I don’t try to predict the future. And I’m not one to hit you with bold, contrarian headlines. You won’t see me pounding a podium at Davos. That’s not my style.

I stick with what works. I dig through the data, identify trends and then follow them to profits.

And with markets well off their recent highs, you want buying opportunities. At the same time, avoiding the worst of the worst is just as crucial.

Let’s put this to practice in a sector I’m super bullish on: energy.

It’s been a rough year in the financial markets, but energy stocks have been a rare bright spot. I turned bullish on the sector well over a year ago, after my models suggested that energy stocks would outperform the broader market.

And now that same system will help us eliminate the worst and buy into the stocks with the most market-crushing potential.

Energy Stocks: Why Settle for “Good Enough”?

There are many ways to play the energy sector.

You could buy a broad sector exchange-traded fund (ETF) or mutual funds to get blanket exposure to the entire sector. For many investors, that’s just fine. Most stocks within a sector tend to move in the same direction, so picking the right sector is often good enough.

But why settle for “good enough” when we have a chance to crush the market? After all, a sector fund includes everything: the good, the bad and everything in between.

Why not focus on the best and eliminate the laggards?

First Step: Eliminate Energy Laggards

I dove into the energy sector using my proprietary Stock Power Ratings system. I found one solid stock to consider and two to discard.

We’ll start with the stocks to avoid.

I ran a screen of all energy stocks currently rated by my Stock Power Ratings system. This sector in general rates well these days, since inflation and the war in Ukraine have pushed energy prices higher.

But there are still some real dogs on the list too.

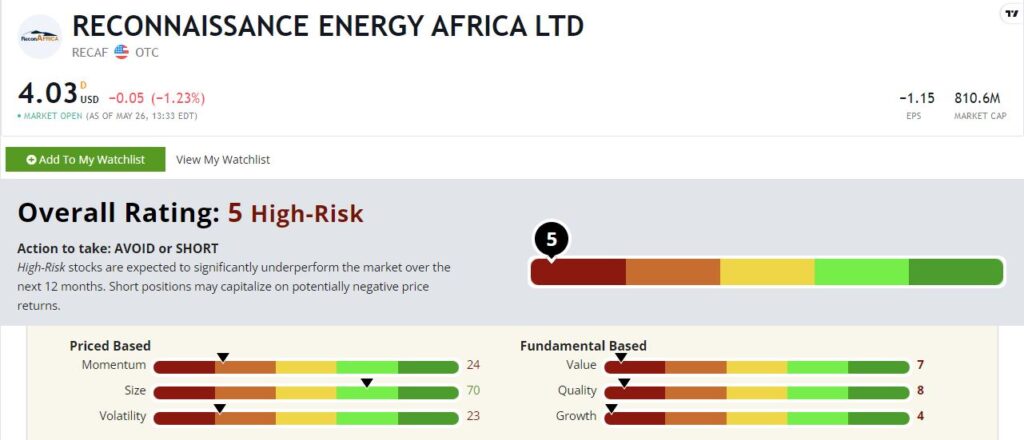

Consider Reconnaissance Energy Africa LTD (OTC: RECAF).

This is an exploration and production company based in Canada with development projects primarily in Namibia and Botswana. Africa is an interesting market … and in some ways resembles China 30 years ago.

Fortunes will be made in this frontier market. But Reconnaissance Energy might not be part of that equation.

RECAF rates a 5 out of 100 in my model, making it one of the lowest-rated stocks in our universe. It rates a pitiful 7 on value, 8 on quality and 4 on growth!

Now, who knows? Crazy things happen in the market every day. It’s possible that RECAF explodes higher. But my model suggests the odds are not in our favor here, so we’re better off looking elsewhere.

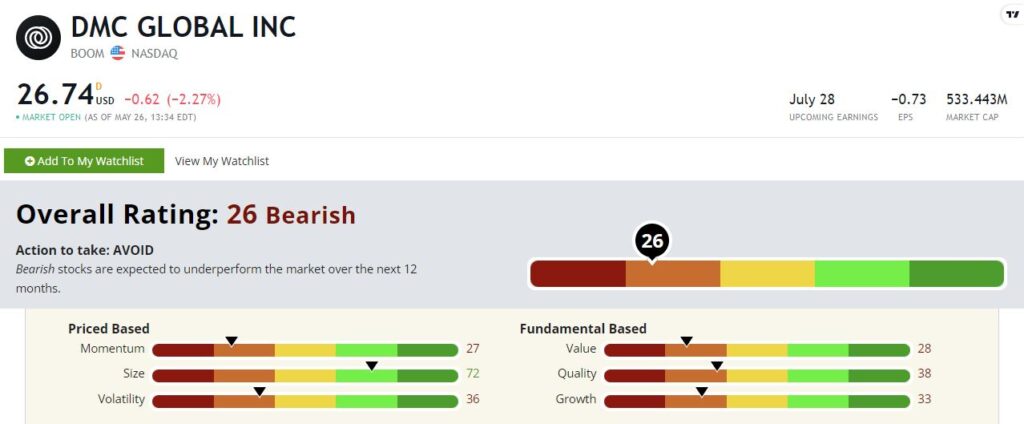

As another example, look at the shares of DMC Global Inc. (Nasdaq: BOOM).

Now, I’ll admit that the ticker symbol got my attention. I’d like to think that “BOOM” refers to the company’s products — explosives used in oil and gas drilling — and not to management’s concept of risk management.

But looking at the stock through the lens of my ratings model, this is another one we’re better off avoiding.

BOOM rates a 26 out of 100. Apart from size — where it rates a 72 — the stock rates below a 40 on every other metric. In other words, it’s an expensive, low-growth, low-quality stock that‘s also volatile and exhibiting bad momentum.

This is not something we want to own.

Second Step: Buy Top-Rated Energy Stocks

Look at an energy stock we might actually want to own: Italian integrated oil major Eni SpA (NYSE: E).

Eni rates a “Strong Bullish” 97 out of 100. It’s in the top 3% of all stocks we rate.

It scores above a 90 in three out of our six factors, and above an 80 in every factor but size. E boasts a stellar 99 on value. And it even pays an attractive 7% dividend.

This stock has potential…

But my highest convictions within the energy sector lie with the future of renewables and the green energy mega trend.

We are investing in the next wave of energy stocks in Green Zone Fortunes. These are the companies working to disrupt the multitrillion-dollar global energy industry.

Frankly, some of these stocks are down after the tech sell-off. But I see it as an opportunity to buy in at even better valuations as these companies lay the foundation for explosive growth in the months and years ahead.

To see how a tiny Silicon Valley company is using artificial intelligence (AI) technology to unleash the largest untapped energy source in the world … and how its early investors could reap the benefits … watch my “Infinite Energy” presentation now.

By joining Green Zone Fortunes, you’ll gain access to all of our top energy stock recommendations, as well as in-depth analysis from me and Charles Sizemore, my co-editor.

So click here to watch my presentation now.

And get ready to crush the market with our top renewable energy plays.

To good profits,

Adam O’Dell

Chief Investment Strategist