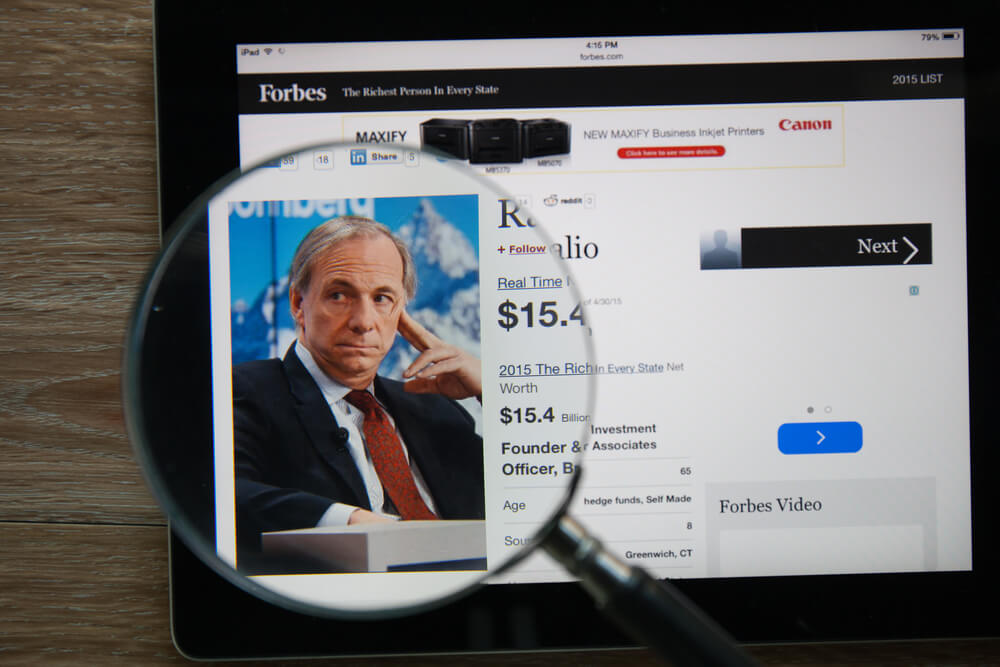

Billionaire Bridgewater Associates founder Ray Dalio said this week that the global economy is in a “great sag” with a political climate much like what we saw in the 1930s, and central banks can no longer provide the stimulus needed to pull out of it.

“We have a situation where we don’t have the ability to ease monetary policy,” Dalio said. “Europe is at the limitation of (interest rate cuts), Japan is and the U.S. doesn’t have much to go on for that.”

Dalio was speaking on a panel at the International Monetary Fund and World Bank’s annual conference in Washington, where he admitted the ongoing business cycle is “the best we get but it’s not going to continue forever — you have this sag,” Dalio said.

It’s this “sag” and zero interest and negative interest rate policies that will prevent banks from stimulating to the level we will eventually need.

“Monetary policy, it’s not going to be so effective,” he said, according to CNBC, which moderated the event. “Imagine if you have a downturn and you have (less) effective monetary policy, then there has to be coordination. So how do you get coordination in this kind of political environment? Then you have to have coordination with fiscal and monetary policy to be able to do something, and then you have to have political coordination between the various factors on what the policy should be.”

Dalio then touched a bit more on the political climate in that we have the dominant global power in the United States, but there is another rising power in the East: China, which of course is locked in a bitter trade war with the U.S.

“There’s four kinds of war: There’s a trade war, a technology war, currency capital war and a geopolitical war — and that’s a phenomenon happening at the same time,” Dalio said. “So internally, we have a lot more conflicts.