizer in an episode of The Bull & The Bear podcast back in November. You can check out my comments here.

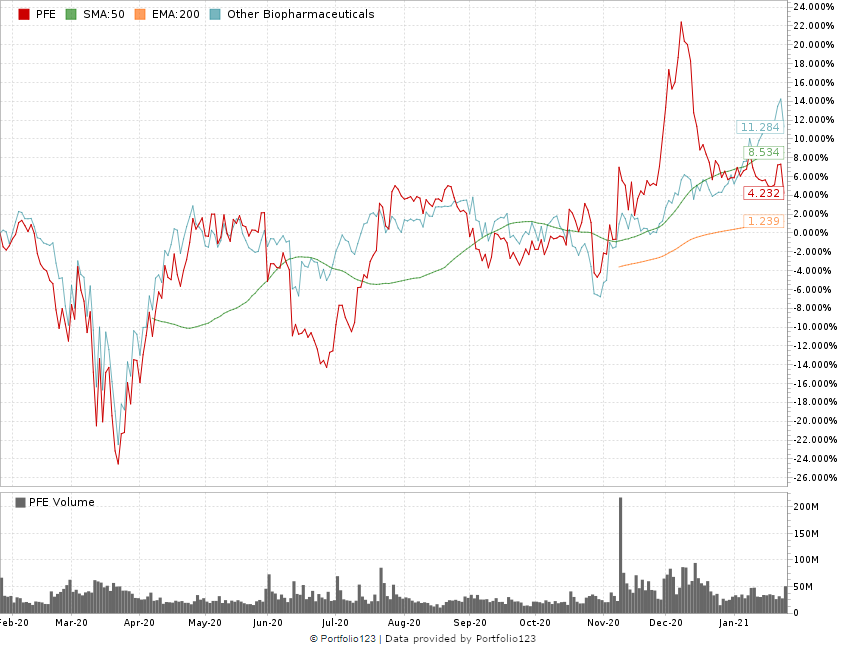

I drew a bit of criticism because I said Pfizer was not a stock to buy, especially for the long term.

And, so far, I’ve been right.

When I said it wasn’t a buy, the stock was trading at about $36.26 per share. As of the time I am recording this, it is actually down to $36.25.

Pfizer Stock Down Since I Recommended Staying Away

Minus a big uptick in mid-December, the stock continues to trade relatively flat, meaning the boost from the COVID-19 vaccine it released was only temporary.

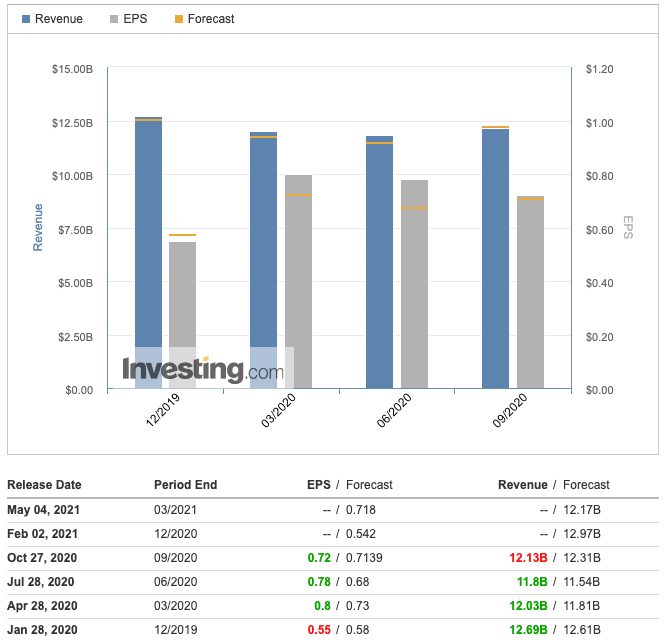

In terms of its earnings, I suspect (as does Wall Street) that its quarterly earnings will be much lower than the previous four quarters.

The company did have an earnings beat in the third quarter of 2020 after reporting earnings per share of $0.72. But the beat wasn’t that much. Wall Street analysts projected earnings of $0.7139 per share.

Its revenue came in at $12.13 billion … much less than the analysts’ projections of $12.31 billion.

Pfizer Earnings Barely Beat Projections in Q3 2020

For the fourth quarter, analysts project earnings per share of $0.542 per share on revenue of $12.97 billion.

The revenue increase is mostly due to its COVID-19 vaccine rollout in the United States.

However, different companies have rolled out their own vaccines since then.

Moderna’s vaccine is now available, and three more company’s vaccines are in Phase 3 clinical trials — meaning they are very close to being released.

What it means … When I recorded the podcast video about Pfizer, I said that because Pfizer wasn’t going to be the only player in the vaccine game, its gains would be short-lived.

And, I was right.

I think Wall Street analysts are pretty spot-on with their projections for Pfizer’s quarterly earnings.

Revenue will be up, but earnings will be much less than the last four quarters.

I still don’t think that Pfizer is a strong buy for your portfolio.

Money & Markets Week Ahead: Data Dump

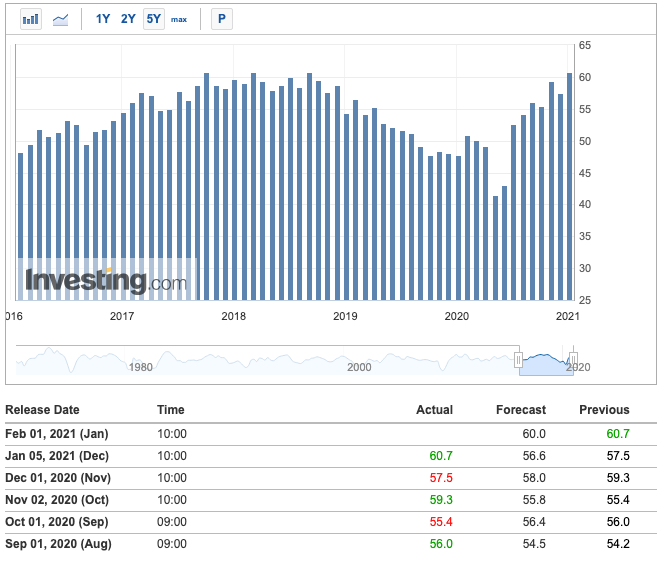

The Institute of Supply Management (ISM) will release its monthly Purchase Manager’s Index for the month of January on Monday.

This index is compiled from a survey of purchasing and supply executives from more than 400 industrial companies. It measures the outlook for American manufacturing.

Monthly Manufacturing PMI Climbed Steadily Since March 2020

For December, the index reading blew past projections as purchase managers felt strongly about the rise in the industry.

January projections are for an index reading of 60 — slightly lower than the 60.7 registered in December.

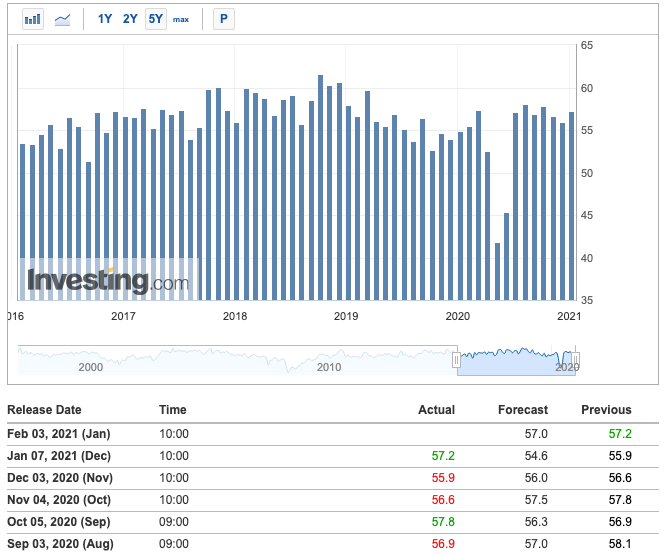

ISM will follow up that report with a separate non-manufacturing purchase manager’s index on Wednesday.

The difference between the two is quite simple: Wednesday’s index factors out all of manufacturing. It looks at business activity in all other sectors.

Take out manufacturing, and you can see that the index has been relatively flat since June 2020.

Non-Manufacturing PMI Moved Slightly Since June 2020

The index — while indicating growth (above 50) — has been between 56 and 57 for the entire second half of 2020.

Forecasts indicate the index will stay in that range for the month of January — meaning slight growth confidence.

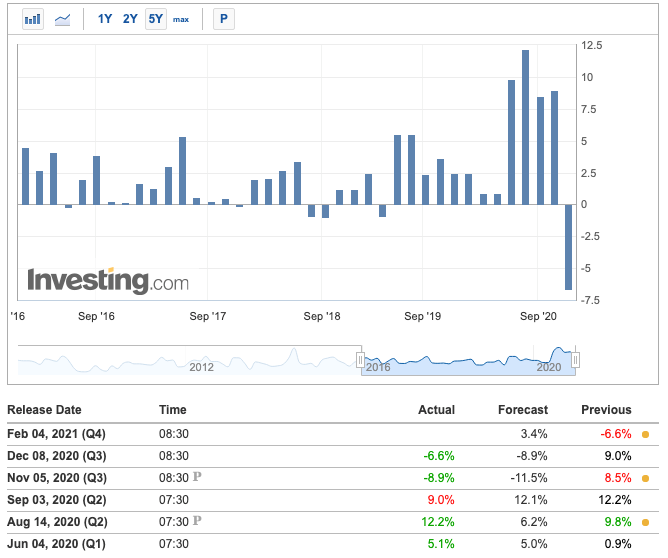

On Thursday, investors and economists will pay attention to the Bureau of Labor Statistics’ quarterly labor cost report.

The report measures the annualized change in the price businesses pay for labor and is a strong indicator of consumer inflation.

Thursday will be a preliminary look at the report before its full release on February 4.

The third quarter of 2020 saw a 6.6% drop in labor costs — the first decline since 2019.

Labor Costs Expected to Rise Slightly in Q4

The third quarter was a strong lens into how the COVID-19 pandemic impacted labor across the country.

Analysts project labor costs increased by 3.4% in the fourth quarter of 2020.

Earnings Reports

To finish off the Money & Markets Week Ahead, here’s a look at some of the key earnings reports due out this week:

Monday

Vertex Pharmaceuticals Inc. (Nasdaq: VRTX)

Otis Worldwide Corp. (NYSE: OTIS)

Tuesday

Amazon.com Inc. (Nasdaq: AMZN)

Alphabet Inc. (Nasdaq: GOOGL)

Pfizer Inc. (NYSE: PFE)

Exxon Mobil Corp. (NYSE: XOM)

ConocoPhillips (NYSE: COP)

Wednesday

Paypal Holdings Inc. (Nasdaq: PYPL)

AbbVie Inc. (NYSE: ABBV)

GlaxoSmithKline PLC (NYSE: GSK)

Spotify Technology SA (NYSE: SPOT)

Scotts Miracle-Gro Co. (NYSE: SMG)

Thursday

Merck & Co. Inc. (NYSE: MRK)

Bristol Myers Squibb Co. (NYSE: BMY)

Cigna Corp. (NYSE: CI)

Activision Blizzard Inc. (Nasdaq: ATVI)

Friday

Sanofi (Nasdaq: SNY)

Regeneron Pharmaceuticals Inc. (Nasdaq: REGN)

That’s all for this week.

Until next time…

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.