Quick: What’s the one massive thing that every business needs?

Money … capital … investment — you guessed it!

You see, companies don’t always rely on product sales to generate the cash they need to expand their operations.

Enter investment banks: financial companies that help finance large stock purchases as well as mergers and acquisitions (M&A).

They act as go-betweens in complex corporate transactions … or anything that deals with large amounts of money.

Investment banking was a huge business before the coronacrash of 2020. The bar chart above shows that it jumped 15.6% from 2012 to 2019.

But after a 3% drop in 2020, investment banking is coming back. Statista projects a record $127 billion in revenue in the U.S. alone by 2024.

While M&A activity has been slow in 2022 due to inflation concerns, I think this is temporary. We’ll see a flurry of big business transactions and company expansion soon.

And today’s Power Stock will benefit: Piper Sandler Cos. (NYSE: PIPR).

Piper Sandler is an investment bank that works with corporations, private equity groups, governments and nonprofits to raise capital.

It also helps companies with mergers and acquisitions, plus underwrites initial public offerings, or IPOs.

As you can see, PIPR helps businesses raise, invest and spend a lot of money.

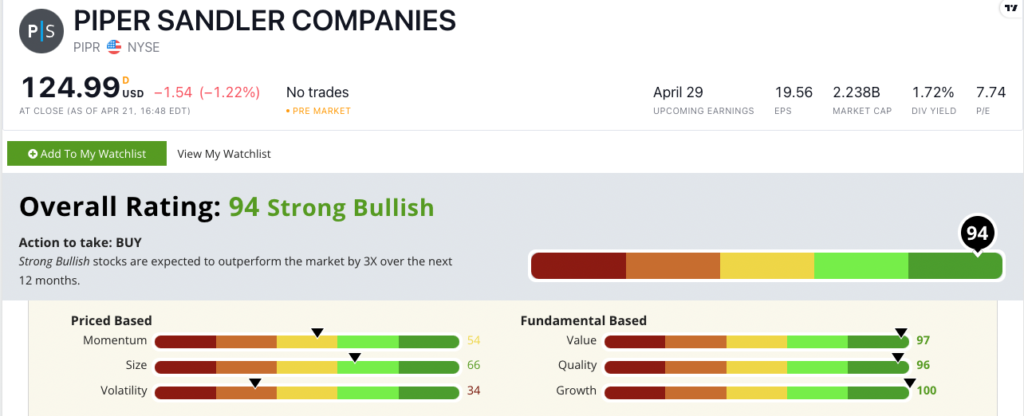

PIPR scores a “Strong Bullish” 94 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

PIPR Stock: Top Fundamentals

Two items stood out in my research:

- From 2017 to 2021, the company increased its adjusted net revenue from $821.5 million to $1.9 billion — including a one-year increase of $700 million from 2020 to 2021.

- In the last decade, PIPR grew its adjusted net income with an impressive compound annual growth rate (CAGR) of 38%.

When it comes to fundamentals, it doesn’t get much better than PIPR.

The stock scores a perfect 100 on our growth metric. Its one-year annual earnings-per-share growth rate is 504.3%, and its annual sales growth rate is 62.5%.

This stock is an incredible value. It scores a 97 on that metric, trading with a price-to-earnings ratio of 7.65 — much lower than its industry peer average of 35.14.

Its quality rating — 96 — falls in the top 4% of all stocks we rate. PIPR boasts double-digit returns on assets, equity and investment. Its gross margin is 94.8%, which means it rakes in a boatload of cash even after taking out the cost of sales.

The market sell-off has pushed PIPR stock down since January 2022.

But I believe this shows us how investors feel about the market overall, rather than how they feel about PIPR.

As M&A activity ticks up when we get past this inflationary period, PIPR will return to prominence.

Piper Sandler stock scores a 94 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Market volatility and a drop in M&A activity pushed the stock price down.

However, this gives us the chance to buy PIPR stock at a solid value.

Bonus: In addition to strong fundamentals, PIPR’s forward dividend yield is 5.52%. This means the company will pay you an additional $6.90 per share per year just to hold the stock!

Stay Tuned: Biotech Stock to Buy

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify.

Stay tuned for the next issue, where I’ll share all the details on an excellent opportunity in the biotech space!

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets