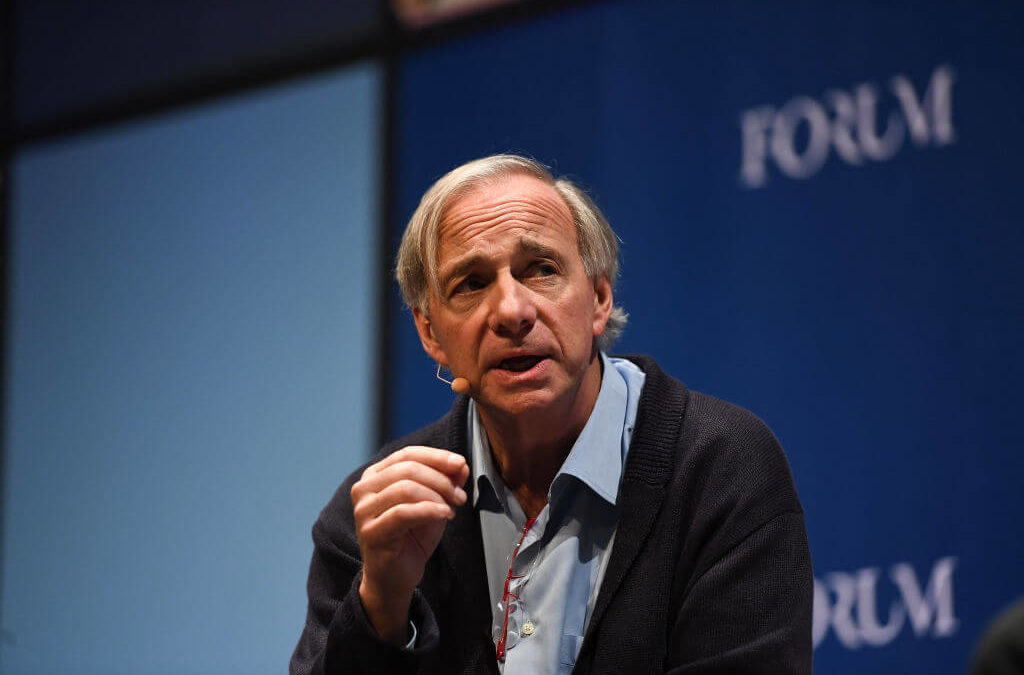

Billionaire hedge fund titan Ray Dalio said in a recent blog post on LinkedIn that the Trump administration could be “inching toward bigger moves” in regard to how it is dealing with China in the ongoing trade war between the world’s two largest economies.

“That’s why the proposed step of limiting American portfolio investments in China makes me both think about the implications of this step and wonder if it is an inching toward bigger moves,” Dalio wrote.

Dalio’s firm, Bridgewater, is the largest hedge fund in the world, managing almost $125 billion. And the founder, chairman and co-chief investment officer is known for speaking out, particularly on matters of wealth inequality. Dalio said central banks are now limited in their abilities to stimulate economies because of how low interest rates have been, including negative rates in Japan and Europe, and near-zero rates in the U.S., which is now in the 1.75% to 2% range.

Meanwhile, government spending has only accelerated, leading to massive budget deficits that will eventually force hike taxes, particularly on the rich, and they’ll have to start printing money again — which are bad things for the economy.

“Typically, this has led to capital flight as investors seek to escape these things, which has quite often led to capital controls that are intended to keep capital in the country and the currency so that it can more easily be taxed and/or devalued. So, naturally, I can’t help but wonder whether this extraordinary (i.e., nothing like this has happened in my lifetime) deviation from convention to restrict capital flows to China could be followed by these other steps when/if the circumstances that I’m describing unfold.”

Dalio noted that a U.S. president has the authority to cut off capital flows into China, freeze payments on the debt that is owed to Beijing and use sanctions to stop other countries from investing in the world’s second-largest economy, all drastic steps.

Dalio’s blog comes on the heels of reports late last week that the Trump administration is considering limiting investment in China, which trade adviser Peter Navarro said is not true on Monday.