It’s been a wild ride ever since the omicron variant was discovered. The market initially dropped as investors feared a return to lockdowns. But then, the rallies have been equally fierce as investors handicap to what extent the new variant might slow down the Fed’s plans to tighten monetary policy.

It’s a rollercoaster ride, and it may be volatile like this for at least another week or two until we have a little more information about the variant.

This little bout of volatility may just be the pause that refreshes, a needed consolidation to create a healthier and more durable bull market. Or, it could very well be the opening shots of a new bear market that takes a major bite out of stocks. It’s too early to say just yet.

But shocks like these remind us why dividend investing matters.

3 Big Benefits for Dividends During a Rocky Market

- Dividend payments allow you to realize a return even when the market isn’t cooperating. When you depend on dividends for income, you never have to sell a good stock at a bad price in order to meet your current living expenses.

- Dividend payments enforce discipline. Companies that need to keep cash on hand for dividends are less likely to blow it on a money-losing acquisition or some other common act of corporate stupidity. Dividend-paying breeds a better kind of company.

- Dividend-paying stocks tend to be less volatile overall. There are varying reasons for this, including the fact that dividend payers tend to be older, more established companies. Dividends also act as an anchor of sorts. As a stock’s price falls, its dividend yield rises, all else equal. And a higher yield attracts new buyers, which helps buoy the price.

A Low-Volatility Dividend Play: Public Storage (NYSE: PSA)

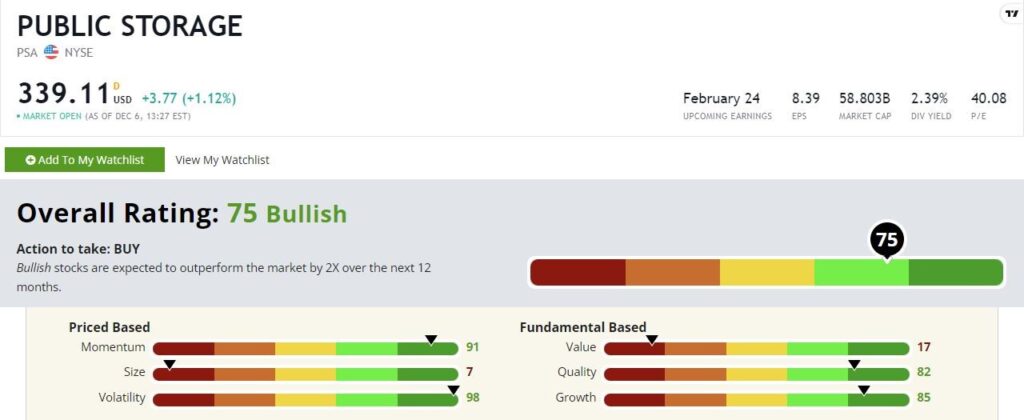

Let’s focus on that low volatility aspect. Volatility is one of the six factors we track in our Green Zone Ratings system, but a high score here means the stock is less volatile. We seek to win by not losing. Avoiding stocks prone to big swings (highlighted by their lower volatility score in Green Zone Ratings) helps us do just that.

Take leading self-storage landlord Public Storage (NYSE: PSA). It isn’t the highest yielder at 2.6%, but this REIT is a reliable dividend payer that has raised or maintained its dividend every year since 1991. Public Storage rates a 75 overall, making it a “Bullish” stock in our system. But the details are far more interesting.

Public Storage’s Green Zone Rating on December 7, 2021.

Volatility — Public Storage rates a 98 out of 100 on volatility. This means that the stock is less volatile and offers better risk-adjusted returns than almost every other stock in our universe. If you’re concerned about a wave of market volatility, a stock like Public Storage makes sense. It’s a company that owns storage sheds, for crying out loud. If there was ever a business model that was recession-proof, this is it.

Quality — Public Storage also rates well on quality at 82. Public Storage rates well on its returns on assets, investment and equity. It also enjoys strong margins. It’s a REIT, so it carries a lot of debt, which dings its score here a little. But overall, this is an excellent company and one that can survive the apocalypse.

Momentum — Public Storage carries a strong momentum score as well, with a factor rating of 91. The business model may be stodgy and boring. But the stock has proven to be anything but. In fact, since I first talked about PSA back in July, the stock has gained almost 10%. That’s the kind of momentum we love to see in a stodgy REIT.

Growth — Since July, PSA’s growth rating has jumped more than 20 points to 85. Tech-like growth is rare in dividend payers, but Public Storage is making it happen. In its latest earnings report, PSA reported $927 million in revenue for the quarter ending in September. That’s 22% growth year-over-year. Tack on a 50% YOY increase in net income, and you might mistake PSA for AMZN.

Value — Public Storage isn’t cheap. It rates a 17 on this factor. Most REITs score low here due to REIT accounting quirks. But even taking that into consideration, Public Storage is an expensive stock. Investors are comfortable paying for quality.

Size — It’s also not small. This is one of the largest REITs in the world by market cap, and it rates a 7 based on size.

Bottom line: Again, we don’t know what comes next in this market. This week’s volatility might have been a flash in the pan, or it might be the start of something worse. Either way, if you’re looking for a low-volatility option to ride out whatever comes next, Public Storage is a fantastic option.

To safe profits,

Charles Sizemore

Editor, Green Zone Fortunes

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

Story updated on December 7, 2021