Federal Reserve Chair Jerome Powell came out guns blazing last week when he told the world he’d keep raising rates “until the job was done.”

Rate hikes at 0.75%, rather than a shock-and-awe tactic, might just become the new normal.

We entered a recession by technical measures in the second quarter, as gross domestic product (GDP) contracted for two consecutive quarters.

But it doesn’t quite look like a true economic downturn yet. The labor market is still tight, and Americans are throwing money around.

Of course, with the Fed now making it clear that it’s nowhere near done tightening, the risk that we slide into a real recession grows by the day.

Stock Power Ratings Help Identify Recession-Proof Stocks

Investing during a recession is harder than investing during more benign economic conditions, but it’s not impossible. It’s all about being tactical, controlling risk and focusing on shorter-term momentum trends.

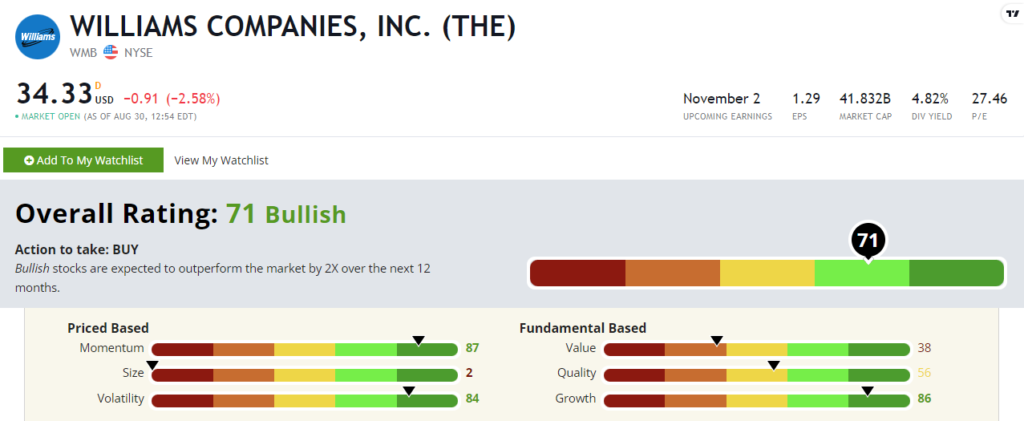

Looking through the lens of our Stock Power Ratings system, you want to focus on stocks with good momentum, volatility and quality ratings.

Value and growth still matter, of course. But in a more defensive environment, I consider momentum, volatility and quality critical factors within my colleague Adam O’Dell’s proprietary system.

On momentum, energy has been a bright spot throughout the ups and downs of 2022.

With that said, let’s take a look at one of my favorite dividend-paying energy stocks: pipeline operator Williams Companies Inc. (NYSE: WMB).

How Williams Companies Rates on Those 3 Factors

Williams is first and foremost a natural gas infrastructure company. Its pipelines move 30% of America’s natural gas.

Williams isn’t insulated from the boom and bust cycle. For example, in a deep recession, people might travel less. That translates to less need for hot water or heat in hotels and resorts — and less demand for this pipeline stock.

But things have to get pretty bad before people start skimping on hot showers or bundling up at home to avoid cranking up the thermostat.

This recession resistance explains why Williams rates an 84 on our volatility factor. Given the low volatility of the underlying business, it stands to reason that the stock itself is also less prone to wild swings.

It also explains WMB’s high momentum score of 87.

Not much is working in 2022. The growth stories that led the market higher over the past decade stalled out this year amidst high inflation and the Fed’s aggressive response. Investors have rotated into more conservative sectors, and that’s driving those stocks’ momentum scores higher.

WMB is one example. In 2022, it’s up almost 30% compared to the broader S&P 500’s 17% loss!

What about quality for this pipeline stock?

We measure quality using objective factors such as profitability and balance sheet strength.

In a tough market, it’s normal to see a flight to stocks with strong financials. Risk management tends to get lax in the late stages of a bull market, and investors get more comfortable taking their chances on junkier or earlier-stage stocks.

But in a bear market, that’s a recipe for heavy losses. To avoid that fate, investors rotate into the highest-quality names … companies that they know will survive whatever comes next.

Williams scores a respectable 56 on our quality factor, which is in the top half of all the companies in our universe. But here’s something to consider: Most pipeline companies carry a lot of debt. These are capital-heavy businesses that, by their nature, tend to be leveraged.

At the same time, high depreciation charges on all of that pipeline investment depresses official earnings, even if those are “paper” expenses that have no impact on actual cashflow.

This is a long way of saying that Williams is a higher-quality company than our factor rating here would suggest!

I mentioned earlier than growth was less important in a bear market than a bull market. But all else equal, wouldn’t you like to see growth too? After all, a growing company is a healthy one!

Well, Williams stock rates in the top 14% of all the stocks our system analyzes on the growth factor. So apart from its benefits as a defensive play, its 86 rating means WMB is a growth dynamo to boot!

WMB’s Solid Dividend Bucks the Pipeline Stock Trend

And, of course, what would a Dividend of the Week be without discussing WMB’s payout?

Williams pays a respectable 4.8% dividend yield, and unlike many of its peers in the pipeline space, its payout is a regular dividend as opposed to a partnership distribution. That makes it a little easier to handle at tax time and safer to hold in an IRA account.

Bottom line: Come what may in the remainder of 2022, Williams looks well-positioned to keep delivering natural gas to millions of Americans … and a steady stream of dividends to millions of investors.

To safe profits,

Charles Sizemore, Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.