If you are like most investors, you’ll hold dozens of stocks for years at a time.

Banyan Hill CMT Chad Shoop

It’s the traditional buy-and-hold approach.

To figure out your returns for any given year, you’d have to average each of those returns to get the gains for the year.

That’s the number that tells you how well you are doing.

The approach I’m sharing with you today flips this strategy upside-down.

Instead of averaging our gains at the end of the year, we get to add up two to four stocks to get our total returns each and every year. It’s like making two to four trades for one of those stocks you were holding. And for each stock taking up your capital, you could put it to work throughout the year with this strategy.

Again, for most investors, maybe even you, this isn’t possible because they hold the same stocks all year.

In that case, you take the overall average.

But because we only hold a stock for a few months, at most, we get to compound our returns during the year, and then average what I call “Profit Stacks.”

The Power of “Profit Stacking”

These are separate groups of trades that are aligned to go from one trade to the next, over an entire year. You can “stack” up to four trades a year.

For example, if a buy-and-hold investor made three trades that worked out to 10%, 15% and 20% gains, a hypothetical example, the average gain for the year would be 15%.

Meanwhile, following my Profit Stacking approach, these same three hypothetical gains would have ended up with 45% returns that year — three times the buy-and-hold approach.

That’s a huge difference and it’s the power in my “Profit Stacking” strategy.

Real Example of Profit Stacking

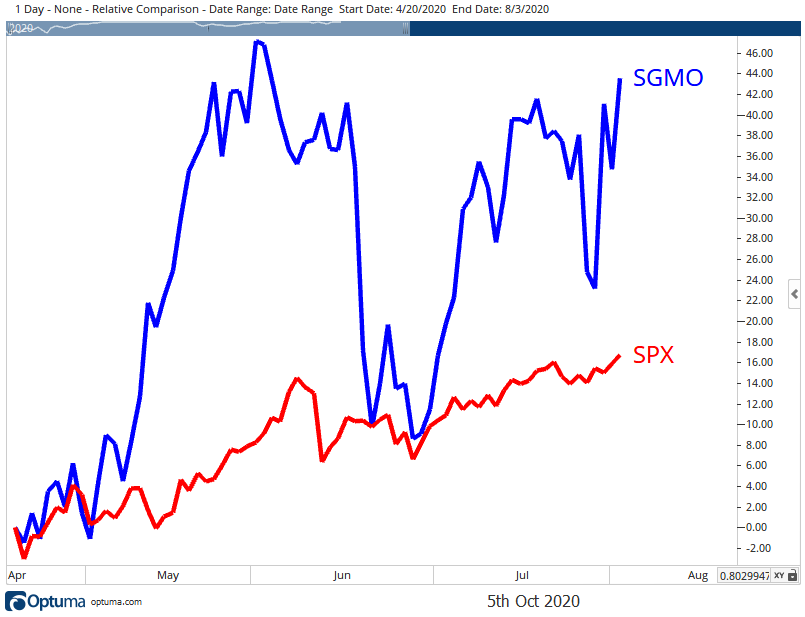

Take a look at this chart of a recent trade, from April 20 to August 3, compared to the sector and the overall market:

You can see that the performance for the benchmark was about 18%.

In April, I sent an alert to readers of my newsletter that uses my Profit Stacking strategy to buy into Sangamo Therapeutics (Nasdaq: SGMO), a biotech stock.

You can see it wasn’t a straight shot higher, at least not for the point we exited at, but shares of Sangamo managed to climb more than 40% over the four-month period — easily doubling the S&P 500 performance.

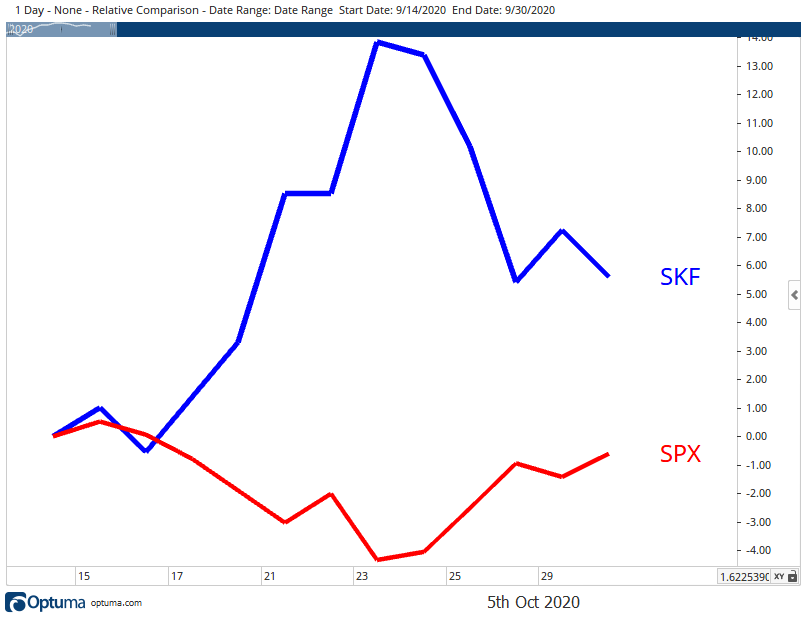

And here’s another example. This came up shortly after it, from September 14 to September 30, just two weeks.

This time we jumped into an inverse exchange-traded fund (ETF), ProShares UltraShort Financials (NYSE: SKF), and you can see how it outperformed the S&P 500 over those two weeks…

It absolutely crushed it.

I know we are talking about just a 6% gain, but when the market is falling, gains like that can really add up. Not to mention we had the chance to exit for a 10% gain in just a few days.

I’m perfectly happy with our 5% returns as volatility hit the markets.

This came in just two weeks, which means we can put that gain right back to work in more trades and continue creating greater returns.

I have three trades lined up that we will jump into any day now.

Of course, there’s a risk a losing trade comes along and reduces our returns in any given Profit Stack. But that’s true in all forms of investing.

The key is to have a sound strategy that helps you navigate a market to find more winners than losers, and that’s what my Profit Stacking strategy is meant to do.

I revealed all of the details of my Profit Stacking strategy in a recent interview. You can read the transcript here to get the details.

Regards,

Chad Shoop, CMT

Editor, Automatic Profits Alert