With inflation still front of mind, investors are scrambling to find the best hedge.

And they’re coming back to old stalwarts such as precious metals, bonds and oil.

Today, I want to focus on metals.

Gold, silver, platinum and other precious metals give investors financial cover during political and economic uncertainty … just like what we’re in the middle of now.

And investors are starting to “come back home” to the tried-and-true hedges of old.

This chart shows the price of gold futures contracts with forecasts to 2028.

Contracts settled in December 2022 were priced around $1,655.70 per troy ounce. Investing.com projects contracts settled in June 2028 will be $1,909.90 — a 15.3% hike in the price of gold.

When I see an upward trend like this, I turn to Adam O’Dell’s Stock Power Ratings system. It helps me identify stocks that are set to benefit as prices climb higher.

And it helped me find a company that’s well-established in the precious metals exchange.

A Precious Metals Stock With Promise

Today’s Power Stock trades gold, silver, platinum, palladium and more: A-Mark Precious Metals Inc. (Nasdaq: AMRK).

AMRK doesn’t mine for these metals … it serves as more of an investment services company by trading physical metals with wholesalers, investors and collectors.

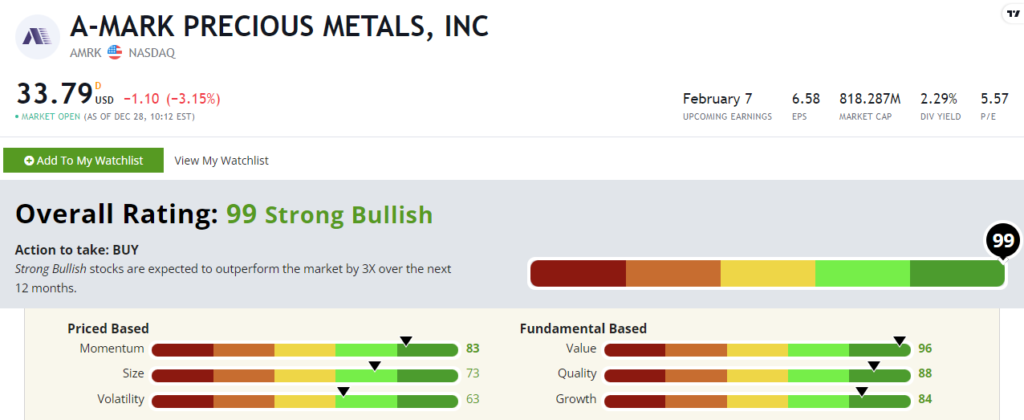

A-Mark stock scores a “Strong Bullish” 99 out of 100 on our Stock Power Ratings system. We expect it to beat the broader market by 3X in the next 12 months.

AMRK Stock: Strong Bullish Fundamentals

A-Mark just reported a strong quarter.

Highlights include:

- Gross profit of $76.6 million — a 36.8% year-over-year increase!

- Net income grew 73.5% to $45.1 million from the same quarter a year ago.

AMRK earns a “Strong Bullish” 84 on growth — spurred by these great financials.

It scores a 96 on value thanks to its price-to-earnings ratio of 5.6 — five times lower than the investment services industry average — making it a tremendous bargain compared to similar stocks.

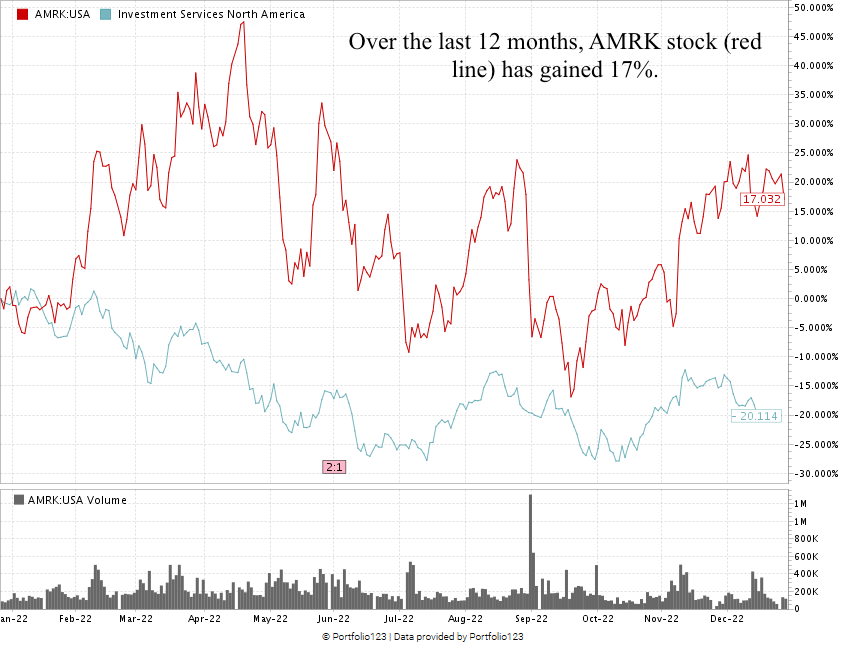

AMRK stock is crushing its industry peers (blue line in the chart below) — which are down 20.1%.

Created in December 2022.

After hitting a 52-week low in September 2022, AMRK ran 46.9% higher into its recent high in mid-December 2022.

AMRK is up 17% over the last 12 months, but its run over the last few months is the “maximum momentum” we love to see in stocks.

AMRK scores a 99 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Inflation is the biggest story of 2022.

Investors are turning back to traditional hedges to guard against rising prices … hedges such as precious metals and oil.

AMRK is a global platform used to trade gold, silver, platinum, palladium and other precious metals.

This is a compelling reason to add A-Mark stock to your portfolio.

Bonus: The company’s 5.16% dividend translates into an annual payout of $1.80 per share you own.

Stay Tuned: Ring in the New Year With a Top-Rated Health Care Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Markets are closed on Monday to observe the New Year’s holiday, but I’ll still have a top-rated stock, according to our Stock Power Ratings system.

I’m kicking off 2023 with a health care company that’s helping to fight the opioid crisis. It rates a 98 out of 100! Stay tuned.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets