The stocks featured in last week’s Earnings Edge stocks didn’t do a whole heck of a lot.

Points International Ltd. (Nasdaq: PCOM) fell on earnings but then rallied to stay in a wedge pattern. A breakout is still coming, it just hasn’t happened yet.

Cryptocurrency platform Coinbase Global Inc. (Nasdaq: COIN) dipped ahead of earnings and didn’t do much after the announcement. But the stock had already broken out. The consolidation it is going through now is bullish, and you can expect COIN shares to trend higher in the coming months.

In Earnings Edge, we look for big moves around quarterly reports.

But, my most recent research advisory service finds even sharper moves, without gambling on earnings … without holding for months or years at a time … and without waiting for a certain time of the year.

It can trigger multiple triple-digit gains every single week — within a matter of days.

No more holding for weeks or months just to realize profits. These gains come practically overnight.

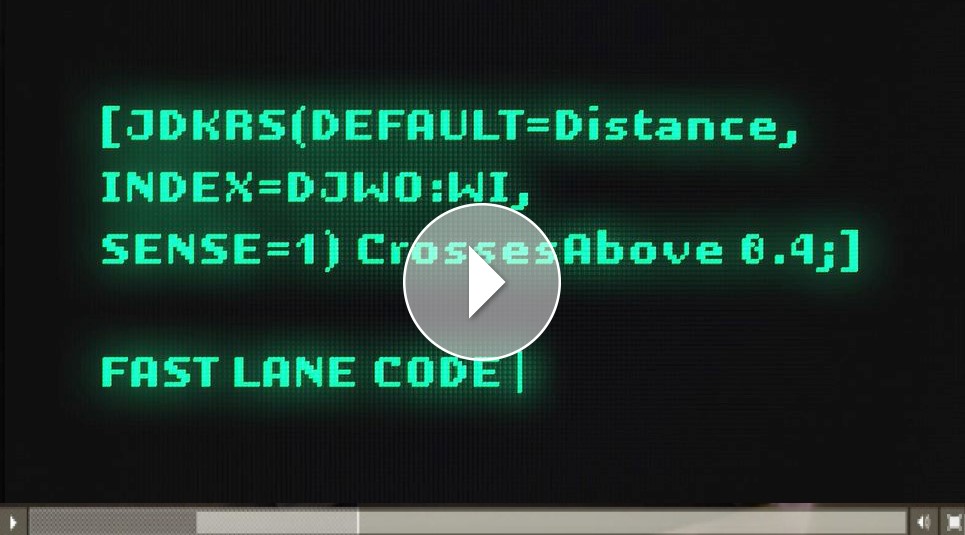

And it’s all thanks to this single line of code from the presentation below.

Just click on the play button below to get all the details on how it works and how you can join me for the next profit opportunity.

For today’s Earnings Edge, we’ll turn our attention to a pair of tech stocks set for big moves this week: Dell Technologies Inc. (NYSE: DELL) and Zoom Video Communications Inc. (Nasdaq: ZM).

Earnings Edge Stock No. 1: Zoom Video Communications Inc. (Nasdaq: ZM)

Earnings Announcement Date: Monday, after the close.

Expectations: Earnings at $1.10 per share. Revenue at $1 billion.

Average Analyst Rating: Outperform.

When it comes to price moves around earnings, it’s all about the chart to me.

We look for potential breakouts or simply stocks that have room to run. Zoom falls into the latter.

Based on the chart, the stock is sitting in a wide descending wedge pattern.

ZM Has Room to Move

Source: Optuma.

The falling red resistance line is converging with a falling green support line. But this has taken place over the past year or so. Since last October, ZM has dropped over 50%.

Notice the color of the bars on the chart, though.

They are currently red. This means the stock is in the lagging quadrant of my Profit Radar. It tells us the stock is lagging the market. But what it also tells us is to expect a rally.

That’s because stocks have a natural rotation through the market in a specific cycle, going from lagging the market to improving (blue), then leading (green), before it weakens (yellow) and falls back to lagging only to do it all over again.

You can see those four colors represented in the chart.

Most of the time, when it hits the red colors, it shoots higher shortly after. Not every time, but most of the time.

And with ZM trading at the bottom of the wedge pattern, look for some bullish moves around earnings.

Earnings Edge Stock No. 2: Dell Technologies (NYSE: DELL)

Earnings Announcement Date: Tuesday, after the close.

Expectations: Earnings at $2.30 per share. Revenue at $27.3 billion.

Average Analyst Rating: Outperform.

Dell Technologies, the on-again, off-again public company is very much public right now. It went private back in 2013 and public again in 2018. Now, DELL is up more than 200% since returning to the New York Stock Exchange.

Investors still love this stock. As we head into earnings this week, the one thing I want to point out is the upside momentum we are seeing.

DELL’s Upward Trajectory

Source: Optuma.

You have to love the strength we see here. After trending sideways for most of this year, highlighted by the previous resistance level in green, we finally got a breakout and surge higher in September and October.

Now, investors have cooled on DELL, and we have a brief downward resistance level forming.

The previous resistance level, in green, is now support.

But with the stock going through that cycle I just mentioned, DELL is primed for a breakout. Since late September, the stock broke higher during the leading (green) and weakening (yellow) segments. And it held around those levels throughout the lagging (red) and improving (blue) segments.

As it shifts back into the leading quadrant in the coming days, it sets up for a nice rally to the upside that earnings can jump-start this week.

Regards,

Chad Shoop

Editor, Quick Hit Profits

Click here to join True Options Masters.