I’m not one to go to the doctor when I’m sick.

I would much rather go to my local drug store, find an over-the-counter (OTC) remedy, get some rest and try to get better.

I just don’t like to go to the doctor.

It’s a hassle to schedule an appointment, drive to the doctor, get a prescription and then wait for it to get filled.

And I’m not alone.

According to the Consumer Healthcare Products Association, Americans make 26 trips per year to buy over-the-counter remedies. They only visit the doctor three times a year, on average.

That led me to today’s stock.

Using Adam O’Dell’s six-factor Green Zone Ratings system, I found a pharmaceutical company that specializes in selling over-the-counter remedies. It’s one we are “Strong Bullish” on.

The underlying pharma stock is in good shape to outperform the broader market by at least three times over the next 12 months.

And a trend I see in over-the-counter pharmaceuticals will push this company even higher.

Demand for Over-the-Counter Medicines Increase

More and more people are turning to over-the-counter remedies for sore throats, eye allergies and upset stomachs.

In 2012, the global OTC pharmaceutical market was worth $90.4 billion.

Projections show that the market will reach $142.8 billion by 2025 — a 58% increase.

From 2020 to 2025, that jump is expected to be more than 25%.

Companies that manufacture and sell these OTC remedies are going to see nice additions to their bottom lines. Investors who recognize and invest in this trend will see gains as well.

OTC Pharma Stock to Buy: Prestige Consumer Healthcare Inc.

We recognize OTC medications by their label. But what sometimes goes overlooked is who makes the products we are taking to feel better.

Prestige Consumer Healthcare Inc. (NYSE: PBH) is one of the biggest OTC pharmaceutical manufacturers in the world. It makes name brands like:

- Goody’s powders.

- Chloraseptic liquids and lozenges.

- Clear Eyes eye drops.

- Compound W wart removal products.

- Dramamine motion sickness medication.

- Gaviscon upset stomach remedies.

These are household names known around the world.

The COVID-19 pandemic impacted the company’s total revenue. From March 2020 to March 2021, Prestige reported total revenue of $943.4 million — a slight 2% decline.

The company is projected to reach the $1 billion mark for top-line revenue in 2022 … only the second time it has reached that mark.

What’s more, Prestige is projected to maintain (and even increase) revenue in 2023.

Prestige Stock Keeps Climbing

Since April, Prestige’s stock has pushed higher. It is zeroing in on its 52-week high.

It met some resistance at the $52 mark in July but broke through and shows no signs of slowing down.

Prestige Stock's Rating

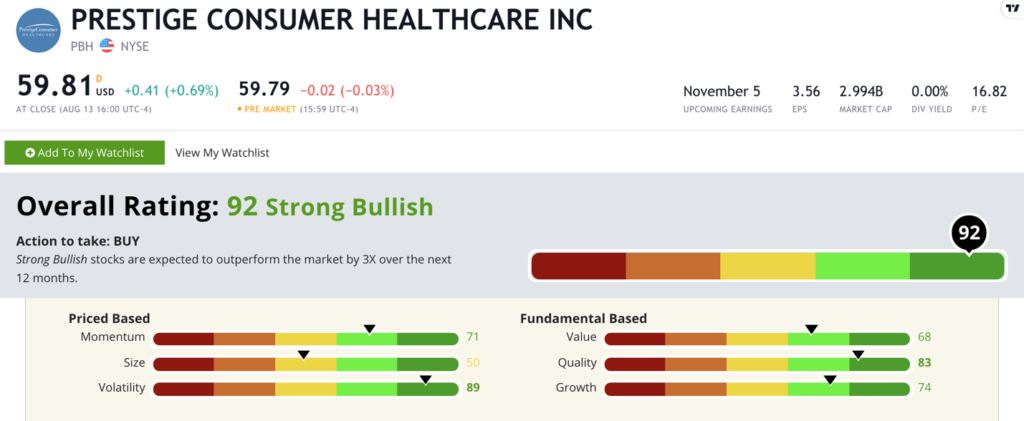

Using Adam’s six-factor Green Zone Ratings system, Prestige Consumer scores a 92 overall. That means we are “Strong Bullish” on this pharma stock and expect it to outperform the broader market by three times in the next 12 months.

Prestige Consumer Healthcare’s Green Zone Rating on Aug. 16, 2021.

Prestige rates in the green in:

- Volatility — Its confirmed uptrend since April has met with very little resistance. It scores an 89 on this metric.

- Quality — The company has positive returns on assets, equity and investment, as well as a 59% gross margin — all above the other biopharmaceuticals industry averages. It scores an 83 on quality.

- Growth — Prestige grew its quarterly sales from $238 million in the quarter ending March 31, 2021, to $269 million in the most recent quarter ending in June — that’s a 13% jump in revenue. Its one-year annual EPS growth rate is 17%. The company earns a 74 on this metric.

- Momentum — The stock has been in a strong, confirmed uptrend since April. Its momentum score is 71.

- Value — Prestige’s price-to-book, sales and earnings are all considerably lower than the industry average, making it a great value compared to its peers. Its price-to-earnings ratio is 17 compared to the industry average of 30. The company earns a 68 on value.

This pharma stock rates a 50 on size. But with a $3 billion market cap, it is still right in the middle of where we want high-rated stocks to be.

Bottom line: Over-the-counter remedies for everyday ailments are a staple of society.

These OTC medicines save us time and money — on average, Americans saved $51.6 billion annually in drug costs by buying over the counter, according to the Consumer Healthcare Products Association.

As this demand increases, companies producing these medications will keep thriving.

That’s why Prestige Consumer Healthcare Inc. is a company worth looking at for your portfolio.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.