Banks want you to think they rely on complex systems to earn money, but it’s simple.

They get by on account fees and loan interest.

And with the Federal Reserve raising interest rates at a steady clip to fight inflation, banks can profit even more on the loans they issue.

That’s terrific news for certain regional bank stocks.

Using Chief Investment Strategist Adam O’Dell’s proprietary six-factor Stock Power Ratings system, I found a “Strong Bullish” company:

- It’s a full-service regional bank in the Midwest.

- The stock is just off its 52-week high and showing solid upward momentum.

- It rates a 94 out of 100 on our Stock Power Ratings system.

Here’s why the regional stock I’m sharing with you today will continue its strong performance in 2022 and beyond.

Regional Banks Profit on Your Money

Banks rely on loan interest for a large portion of their income stream.

They take money you deposit and loan it out to other individuals and businesses. The interest on those loans is a profit for the bank.

Looking at mortgage rates, the national average interest rate on a 30-year fixed-rate loan was 5.77% on July 13, according to Bankrate. That number was only 3.4% on January 5.

In the simplest terms, that means a bank can make $5,770 on a $100,000 loan that was only going to pay out $3,400 seven months ago.

Banks are loaning out more money as well … that’s more interest flowing in. And, as this chart below shows, the trend is growing:

U.S. banks have issued $11.4 trillion in loans and leases, as of the week ending June 29, 2022.

That’s a 10% increase from the same time a year ago!

Bottom line: Banks are lending more — and that means more money coming back into their coffers.

Low Volatility and Strong Momentum: Great Southern Bancorp Inc.

Robust deposit and loan growth helps all banks, but regional banks in particular stand to benefit.

Large banks like Bank of America or Wells Fargo have additional sources of income … such as trading stocks. But regional bank income comes from interest charged on loans and lines of credit.

Great Southern Bancorp Inc. (Nasdaq: GSBC) is a regional bank operating in the Midwest.

The Missouri-based company has 93 locations and 200 ATMs in Missouri, Iowa, Minnesota, Kansas, Nebraska and Arkansas.

Despite regional operations, GSBC‘s revenue growth has been strong and steady:

In 2017, GSBC earned $176.4 million in total annual revenue.

By next year, that number is expected to surge to $226.2 million — a 28.2% increase from 2017.

Now let’s look at this regional bank stock’s recent performance.

GSBC Blows Away Peers

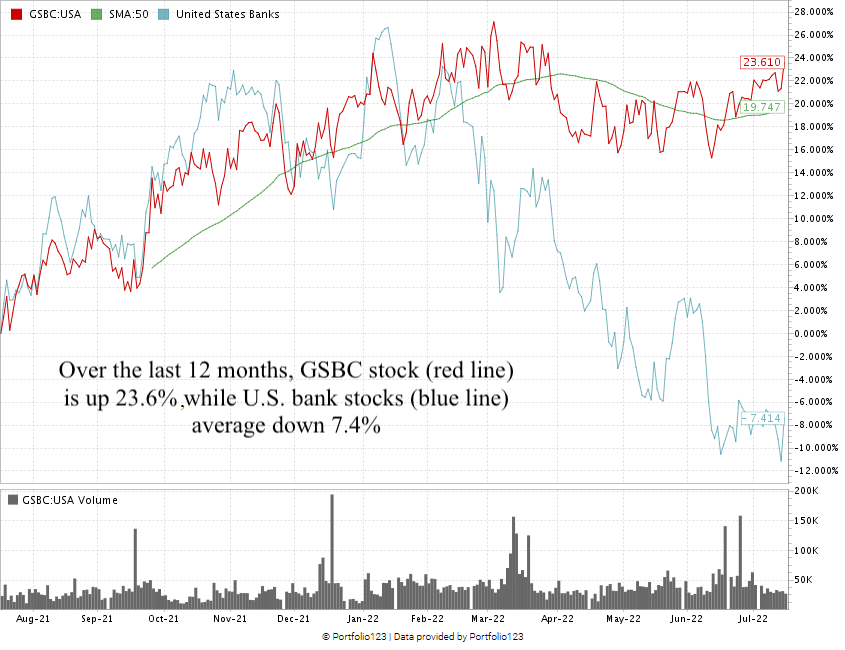

Despite the broad market downturn, GSBC stock is up 23.6% over the last 12 months as I write.

The regional bank stock continues to outperform its banking peers — which are down 7.4% over the same time.

GSBC is also only 2.8% off its 52-week high set in March 2022. It has weathered the market sell-off well.

Great Southern Bancorp Inc. Stock Rating

Using Adam’s six-factor Stock Power Ratings system, GSBC scores a 94 overall.

That means we’re “Strong Bullish” on this regional bank stock and expect it to beat the broader market by at least three times over the next 12 months.

Great Southern Bancorp Inc.’s Stock Power Rating on July 18, 2022.

GSBC rates in the green on five of our six factors:

- Volatility — In the last 52 weeks, GSBC hit a new high with little downside. It scores a 94 on volatility.

- Momentum — Since this time a year ago, GSBC’s stock price has been on a steady upward climb. It scores an 87 on momentum.

- Size — With a market cap of $762.1 million, Great Southern scores an 82 on our size factor. When looking at two stocks with similar ratings on the other five factors, smaller stocks historically outperform their larger counterparts.

- Value — GSBC scores a 72 on value, with a price-to-earnings ratio of 11.2 compared to its sector peer average of 10. GSBC’s price-to-book value ratio is 1.35, while the U.S. bank industry average is 1.1.

- Quality — GSBC’s return-ons (assets, equity and investment) are all in line or slightly above the banking industry’s averages. GSBC scores a 61 on quality.

GSBC earns a “Neutral” 47 on growth, but its one-year annual earnings-per-share growth rate is 29.8%. A neutral rating just means the company is average compared to the broader market, which isn’t a bad thing!

Bottom line: The amount we borrow for homes, automobiles and credit cards is going up.

This means banks like Great Southern will earn more money on the interest they charge for those loans.

It’s why GSBC is a great regional banking stock to have in your portfolio.

GSBC Bonus: Great Southern pays a forward dividend yield of 2.66%. That means shareholders earn an extra $1.60 per share in dividend payments every year for each share they own.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Stock Power Podcast, as well as the Marijuana Market Update. He’s also a certified Capital Markets and Securities Analyst through the Corporate Finance Institute. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.