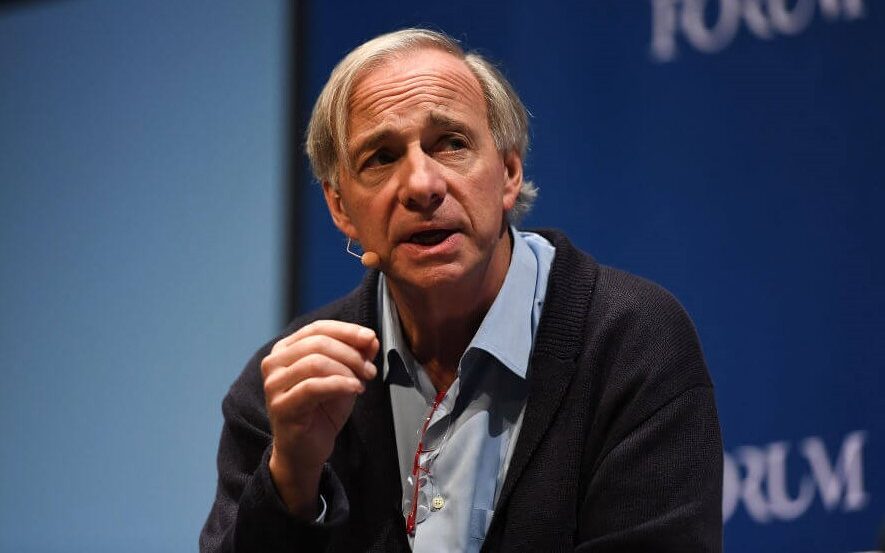

Bridgewater Associates, the largest hedge fund in the world, made a $1.5 billion bearish bet on the stock market crashing by March, but founder Ray Dalio said the wager was mischaracterized by The Wall Street Journal, which first broke the story last week.

The bet will pay off if the S&P 500 or Euro Stoxx 50, or both, decline, people in the know told TWSJ, which we also reported here on Money and Markets on Friday. The bet was mostly made up of put options that are essentially contracts giving the owner the right to sell a specific number of stocks at a predetermined price, or strike price, within a certain time frame.

Put options allow a trader, or in this case a firm, Bridgewater, to bet a smaller amount of money to hedge against larger positions, should those positions decline.

Bridgewater spent about $1.5 billion on such a bet, which is about 1% of the firm’s $150 billion in assets under management.

Dalio didn’t refute the bet, but rather the way it was reported by the TWSJ.

I believe that we are now living in a world in which sensationalistic headlines are what many writers want above all else, even if the facts don’t square w/ the headlines. You can believe me or you can believe The WSJ writer. I hope you have come to know that you can believe me.

— Ray Dalio (@RayDalio) November 22, 2019

TWSJ defended the way the story was handled when questioned by CNBC.

“The Journal’s article is based on interviews with multiple sources and we stand by the conclusions we reported,” Severinghaus said in an email, according to CNBC.

“The article does not report, as Mr. Dalio says, that Bridgewater has a ‘net’ bearish position on the stock market. The article made clear that the trade could be a hedge for the firm’s significant long exposure to equity markets, among other possibilities.”

Bridgewater also gave a statement on the bearish bet that, according to Dalio, isn’t a bearish bet at all.

“Though we won’t comment on our specific positions we do want to make two things clear,” Bridgewater told CNBC. “First, the way we manage money is to have many interrelated positions, often to hedge other positions, and these change often, so that it would be a mistake to look at any one position at any one time to try to deduce the motivation behind that position.

“Second, we have no positions that are intended to either hedge or bet on any potential political developments in the U.S.”

So while Dalio and Bridgewater say the bet wasn’t bearish (it is) or meant to hedge against other positions, it most certainly was, no matter how they attempt to spin it.

And it’s no surprise considering traders and firms are growing wary of the market hitting new record highs amid the seesawing, will they, won’t they get a deal done between the U.S. and China in the ongoing trade war.