Commodity stocks are on my radar right now.

In the past six months, I’ve watched the commodities market and placed trades in the sector in my Home Run Profits trading service.

My interest was triggered by buy signals in the energy sector. As those plays advance, I’m also seeing buy signals in other commodities like base metals and agriculture.

I stay up-to-date on the commodities market by keeping my finger on the pulse. The U.S. dollar is a great indicator of the health of the commodity market. A weak U.S. dollar is bullish for commodities. When the dollar is down, commodity prices are always up.

Right now, we are in a downtrend in the value of the U.S. dollar. As an independent investor, you want to be in a position to take advantage of that.

A weak U.S. dollar is also great for emerging industries in foreign markets.

The commodities trend is just getting started.

POSCO’s Green Zone Rating

My stock selection this week is a foreign, commodity-sector play.

POSCO (NYSE: PKX), based in South Korea, is the world’s fourth-largest steel manufacturer. It makes steel for automobiles, construction companies and raw material companies both in South Korea and abroad.

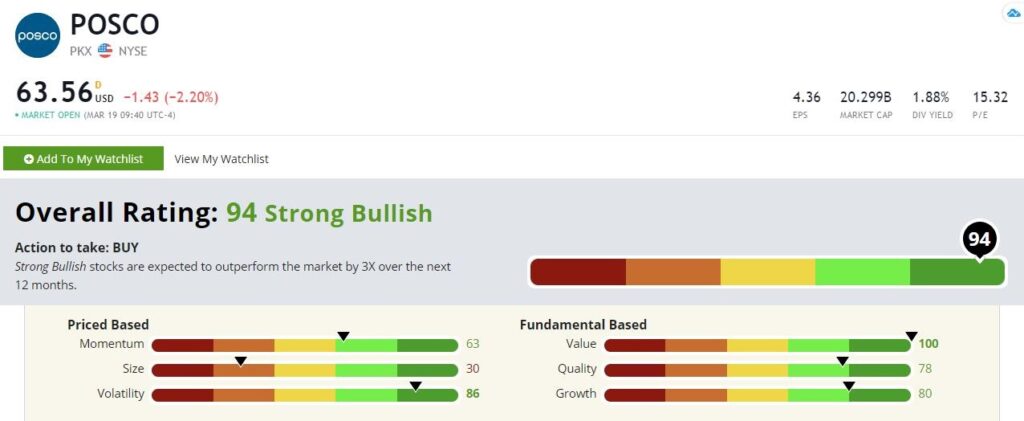

PKX rates a 94 overall on my Green Zone Ratings system, which means this stock is on our watchlist.

POSCO’s Green Zone Rating on March 19, 2021.

Here’s a breakdown of its overall score:

Value — PKX is a high-value stock. With a value score of 100, few stocks compete with PKX on this factor.

Volatility — PKX rates a 86 on volatility, which means that this a low-risk, stable stock pick. In risk-adjusted returns, PKX has doubled off its March 2020 lows and proved resilient against external market factors.

Growth — POSCO is also a high-growth stock. With a score of 80, PKX will expand its market and scope in the near future. The COVID-19 pandemic hit the global steel industry hard, but this company maintained its earnings per share and dividends. High-growth and high-quality companies can maintain themselves despite market dips and crises.

Bottom line: PKX is a well-rounded stock. Its lowest score is in size, and that’s because it’s a $14 billion company, the fourth-largest steel manufacturer in the world. Sales are ramping up, and there’s a huge amount of growth to come for POSCO. It’s the perfect time to take advantage of this opportunity.

To good profits,

Adam O’Dell

Adam O’Dell is the chief investment strategist of Money & Markets and has held the title of Chartered Market Technician for nearly a decade. He is the editor of Green Zone Fortunes, the trend and momentum options-trading powerhouse Home Run Profits and the time-tested switch system 10X Profits.

P.S. Check out The Bull & The Bear podcast every week for more picks from Adam, Charles and me. You can listen on Apple Podcasts, Spotify, Amazon and Google Podcasts. You can also catch episodes on our YouTube channel here.