It’s time to get on the fast track to stock profits — with the five things you need to make money this week … in just 5 minutes.

Let’s get started!

Well, That Rally Didn’t Last Long

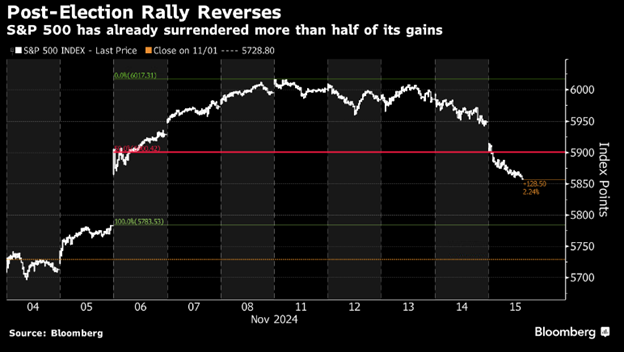

After shutting the book on the 2024 U.S. presidential election, the market seemed poised to cash in on a big run.

The S&P 500 eclipsed the 6,000 mark less than a week after Election Day.

But what comes up inevitably comes back down.

By Friday last week, the benchmark index erased nearly half its trough-to-peak gains made after the election as tech stocks dragged down the market.

By the end of the week, heavy hitters like Amazon.com Inc. (Nasdaq: AMZN), Nvidia Corp. (Nasdaq: NVDA) and Meta Platforms Inc. (Nasdaq: META) slid nearly 3%.

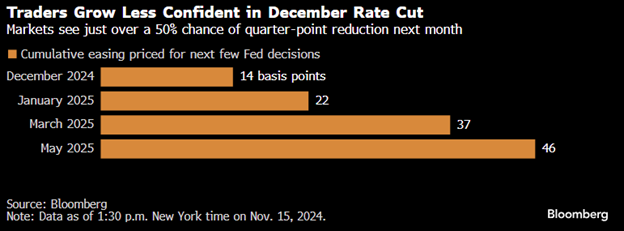

The post-election hangover came to an abrupt end after Federal Reserve Chair Jerome Powell threw the proverbial bucket of cool water on the possibility of another 25-basis-point cut to benchmark rates in December.

A big bright spot… thanks again to Powell… was 10-year Treasury bonds. The benchmark yield reached 4.5% Friday for the first time since May after retail sales data included large upward revisions.

Oil and equities retreated Friday afternoon, but bond yields proved more attractive despite falling back to 4.4%.

As I mentioned last week, I still believe the market is in store for a rally due to the diversification away from mega-cap tech stocks and into small caps. But it won’t be without bumps in the road.

All Eyes on Nvidia

Nvidia Corp. (Nasdaq: NVDA), the artificial intelligence (AI) superstar, is set to report earnings on Wednesday.

Investors are waiting to see what’s next for the AI revolution after the chipmaker has ridden the wave to a $3.4 trillion market cap!

Of course, we’ll also be looking for any potential headwinds the company is facing as it prepares to launch its latest Blackwell AI processors.

Chief Investment Strategist Adam O’Dell has pinpointed one of the biggest roadblocks for Nvidia AI, and the solution is creating a massive opportunity for certain companies.

He’ll have more on that later this week in Money & Markets Daily.

From the Department of Crypto Rallies

After languishing at around $0.10, meme cryptocurrency Dogecoin has mounted a strong rally.

Since November 4, the crypto’s value has jumped 140% from $0.15 to $0.36 … even eclipsing $0.40 briefly last week.

Of course, it probably helps that Tesla CEO and Dogecoin advocate Elon Musk will head the new Department of Government Efficiency (otherwise cleverly known as DOGE) once Donald Trump takes the White House.

How long will the rally in Dogecoin last? It’s still well off its May 2021 high of $0.73, so there’s room to run.

Speaking of Elon Musk…

If you’re looking for the most valuable private company in the U.S., Musk has you covered here as well.

Musk’s SpaceX rocket and satellite company is on the verge of selling insider shares that, according to Bloomberg, could value the company at around $255 billion.

That’s even more impressive, considering the previous valuation of the company was closer to $210 billion.

The Financial Times reported that the company will attempt a tender offer in December to sell existing shares at around $135 each. A tender offer means the company does not have to offer new shares, award equity or raise funds from the purchase of shares.

Now, a stipulation … The $255 billion would make SpaceX the largest American private company. The global record is the $268 billion December 2023 valuation of ByteDance Ltd., the Chinese parent company of TikTok.

Want to buy into SpaceX pre-IPO? Well, that’s a little more difficult to explain.

You have to be an accredited investor … meaning you have to be an investor who’s had two consecutive years of earned income of at least $200,000 (or $300,000 if you’re married). You could also have a net worth of at least $1 million, taking out the value of your home.

Then, you actually have to find an existing holder of common or preferred stock. Good luck with that, too. You’ll likely have to go through a private wealth manager who can find a willing seller.

Another option is to find a diversified fund that already holds shares of SpaceX, such as the Baron Focused Growth Fund (BFGFX) or Fidelity Investments. You could also look at Destiny Tech100, a publicly traded closed-end fund focused on pre-public companies (this fund holds SpaceX and ChatGPT parent OpenAI).

If all of that fails and you still want to own a piece of SpaceX … go to its website and buy a hat for $25.

The Results Are In…

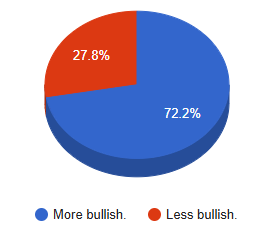

Thank you to everyone who participated in last week’s Money & Markets Daily poll!

Looking over the results, one thing is clear…

You all are more bullish now that we are clear of the election:

Are You More Bullish for Stocks After the Election?

Almost three-quarters of respondents (72%) said they are more bullish now that the election is over.

While the post-election rally hit some speedbumps last week, there is a lot to be excited about.

For one, markets hate uncertainty. Just knowing who will be in the Oval Office come January is enough to boost confidence.

We also know that Donald Trump will be a boon for certain industries, especially within the U.S. Trump wants America to be the leader in areas such as AI and energy, which is a good sign for U.S. stocks.

Add on lower interest rates through additional Federal Reserve rate cuts, and we have a robust setup heading into 2025.

Thanks again for voting in our poll. Look out for more surveys in future editions of Money & Markets Daily!

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets