Ray Dalio is long on Chinese investment and said the current government under President Xi Jinping is different from past generations.

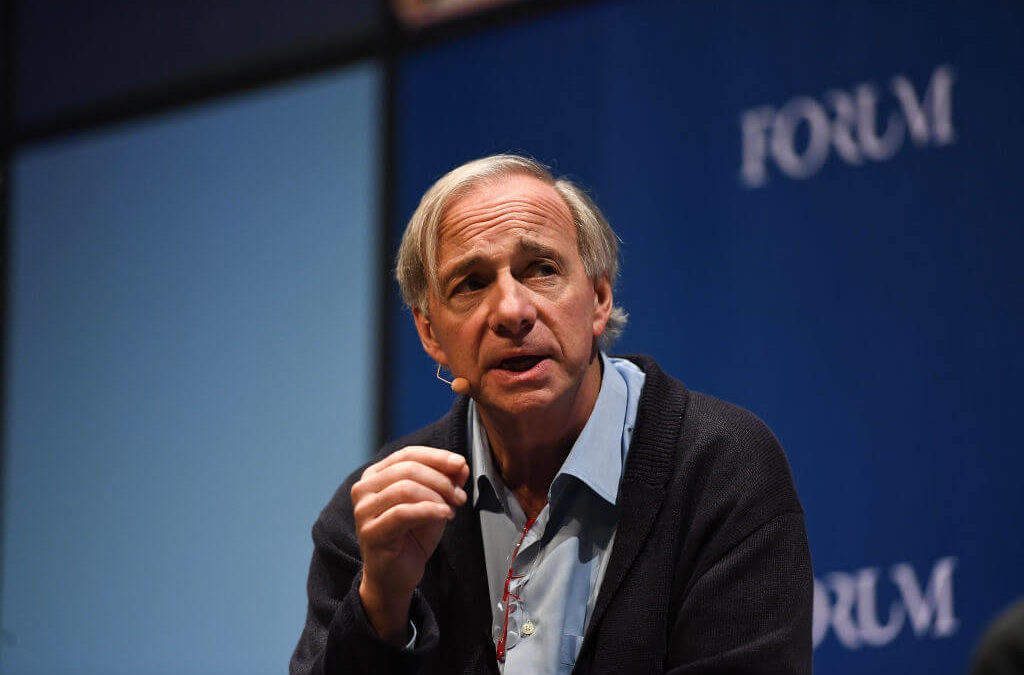

“You have to understand that the word communism has a connotation to an American of what it is, and this ain’t your grandfather’s communism,” the billionaire Bridgewater Associates founder, co-chair and co-CIO said during a Fox Business interview while attending the World Economic Forum in Davos, Switzerland, last week.

Shifting tides are currently going on in both China and the U.S., where the Chinese are becoming more capitalist, while socialism has been on the rise in the U.S.

Sen. Bernie Sanders, a Democratic socialist, is currently polling second and charging hard at front-runner Joe Biden in the upcoming Democratic primary, the winner of which will face incumbent President Donald Trump in the 2020 election.

“We’re almost at an anticapitalist move here,” Dalio said, referring to politicians like Sanders, Rep. Alexandria Ocasio-Cortez and Sen. Elizabeth Warren, another primary candidate pushing wealth taxes to fund a number of social programs like universal childcare and free college tuition.

“Bond King” Jeffrey Gundlach says Sanders is the biggest risk for stock markets in 2020.

China’s communist government was founded in the late 1940s by Mao Zedong and originally had a centrally planned and controlled economy, but the country has slowly moved toward an open-market system, having been accepted into the World Trade Organization nearly two decades ago.

China now has the world’s second-largest economy, trailing only the U.S. and twice the size of third-place Japan.

“The energy to being able to come up with ideas and become a billionaire and to do things in terms of venture capital is really great,” Dalio said, adding that he is bullish on investing in China.

The Chinese economy grew at 6.1% in 2019, according to Beijing — though, it is widely believed the government in China inflates its numbers. The 6.1% is more than double the United States’ growth for the same year, but it was still China’s slowest growth since 1990 due to weaker consumption, growing debt and the ongoing trade war with the U.S.

However, the Shanghai Composite rose 22%, its best year since 2014.

“I like investing in China,” Dalio said. “I know it’s controversial, but that’s an opportunity.”