In a raging bull market (recent action notwithstanding), it’s hard to find stocks trading at levels first seen almost 10 years ago.

But that’s where we are today in leading global tobacco giant Philip Morris International Inc. (NYSE: PM).

After topping out at $106 per share this past summer, PM shares have slid to around $86 as I’m writing this, putting it at levels first seen in the summer of 2012.

As for the “why,” pick your reason. A respiratory pandemic didn’t help cigarette sales. And vaping products still face ongoing regulatory risks.

But the biggest single factor is that Philip Morris International gets a large chunk of its revenues from emerging markets. And those markets have been dead money for years now. It’s a never-ending series of currency crises, political upheaval and general instability … and that was before COVID-19.

While it’s been a rough decade overall for emerging markets, Philip Morris managed to plod along just fine. It’s more than doubled its dividend since 2010. PM yields an attractive 5.6%, and if history is any guide, it shouldn’t have a problem raising it well above the rate of inflation going forward.

Philip Morris Stock Is Bullish

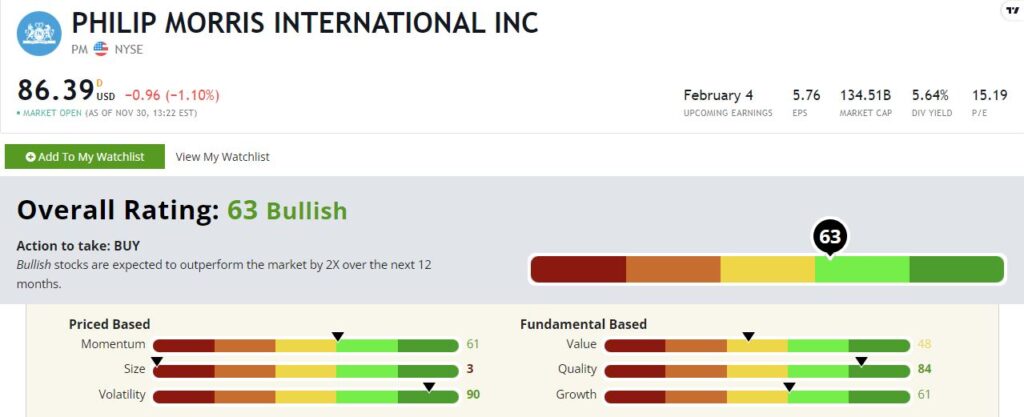

Philip Morris stock rates a “Bullish” 63 out of 100 on our Green Zone Ratings system. We expect it to outpace the market by at least two times.

Let’s do a deeper dive.

Volatility — To long-term investors, it should come as no surprise that Philip Morris stock rates well on our volatility factor with a score of 90. This means that the stock is less volatile than 90% of the stocks in our universe of more than 8,000 stocks. Demand for tobacco products is stable and isn’t as prone to the swings of the economic cycle. If anything, people may smoke more during a recession to deal with the stress.

Quality — PM rates a very respectable 84 on quality. Our quality metric is an objective analysis of balance sheet strength and profitability. Philip Morris International maintains a modest debt load. It also enjoys the fat profit margins that come from owning some of the most recognized tobacco brand names.

Growth — You might not think of tobacco as a growth business, but that hasn’t stopped Philip Morris International. It rates a 61 on our growth factor. Smoking rates are declining in most emerging markets, but you also have a countervailing force of locals trading up to premium western brands and away from cheaper domestic brands. This has worked in the company’s favor.

Momentum — PM also rates well on our momentum factor at 61. As the tech trade starts to look long in the tooth, investors have been rotating into more traditional names. PM benefits from that trend.

Value — Philip Morris International isn’t cheap, per se, but it’s certainly not expensive by our value factor. It rates a 48, which puts it in the middle of the pack.

Size — PM loses points for its 3 rating on our size factor. This is a big stock with a market cap of $140 billion. We’re not going to see a small-cap bounce here.

What to Do With This 5.6% Yielder Now

Philip Morris International is a solid addition to a dividend portfolio. But I might wait a few weeks before dipping my toes in the water here.

PM’s price is reasonable, and the stock rates well across most of our metrics. But it’s been trending lower since August. I’d advise waiting for some sign of a bottom before buying shares. You don’t have to time it exactly right, but there’s no reason to rush in now.

To safe profits,

Charles Sizemore

Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.