I love and value your feedback. It helps expand my expertise in the cannabis market.

It also reveals new cannabis stocks that I’d never considered.

In a recent YouTube video, viewer Fernando asked:

Matt, what do you think about PCLOF stock?

Thanks for the question about PharmaCielo Ltd. (OTC: PCLOF), Fernando.

Let’s see if PharmaCielo stock is worth investing in.

PharmaCielo Ltd.’s Growing Pains

The Canadian PharmaCielo Ltd. also trades on the Toronto Stock Exchange under the ticker PCLO.

The company specializes in medicinal-grade cannabis oil extracts, tetrahydrocannabinol and other products used by pharmacies, medical clinics and cosmetic companies.

PharmaCielo also offers telemedicine software.

Its products are available in Canada, Columbia, Italy and Mexico.

In December, PharmaCielo named longtime board member Henning Von Koss its CEO. It was a significant change in the company’s leadership after several years of financial hardships.

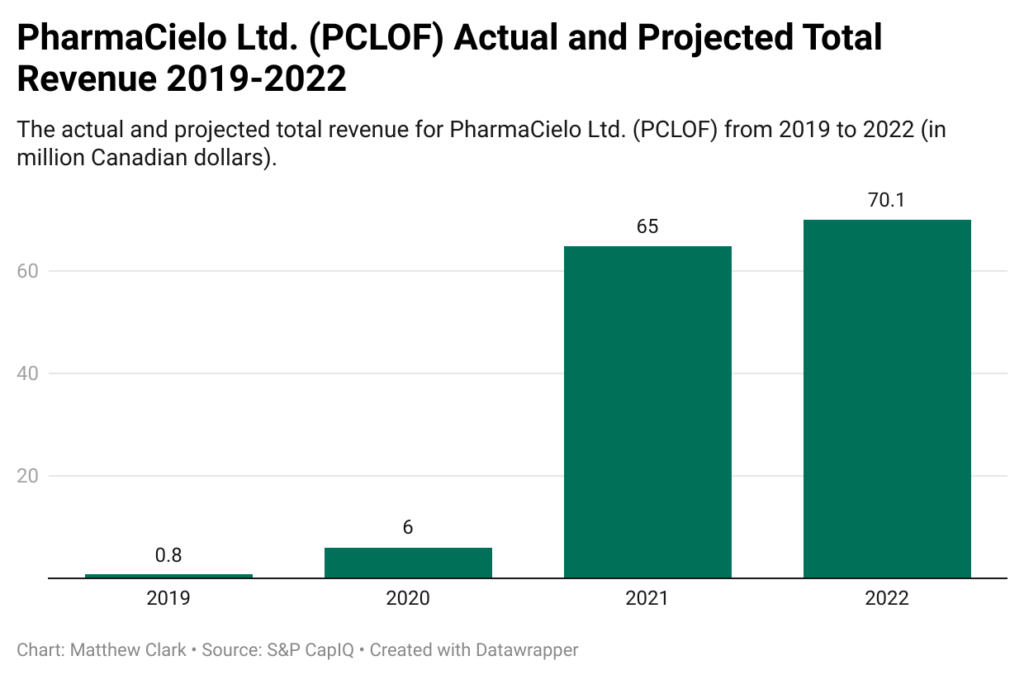

In 2019, PharmaCielo‘s total revenue was just under CAD $800,000. But its future looks bright.

In 2020, revenue surged to around $6 million CAD. That number is projected to jump to $65 million CAD this year and $70.1 million in 2022.

PharmaCielo’s expansion plans can be attributed to part of that jump. It is entering the United Kingdom via a sales agreement with a British wellness and cosmetics wholesaler.

And its core business is chugging along.

PharmaCielo’s Rionegro processing plant is one of the largest in Columbia. It’s able to produce more than 30,000 kilograms of extract per year.

Paired with a high-THC quota granted by the Columbian government, PharmaCielo will keep expanding its product portfolio.

Is PharmaCielo Stock a Buy?

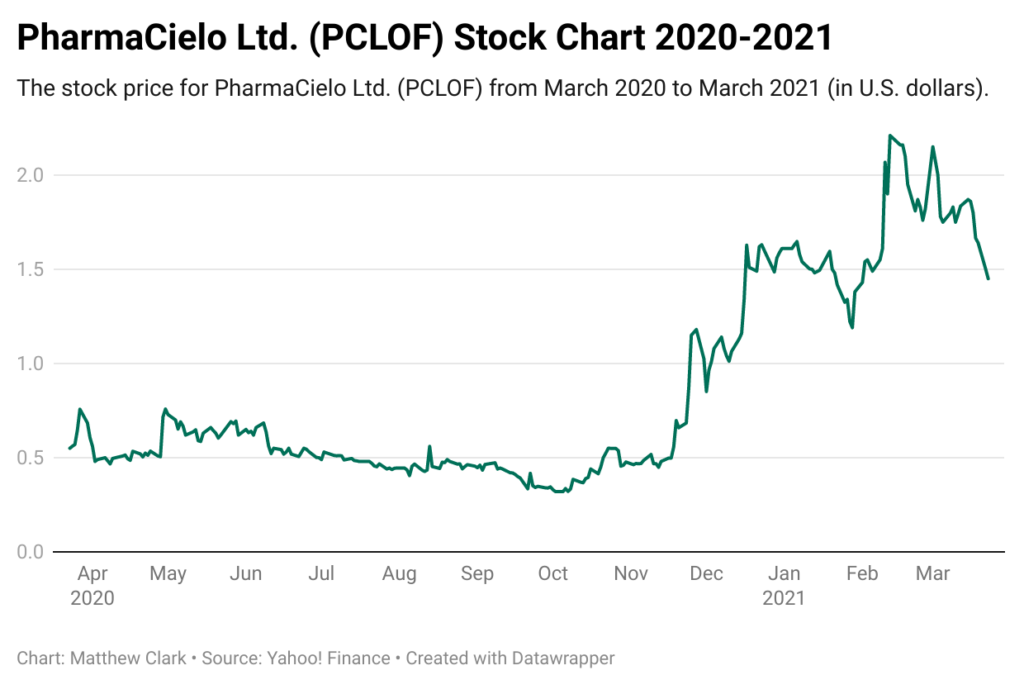

PharmaCielo’s stock has experienced some nice jumps in the last few months.

After the COVID-19 pandemic crash in March 2020, PharmaCielo’s stock price was flat.

But it pushed past $1 per share in late December and continued to rise.

The stock hit a 52-week high of $2.21 in mid-February — a 590% bounce off its low of $0.32 set in October 2020.

It tested resistance of around $2.15 twice before paring back below $2 to trade at around $1.45 as of right now.

Bottom line: In short, there’s potential here. But its future is still unpredictable. Proceed with caution.

You can invest in this company on the dip and hope for another test at the $2.15 price point. Keep in mind: It is a risk. It’s hard to say where the dip will stop and when an uptrend will start. If you aren’t comfortable buying its current dip, I would at least put this cannabis stock on your shortlist. PharmaCielo is worth watching.

Cannabis Watchlist Update

Let’s look at our Money & Markets Cannabis Watchlist.

Investors have bought back into the cannabis sector after a brief sell-off.

This week, the average total gain of our seven stocks is 39.9%.

Here’s a breakdown of each position after Thursday, March 25’s close:

Scotts Miracle-Gro Co. (SMG) — Wall Street analysts keep raising their ratings for this fertilizer company. Recently, analysts with Raymond James and Truist Financial both reiterated their “buy” rating and raised their price targets for the company. SMG is up 39% since it put it on the watchlist in September.

Schweitzer-Mauduit International Inc. (SWM) — It’s been relatively quiet for this company since it beat earnings and revenue projections in its most recent quarterly report. SWM is now up 59.2% since being added to the watchlist in September.

PerkinElmer Inc. (PKI) — The testing company experienced a dip during the recent stock rotation. However, Vantage Consulting and Epoch Investment Partners recently bought stakes in the company. PKI is showing a 5.5% positive gain since I added it to the watchlist in September.

Turning Point Brands Inc. (TPB) — Like SWM, things have been quiet for Turning Point since the company beat expectations for earnings and revenue for the last quarter. TPB is now up 69.3% since I put it on the watchlist in October.

GrowGeneration Corp. (GRWG) — This cannabis company has been very busy over the last week. It recently acquired 55 Hydroponics, based in Orange County, California, and B2B inventory and operations platform Agron.io. They are the seventh and eighth acquisitions for GRWG in 2021. GrowGeneration is up 64.9% since I added it in November.

Planet 13 Holdings Inc. (PLNHF) — The Nevada-based cannabis company dropped as much as 10% after I recommended it in January. However, its Santa Ana superstore continues on track to open later this year. Now, Planet 13 shares are up 1.4% since January.

High Tide Inc. (HITIF) — This is the latest addition to the watchlist after I added it a few weeks ago. Most recently, the company filed its 40-F with the Securities and Exchange Commission — a significant move to list the company on the Nasdaq. Now, Nasdaq has to approve the form before the company starts trading. High Tide will also release its quarterly earnings on April 1. We’ll keep a close eye on it. So far, High Tide stock is up 4.8% in just a few weeks.

I’ll keep a close eye on the cannabis market and let you know if we need to make any changes to our watchlist soon.

Where to Find Us

To watch the Marijuana Market Update before anyone else, just subscribe to our YouTube channel and get an alert when we release a new update.

Coming up this week, we’ll have more on The Bull & The Bear podcast and our Money & Markets Week Ahead, so stay tuned.

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.