Sometimes it feels like investors have picked the market clean of cheap stocks, but there are still a few good bargains out there. Consider business development company (BDC) Prospect Capital Corp. (Nasdaq: PSEC).

Prospect Capital is objectively cheap. There’s the obvious — it pays a nice 8.2% yield. But what I really like is that it trades at a 9% discount to book value. You could sell off the company for spare parts and still walk away with a 9% profit. The investments are not liquid, of course, and you never really know what they are worth until you try to sell them. So there may be a little wiggle room in that valuation. But still, I’m interested in any company trading at below its liquidation value.

PSEC, like most BDCs, provides capital to middle-market companies. These are companies that are a little too big to go to the bank for a loan but not quite big enough to go to Wall Street for a major stock or bond offering.

Prospect’s portfolio is:

- Mostly debt-based: 80% is invested in first-lien loans and other senior-secured debt.

- Well diversified: Its investments are spread across more than 120 companies in 39 industries.

What to Look for in Business Development Companies

BDCs are about as close to the proverbial “Main Street” as Wall Street gets. So, as the economy reopens and recovers from last year’s train wreck, PSEC’s portfolio companies should follow that upward trend higher.

In the world of investing, there is always an information mismatch. You and I don’t get access to market-moving news until it’s released to the general public. Even if we somehow had access to insider information, it would be illegal for us to act on it.

Well, the people that run a company like Prospect have access to information that we don’t. But more than specific numbers, they have their hands on the pulse of the company. They have a good feeling for what the company’s prospects look like. So, when you see insiders buying the stock, that’s a fantastic sign.

Suffice it to say, insiders are buying Prospect Capital stock. CEO John Barry has been gobbling up shares as if it were an all-you-can-eat buffet. He bought nearly 31 million shares last year and owns close to 70 million shares in total. Come what may, he’s committed to the success of his own company. If the company fails, he’ll be $600 million poorer.

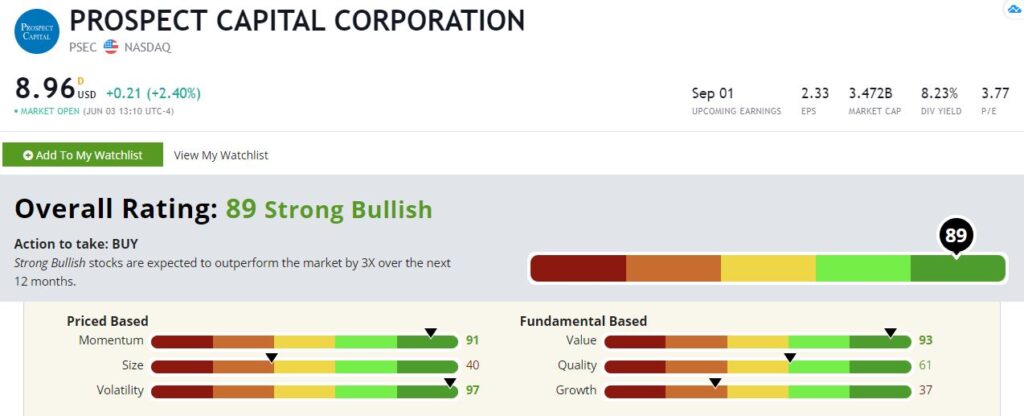

Let’s see how Prospect Capital stacks up on our Green Zone Ratings system.

Prospect Capital’s Green Zone Rating

It rates an 89 overall, which puts it well within “Strong Bullish” territory. And breaking it down further, it rates well across nearly all of our six factors.

Prospect Capital Corp.’s Green Zone Rating on June 3, 2021.

Volatility — With a volatility score of 97, Prospect Capital is the definition of a steady-eddy producer. That’s not uncommon for business development companies. As these are income plays, the stock price tends not to move all that much.

Value — I mentioned Prospect was objectively cheap, and its value rating confirms this. The stock rates a 93 on value, helped by that nice P/B ratio I highlighted earlier.

Momentum — Perhaps unusually for a low-vol stock, Prospect also rates well on momentum with a score of 91. Some of this is a product of the pandemic bear market. PSEC’s shares got hit hard last March, but have performed well ever since.

Quality — With a rating of 61, Prospect is no slouch on quality. We like to see profitability and good balance sheet management here, and Prospect makes the grade.

Size — Prospect is one of the larger publicly traded BDCs with a market cap of almost $3.5 billion. That brings its size factor rating down to 40.

Growth — If there is one factor where Prospect rates poorly, it would be growth, with a score of just 37. That’s not a deal-breaker here Because this is an income play. And PSEC’s other factors more than make up for the lower growth score.

Bottom line: Overall, Prospect Capital looks good. It’s a high-value stock that will benefit from the continued reopening of the economy, and it has some of the strongest insider buying I’ve ever seen. It should make a nice addition to an income portfolio.

To safe profits,

Charles Sizemore

Editor, Green Zone Fortunes

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.