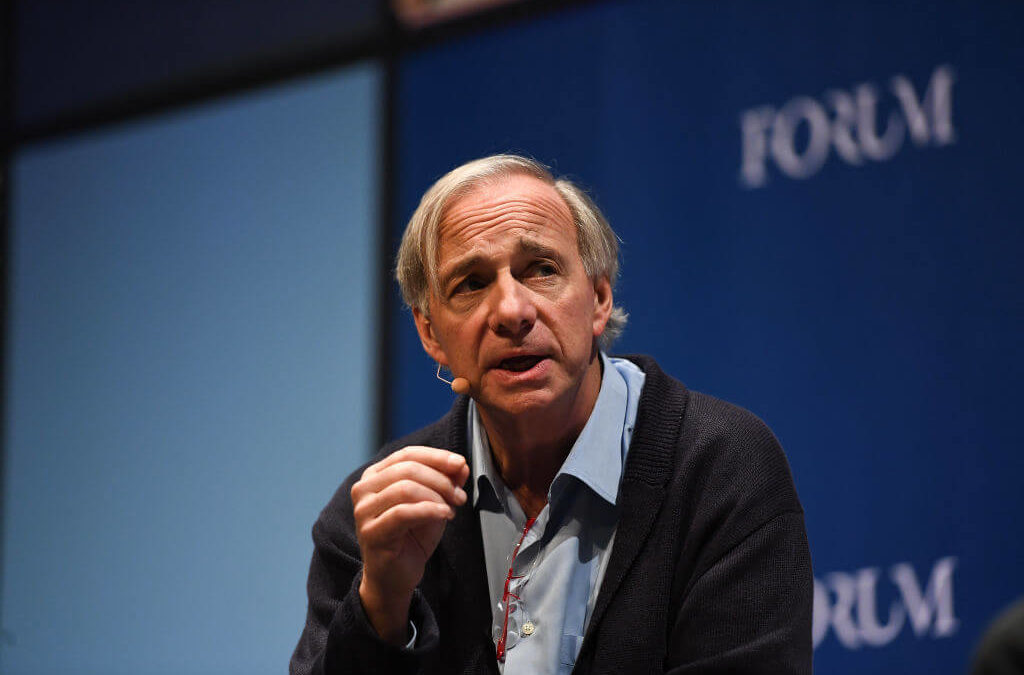

After seeing “signficant risk” of recession just a month ago, Bridgewater Associates founder Ray Dalio has slashed his odds to about 35 percent because the Fed has pivoted to a more dovish position regarding rate hikes.

“While I still expect that there will be a significant slowing of growth in the US and most other countries, I have lowered my odds of a US recession coming prior to the US presidential election to about 35 percent,” Dalio wrote in a blog post published Thursday on LinkedIn. “Because the markets weakened and Fed officials now see that the economy and inflation are weak there has been a shift to an easier stance by the Fed. Similarly, because of weaker markets, economies, and inflation rates in other countries, other central banks have also become more inclined to ease, though they have less room to ease than the Fed.”

In a Jan. 22 interview with CNBC from the World Economic Form in Davos, Switzerland, Dalio said he saw “significant risk” of recession before 2020.

“Where we are in the later [economic] cycle and the inability of central banks to ease as much, that’s the cauldron that will define 2019 and 2020,” he said at the time.

The Fed said it would be “more patient” concerning rate hikes at the end of January, pleasing investors who assumed two rate hikes were already baked in for 2019.

Chair Jerome Powell also said the central bank would end its balance sheet roll-off as soon as this year.

“While the Fed probably doesn’t have enough firepower to offset a deep recession, the big sag that we expect is probably manageable,” Dalio said in his note. “More specifically, the Fed now has 250 bps of easing (which will be more impactful than typical because of the longer durations of assets this cycle), plus the ability to turn QE back on, which we estimate is roughly equivalent to the 4% to 5% of easing typically required to get out of recessions.”