In the latest Marijuana Market Update, I answer a question about the psychedelic industry and dive deeper into the sector.

Michael emailed me:

Should I invest in some psychedelics now, just like cannabis from a few years ago? Is that a good speculation at this time? — Michael

Thank you for the question, Michael! I’m more than happy to address psychedelic stocks.

Companies are researching the potential for psychedelics —psilocybin, for the most part — to help treat post-traumatic stress disorder, depression and more.

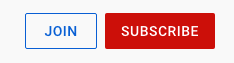

I found an index that tracks around 52 companies in this category: the PsyIndex Psychedelic Index.

The Psychedelic Index is an equal-weighted index like the Money & Markets Cannabis Index.

As you can see here, the index peaked at around 220 in May 2020, dipped and went on another run between December 2020 and February 2021.

Since then, the lows for these psychedelic stocks have been higher, but the index is trending sideways, telling me that movement in the sector is limited.

While the index tracks 52 companies, they are, for the most part, tiny pharmaceutical companies. Most are thinly traded — with less than 100,000 shares traded daily.

The biggest headwind facing these companies is that, like cannabis companies, the use of psychedelics isn’t legal here in the United States.

And, like cannabis, advocates for the legalization of psychedelics are taking a similar path to convince lawmakers that they should be.

They are starting with promoting the positive effects psychedelics have on treating mental health issues such as depression, ADHD and PTSD.

This is similar to how cannabis advocates promoted legalization — and why medical-use cannabis is more widely legal than recreational.

Psychedelic advocates’ argument makes sense, especially because these mental health issues are prevalent here in the U.S. Once these small companies can show the medical benefit of psilocybin as a treatment, it will be difficult to argue against medical use.

But that, as with cannabis, will take some time before lawmakers understand and get behind legalization efforts.

In terms of investing, the other challenge companies researching psychedelics face is that they haven’t made any money yet.

This means their value metrics — like price-to-earnings, price-to-sales and price-to-book — are all over the map.

2 Psychedelic Stocks to Watch

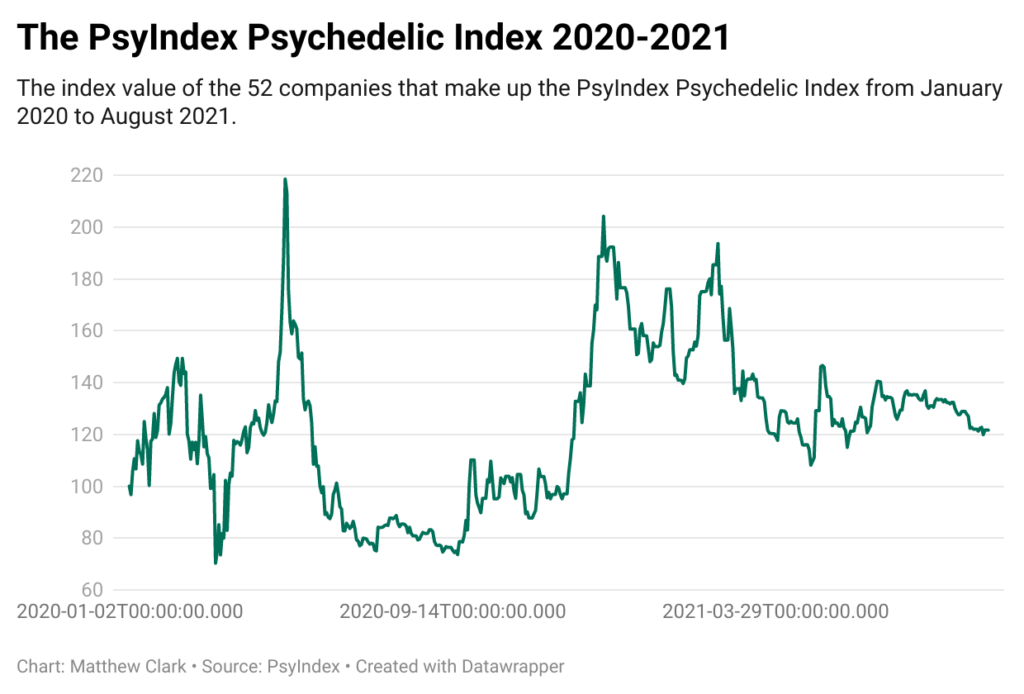

Take ATAI Life Sciences BV (Nasdaq: ATAI), for example.

This is a German company researching a variant of R-ketamine to treat depression and other forms of psychedelics to treat mental issues such as anxiety, opioid abuse and schizophrenia.

The company formed in 2018 and went public on the American market earlier this year.

While it recorded $20 million in sales in the first quarter of 2021, the money was collected as part of a collaboration with another pharmaceutical company — Otsuka — to continue researching its R-ketamine therapy.

So, ATAI hasn’t sold anything, and it could be some time before it does.

Since its IPO — which raised $258 million — ATAI stock has dropped almost 18%, but it is showing signs of an uptick.

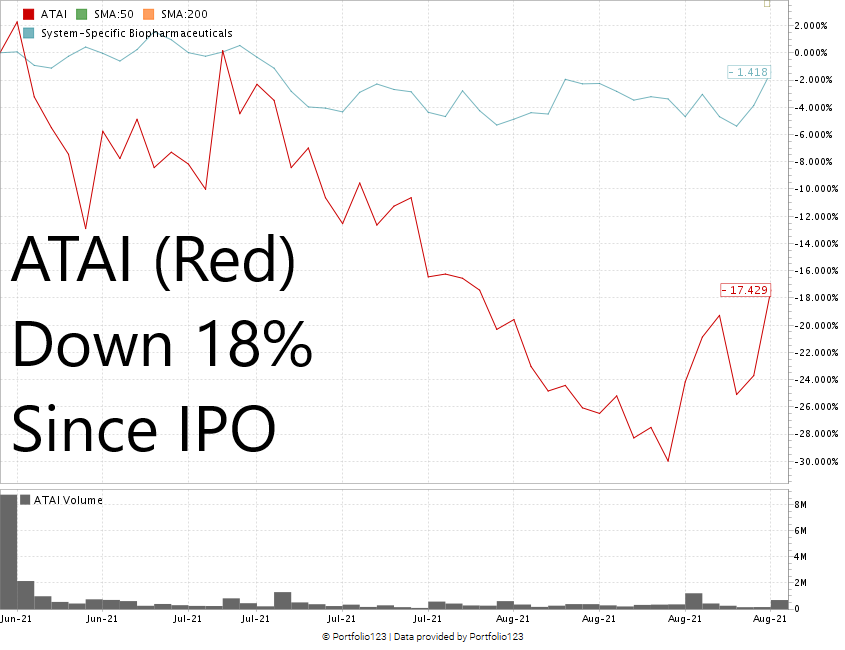

Another psychedelic stock I’m keeping an eye on is Mind Medicine Inc. (Nasdaq: MNMD). It is more liquid than its peers — it moved 4.5 million shares on Monday.

It focuses on developing psychedelic therapies to treat addiction and mental illness and is based in New York.

Over the last 12 months, MNMD has jumped more than 840%, but consider it was trading at $0.34 per share a year ago and is at almost $2.70 today.

MNMD dropped after reaching a high in April but seems to be rebounding.

I don’t see any debt for the company, but I don’t see any income either.

Regardless, in the psychedelic space, MNMD is one to watch.

The Takeaway on Psychedelic Stocks

There is a significant risk with investing in psychedelic companies.

Should you? Well, if you are willing to play the long game to realize any gains and the sector interests you, then go for it.

But if you aren’t willing to see some red in your portfolio for the foreseeable future, then it’s best to wait.

I believe that studies will show the positive effects of psychedelic treatment, and psychedelics will follow the same path as cannabis to legalization.

I also think the timeline for psychedelic legalization will be much faster than cannabis as cannabis paved the way to increase understanding of how these drugs, once considered a stigma, can help treat mental issues.

Thanks for the question, Michael. Look out for an email from my team as we will send you Money & Markets merchandise.

You, too, can get Money & Markets swag by submitting a question for me, Adam O’Dell or Charles Sizemore that we use in any of our videos. Just send us your questions and feedback.

YouTube “Join” Feature

We offer members exclusive content, including:

- Interviews with cannabis insiders.

- Blog posts, stock analysis and company breakdowns.

- More content related to our Cannabis Watchlist.

- Monthly live chats with me, where we’ll discuss cannabis stocks, the cannabis sector and much more.

I even unveiled another tool you can use to help point you in the right direction for cannabis stock investments.

Just click “Join” on our YouTube page to find out what you can access by joining.

If you have a cannabis stock you’d like me to look at, email me at feedback@moneyandmarkets.com.

Where to Find Us

Coming up this week, we’ll have more on The Bull & The Bear podcast and our Money & Markets Week Ahead, so stay tuned.

Don’t forget to check out our Ask Adam Anything video series, where we ask any question to chief investment strategist Adam O’Dell, and our Investing With Charles series, in which our expert Charles Sizemore and I discuss the trends you write in to ask about.

Also, you can follow me on Twitter (@InvestWithMattC), where I’ll give you even more insights, not just in the cannabis market.

Remember, you can email my team and me at feedback@moneyandmarkets.com — or leave a comment on YouTube. We love to hear from you!

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.