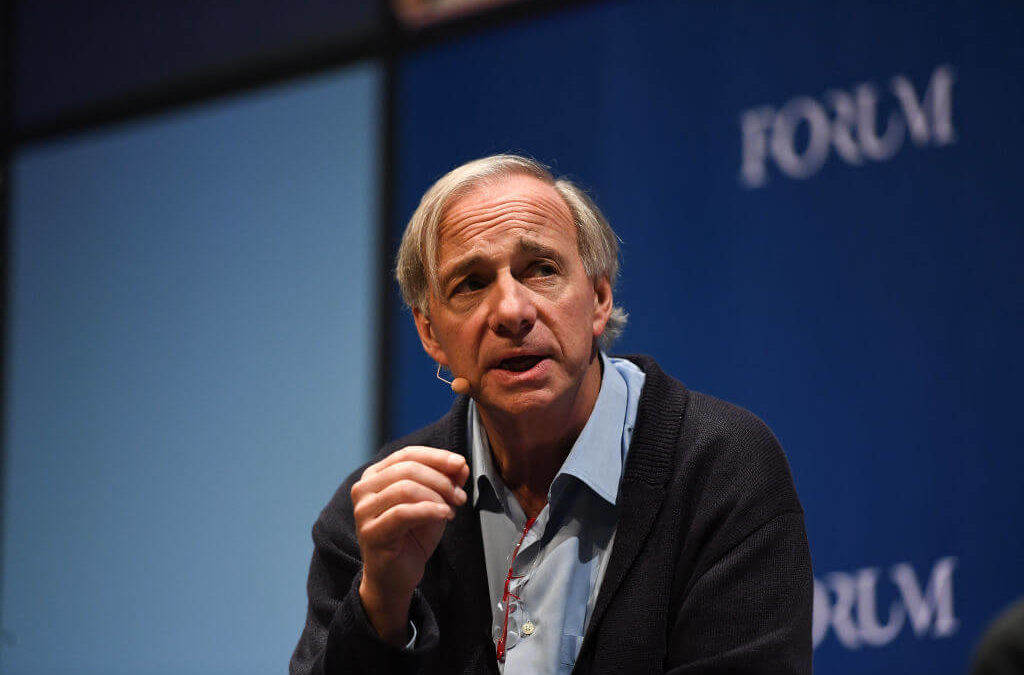

Billionaire Bridgewater Associates founder Ray Dalio argues that central banks soon will be out of tools to prevent or reverse an economic downturn as the world enters what he calls the late stages of the long-term debt cycle.

“Interest rates get so low that lowering them enough to stimulate growth doesn’t work well,” Dalio wrote in his newest essay posted on LinkedIn.

The Federal Reserve cut its key interest rate for the first time in over a decade back in July, and many economists believe another rate cut is coming during the Fed’s mid-September meeting.

It doesn’t stop at interest rates, either, as Dalio argues against other monetary policies making up the lost ground.

Per LinkedIn:

Monetary Policy 2 (i.e., printing money and buying financial assets) doesn’t work well because that doesn’t produce adequate credit in the real economy (as distinct from credit growth to leverage up investment assets), so there is “pushing on a string.” That creates the need for…

Monetary Policy 3 (large budget deficits and monetizing of them) which is problematic especially in this highly politicized and undisciplined environment.

In the piece, Dalio draws comparisons between the current global economic situation and what was happening in the late 1930s before the second world war. And while he doesn’t think the comparison is completely indenticle, he does make a good case for history repeating itself:

Please understand that I’m not saying that the past is prologue in an identical way. What I am saying that the basic cause/effect relationships are analogous: a) approaching the ends of the short-term and long-term debt cycles, while b) the internal politics is driven by large wealth and political gaps, which are producing large internal conflicts between the rich and the poor and between capitalists and socialists, and c) the external political conflict that is driven by the rising of an emerging power to challenge the existing world power, leading to significant external conflict that eventually leads to a change in the world order.

“There is a lot to be learned by understanding the mechanics of what happened then,” he wrote.

Click here to read Dalio’s full analysis.