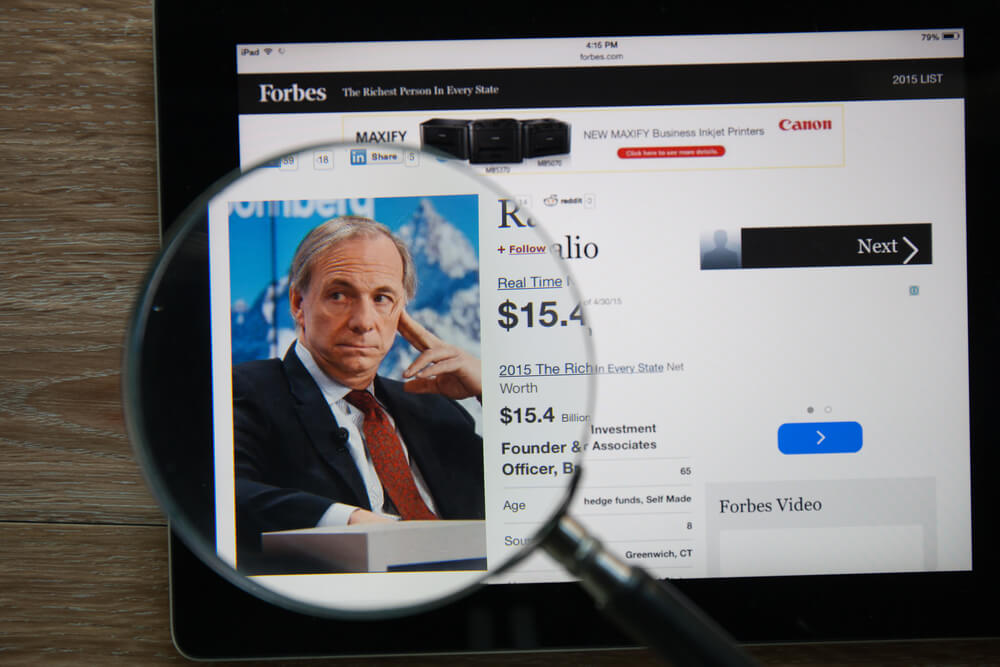

Ray Dalio, the Co-Chief Investment Officer and Co-Chairman of Bridgewater Associates, posted his how-to guide concerning the machinations of the stock market and economy in a post this week on LinkedIn to try and put the recent volatility in perspective.

Dalio believes all things, including the economy and market, work like a machine, with cause-effect relationships that drive what happens.

To understand how economies work, one has to understand how markets work. His piece on LinkedIn is his very own template to helping you understand what’s happening in the markets now.

This is a rather long piece but it’s packed with great information from one of the best minds on Wall Street.

You can also click here to watch a 30-minute video where he explains these same principles.

Per LinkedIn:

Dalio: How the Market and Economic Machines Work

At the biggest picture level, there are three big forces that interact to drive market and economic conditions over time. They are 1) productivity growth, 2) the short-term debt cycle (which typically takes about 5-10 years), and 3) the long-term debt cycle (which typically takes about 50-75 years). These factors also affect geopolitics both within and between countries, which also affects the market and economic conditions.

Productivity growth is the most important influence over the long term, though over the short term it doesn’t seem so important because it’s not highly volatile. Productivity trends higher over time as people learn and become more efficient so they are able to raise the output per hour worked. As explained in greater depth in “Productivity and Structural Reform: Why Countries Succeed & Fail, and What Should Be Done So Failing Countries Succeed” (located here), a country’s productivity growth is driven by its competitiveness as well as cultural factors. Competitiveness is mostly a function of the relative value a country offers, most importantly the value of people (as measured by the cost of comparably educated people in other countries). Culture (i.e., values and ways of operating) is very important because it influences the decisions people make about work, savings rates, corruption, reliability, and a number of other factors that are determinant of, and highly correlated with, subsequent years’ growth rates. These influences come together to influence the quality of a) the people (through the education system and through the quality of family guidance), b) infrastructure, c) rule of law, and d) market systems—all of which are shown to determine and be highly correlated with subsequent years’ growth rates. As for what’s happening lately, productivity growth in developed countries has been relatively slow (though in line with what we projected based on these determinants), and is more concentrated in a shrinking percentage of the population and in the area of automation that reduces the need for workers. These changes have significantly changed the labor markets, widened the gaps between the “haves” and the “have nots,” and raised company profit margins. (See “Our Biggest Economic, Social, and Political Issue—The Two Economies: The Top 40% and the Bottom 60%,” located here.)

Credit/debt cycles cause swings around that productivity uptrend. The way it works is that providing credit provides buying power that fuels spending on goods, services, and investment assets (first), which causes stronger economic activity and higher prices of these things (next). Providing credit also creates debt, which creates the need to pay back in the form of debt-service payments (that comes later) which in turn lessens the spending on goods, services, and investment assets (later) which leads to weaker economic activity and weaker prices of these things (after). So, credit/debt boosts growth at first and depresses it later. Central banks provide it to put on the gas when the economy has lots of slack and is growing slowly, and restrict it to put on the brakes when there isn’t much slack and the economy is growing fast. For these reasons, the effects of credit/debt on the demand, production, and prices of goods, services, and investment assets are inherently cyclical, which is why we have credit/debt cyclical moves around the earlier-described productivity uptrend.

Basically, these cycles come in two forms: the short-term debt cycle and the long-term debt cycle.

Dalio: The Short-Term Debt Cycle

The short-term debt cycle lasts about 5-10 years, depending on how long it takes the economy to go from having a lot of slack to not having much, which depends on how much slack it starts off with and how fast demand grows. In the cycle that we are now in, the expansion has been long because it started from a very depressed level (because the 2008 downturn was so deep) and because growth in demand has been relatively slow (because of the debt crisis hangover, because of the growing wealth gap and spending of those with a lot of wealth having a lower propensity to spend than those with little wealth, and because of other structural reasons). When slack is reduced and credit-financed spending growth is faster than capacity growth early in the cycle, that leads to price increases until the rate of growth in spending is curtailed by central banks tightening credit, which happens late in the “late-cycle” phase of the short-term debt cycle (where we are now). At that time, demand is strong, capacity is limited, and profit growth is strong. Also at that time, the strong demand for credit, rising prices/inflation, and eventually central banks’ tightenings of monetary policy to put the brakes on growth and inflation, causes stock and other asset prices to fall. They fall because all investment assets are priced as the present value of their future cash flows and interest rates are the discount rate used to calculate present values, so higher interest rates lower these assets’ present values. Also, tighter monetary policy slows prospective earnings growth, which makes most investment assets worth less. For these reasons, it is common to see strong economies being accompanied by falling stock and other asset prices, which is curious to people who wonder why stocks go down when the economic and profit growth is strong (because they don’t understand how this dynamic works). That is where we now are in this short-term debt cycle.

More particularly, during the expansion phase of the cycle that we are in, central banks created exceptionally low interest rates, which made it attractive for companies to borrow money to buy their own and other companies’ stocks, which boosted stock prices and has left corporate balance sheets much more indebted. Additionally, the US corporate tax cuts boosted equity prices even more and increased the budget deficit, which will require the Treasury to borrow much more. In addition to creating exceptionally low interest rates, central banks printed a lot of money and bought a lot of debt, which supported the markets. These one-time boosts to the markets and economies—at first via the low interest rates and the central bank purchasing of debt and more recently in the form of corporate tax cuts (in the US economy)—coming in the late stage of this short-term debt cycle when the capacity to produce was constrained—led the Fed to raise interest rates. Also contributing to the rate rise has been a) the Fed selling off some of the debt that it acquired through QE and b) big corporate borrowings. As a result, we are now seeing this classic late-cycle strong profit growth and strong economic growth that is accompanied by falling stock prices due to the financial squeeze. That’s when the cracks in the system begin to appear and what most people never expected to happen starts happening.

Typically at this phase of the short-term debt cycle (which is where we are now), the prices of the hottest stocks and other equity-like assets that do well when growth is strong (e.g., private equity and real estate) decline and corporate credit spreads and credit risks start to rise. Typically, that happens in the areas that have had the biggest debt growth, especially if that happens in the largely unregulated shadow banking system (i.e., the non-bank lending system). In the last cycle, it was in the mortgage debt market. In this cycle, it has been in corporate and government debt markets.

When the cracks start to appear, both those problems that one can anticipate and those that one can’t start to appear, so it is especially important to identify them quickly and stay one step ahead of them.

Of course psychology—most importantly fear and greed—plays an important role in driving the markets. Most people greedily switch from buying when things are going up to fearfully selling when they are going down. In the late-cycle stage of the short-term debt cycle, once the previously described tightening top is made, the cracks appear. The market movements are like a punch in the face to investors, who never imagined the punch coming, and it changes psychology, which leads to a pulling back and higher risk premiums (i.e., cheaper prices). Typically, the contraction in credit leads to a contraction in demand that is self-reinforcing until the pricing of asset classes and central banks’ policies change to reverse it. That normally happens when demand growth falls to less than capacity growth and there is greater slack in the economy. After central banks ease by several percent (typically about 5%), that changes the expected returns of stocks and bonds to make stocks cheap and it provides stimulation to the economy, which causes stock and other asset prices to rise. For these reasons, it is classically best to buy stocks when the economy is very weak, there is a lot of excess capacity, and interest rates are falling, and to sell stocks when the reverse is the case. Because these cycles happen relatively frequently (every 5-10 years or so), those people who have been around awhile have typically experienced a few of them, so this short-term debt cycle is reasonably well recognized.

Dalio: The Long-Term Debt Cycle

The long-term debt cycle comes around approximately once every 50-75 years and happens because several short-term cycles add up to steadily higher debt and debt-service burdens, which the central banks try to more than neutralize by lowering interest rates and, when they can’t do that anymore, they try to do so by printing money and buying debt. Because most everyone wants to get markets and economies to go up and because the best way to do that is to lower interest rates and make credit readily available, there is a bias among policy makers to do what is stimulative until they can’t do that anymore. When the risk-free interest rate that they control hits 0% in a big debt crisis, central banks lowering interest rates doesn’t work. That drives them to print money and buy financial assets. That happened in 1929-33 and 2008-09. That causes financial asset prices and economic activity to pick up as they did in 1933-37 and 2009-now. In both the 1930s case and our most recent case, that led to a short-term debt cycle rebound, which eventually led to a tightening (in 1937 and over the last couple of years) for the reasons I previously described in explaining the short-term debt cycle. This time around, the tightening is coming via both interest rate increases and the Federal Reserve reducing its holdings of the debt it had acquired.

For all of the previously described reasons, the period that we are now in looks a lot like 1937.

Tightenings never work perfectly, so downturns follow. They are more difficult to reverse in the late stage of the long-term debt cycle because the abilities of central banks to lower interest rates and buy and push up financial assets are then limited. When they can’t do that anymore, there is the end of the long-term debt cycle. The proximity to the end can be measured by a) the proximity of interest rates to zero and b) the amount of remaining capacity of central banks to print money and buy assets and the capacity of these assets to rise in price.

The limitation in the ability to print money and make purchases typically comes about when a) asset prices rise to levels that lower the expected returns of these assets relative to the expected return of cash, b) central banks have bought such a large percentage of what there was to sell that buying more is difficult, or c) political obstacles stand in the way of buying more. We call the power of central banks to stimulate money and credit growth in these ways “the amount of fuel in the tank.” Right now, the world’s major central banks have the least fuel in their tanks since the late 1930s so are now in the later stages of the long-term debt cycle. Because the key turning points in the long-term debt cycle come along so infrequently (once in a lifetime), they are typically not well understood and take people by surprise. For a more complete explanation of the archetypical long-term debt cycle, see Part 1 of “Principles for Navigating Big Debt Crises” (link).

So, it appears to me that we are in the late stages of both the short-term and long-term debt cycles. In other words, a) we are in the late-cycle phase of the short-term debt cycle when profit and earnings growth are still strong and the tightening of credit is causing asset prices to decline, and b) we are in the late-cycle phase of the long-term debt cycle when asset prices and economies are sensitive to tightenings and when central banks don’t have much power to ease credit.

Dalio: Politics

Politics is affected by economics and affects economics in classic ways. I won’t go into them all now, but I will touch on what I believe is most relevant for us to now consider. As previously mentioned, when interest rates hit 0%, central banks print money and buy financial assets, which causes these assets to rise. That benefits those who own financial assets (e.g., the wealthy) relative to those who don’t, which widens the wealth gap. Other factors such as technology and globalization (which remove the barriers between lower-cost and higher-cost populations) also contribute to the widening wealth gap within countries while narrowing the wealth gaps between counties. This causes the rise of populism and greater conflicts both within countries and between countries. Populism can be of the right or of the left. The conflicts can become harmful to the effective operations of government, the economy, and daily life (e.g., through strikes and demonstrations). This dynamic can become self-reinforcing because when populist conflicts undermine efficiency it can lead to more conflict and more extreme populism, which is more disruptive, and so on. Such times at their worst can threaten democracies and favor autocracies as most people believe that a strong leader is needed to get control of the chaos “to make the trains run on time.” For a more in-depth examination of this dynamic, see “Populism: The Phenomenon” (located here). Because populists are more confrontational and nationalistic by nature, and because domestic conditions are more stressful, the risks of confrontations between countries also rise during such periods. Over the past few years, we have seen this grow around the world. The emergence of populism in developed countries classically happens most forcefully late in long-term debt cycles when the short-term debt cycle turns down, which happened in the late 1930s and has a good chance of happening over the next couple of years, perhaps before the next US presidential election. The outcome of that election will have a big impact on just about everything.

There is another geopolitical principle that is relevant today and was relevant in the 1930s (and many other times before) that was highlighted by the great American political scientist Graham Allison (who was also dean of the Kennedy School of Government at Harvard and is now a professor there), which he calls the Thucydides Trap. In short, when a rising power gains comparable strength to compete with an existing power, there will inevitably be greater conflict between these countries. That conflict typically starts off being economic and becomes geopolitical in most ways. It typically affects trade and capital flows, what is produced where, and military encounters. “Wars” of various forms happen because there is a conflict between countries to establish which country is dominant in a number of areas and a number of locations (which become hot spots). Over the last 500 years, there were 16 times when an emerging power developed to become comparable to an existing power, and in 12 of those times there were shooting wars, which determines which country is dominant and which one has to be submissive. Wars are naturally followed by periods of peace because when a country wins a war no one wants to go to war with that dominant country. That continues until there is a new rising power to challenge the leading power, at which time there’s a war again to establish which power is dominant. Hence, there is a war-peace cycle that has shown up throughout history and tracks the long-term debt cycle pretty closely. China is certainly a rising power that is gaining comparable strength to challenge the US in much the same way as Germany and Japan rose to challenge the weakening “British Empire” and other countries that won World War I. This sort of conflict has relevant economic implications because anticipations of such circumstances trigger behaviors on both sides that can adversely affect trade flows, capital flows, and supply lines. This issue is now playing a significant role in the markets and will be with us for the next several years.

In other words, as I see it there are a number of analogous timeless and universal cause-effect relationships that are driving things now that drove things in the 1935-40 period and in a number of times in history, which we should be mindful of. That doesn’t mean that the future is destined to play out the way it did in the 1940s. There are certainly levers that can be moved to produce good outcomes. What matters most is whether there are skilled and wise people who have their hands on those levers.

Dalio: The Markets’ Connections with the Economy

In order to understand what’s happening and what’s likely to happen in the markets and the economy, it’s essential to understand the relationship between the financial markets and the economy. The financial system and the economy are inextricably linked because it is the financial system that provides the money and credit that is behind spending. Think of money and credit as being the fuel that changes demand.

Economic movements are driven by all markets interacting and trying to find their equilibrium levels, in much the same way as the parts of nature interact in a never-ending process of trying to find their equilibria. They are constantly moving to adjust the supplies and demands of goods, services, and financial assets in such a way that nothing can stay either very profitable or very unprofitable for long. If a good, service, or financial asset is very profitable for long, the quantities produced and the competition to produce it will increase, eliminating that excessive profitability, and if making it is unprofitable, the reverse will happen.

At the big picture level, there are three important equilibria that must be achieved or big changes will eventually occur to lead them to adjust toward these things being in equilibrium. Governments have two levers to use in order to push them toward equilibrium—monetary and fiscal policy. By understanding these three equilibria and these two levers, and by understanding how they influence each other, one can pretty well see what will come next.

The three most important equilibria are:

1) Debt growth is in line with the income and money growth that is required to service debts. Debt growth itself isn’t a problem. More specifically, a) if the debt is used for purposes that produce more cash inflow than the cash outflow due to the increased debt service then there will be a net benefit, and if the reverse is true there will be a problem, but b) if debt growth is at rates that finance spending rates that do not produce the cash flows to pay for debt service, it will be unsustainable and big changes need to occur.

To be sustainable, debt growth must happen in a balanced way. Borrowing and lending has to be good for both debtors and creditors. When debt growth is too slow, investing and spending will not be enough for the economy to reach its potential, yet when debt growth is persistently higher than the growth rate of the income that is required to service the debts, demand will be unsustainable and debt problems will follow. For these reasons, the equilibrium rate of debt growth is that which is in line with the growth in the income that is required to service the debt. Because incomes are volatile, this cannot be precisely calibrated, which is why having savings (e.g., for a country, foreign exchange reserves) is important.

2) Utilization of the economy’s capacity is neither too high nor too low. Too much spare capacity (lots of unemployed workers, idle factories, etc.) is a painful set of economic conditions. Over time, it will spur unrest and policy makers to act to improve conditions (through the levers described below), and it will lead to pricing adjustments until using up the spare capacity is profitable again. Too little spare capacity creates undesirable inflation pressures, which spurs central banks to try to limit demand growth by tightening credit.

3) The projected return of cash is below the projected return of bonds, which is below the projected return of equities by appropriate risk premia. These spreads in expected returns are important for the healthy functioning of capital markets and the economy because they create the incentives to lend, borrow, and produce. Remember that economies work because people are trading things that they have for things that they want more, based on the relative appeal of those things. This is no different when it comes to financial assets. Investors will demand higher returns for riskier assets, since the extra risk makes the assets less appealing otherwise. The size of the spreads between the expected return of cash and the expected returns of risky assets will determine how much capital will move where and drive the movement of money and credit through the system. In fact, most financial decisions are made by financial intermediaries trying to grab this spread, and it is therefore a big driver of credit growth, asset class returns, and economic growth.

Appropriate spreads are required for the capitalist system to work. In essence, one person’s return is another person’s cost of financing. The economic machine works by central banks making cash available to those who can borrow it and generate higher returns than they have to pay back in interest. These spreads cannot be too large or too small because if they are too large they will encourage too much borrowing and lending and if they are too small they will lead to too little. Because short-term interest rates are normally below the rates of return of longer-term assets, people borrow at the short-term interest rate and buy long-term assets to profit from the spread. These long-term assets might be businesses, the assets that make these businesses work well (e.g., capital investments such as factories or equipment), equities, etc. Because of the borrowing and buying, the assets bought tend to go up, which rewards the leveraged borrower. That fuels asset price appreciation and most economic activity, and leads to the building of leveraged long positions. By contrast, if the expected returns of cash rise above the expected returns of bonds and/or above the expected returns of equities, investors are rewarded for holding on to cash and economic contractions will occur because the lending that would have been done instead is slowed.

While there is normally a positive spread between the expected returns of equities and bonds and bonds and cash, that can’t always be the case. If short-term interest rates were always lower than the returns of other asset classes (i.e., the spreads were always positive), everyone would run out and borrow cash and own higher-returning assets to the maximum degree possible, which would be unsustainable. So there are occasional ”bad“ periods when that is not the case, at which time both people with leveraged long positions and the economy do badly. As I’ll describe below, central banks typically determine when these bad periods occur, just as they determine when the good periods occur, by affecting the spreads through their use of monetary policy. They have recently made such a bad period in order to put the brakes on the economy and markets.

These three things—i.e., 1) debt service obligations in relation to cash flows needed to meet them, 2) demand relative to the capacity to meet it, and 3) the relative attractiveness of each of the different capital markets for both those who seek to invest their money well and those who seek to get funding well—fluctuate around their equilibrium levels in an interactive way, with the pushing for equilibrium in one shoving the other out of equilibrium. If these conditions remain out of equilibrium for long, intolerable circumstances will ensue, which will drive changes toward these equilibria. For example, if the economy’s usage of capacity (e.g., labor and capital) remains low for an extended period of time, that will lead to social and political problems, as well as business losses, which will produce change until the equilibria are reached. The US in the Great Depression is a classic example of this process: at first the US provided too little stimulation, until the resulting deep depression brought about the election of President Franklin Roosevelt, who subsequently printed money and devalued the dollar to stimulate the economy.

The two levers that governments have to help bring about these equilibria are:

- Monetary policy: Central banks change the quantities and pricing of money and credit to affect economic activity, the value of assets, and the value of its currency. They do this primarily by buying debt assets, thus putting more money into the system and affecting the spreads in expected returns of investment assets in the way previously described. When debt growth is slow and capacity utilization is low, central banks typically add money to the system, which pushes short-term interest rates down in relation to bond yields, which are made low in relation to expected equity returns (i.e., “risk premia” are high). Those who acquire this liquidity buy assets that have higher expected returns, pushing their prices up and increasing lending. Higher asset values make people wealthier, which encourages lending and spending. Conversely, when debt growth is too fast and capacity is too tight (so inflation is rising), central banks do the reverse—i.e., they take “money” out of the system, making cash more attractive relative to bonds, which makes bonds more attractive relative to equities, which causes asset prices to fall (or rise less quickly) and lending and spending to slow. There are three types of monetary policy that central banks progressively turn to: interest rate policy (which I’ll call Monetary Policy 1), quantitative easing (Monetary Policy 2), and finally monetary stimulus targeted more directly at spenders (Monetary Policy 3). Interest rate policy is the most effective type because it has a broad effect on the economy. By reducing interest rates, central banks can stimulate by a) reducing debt-service burdens, b) making it easier to buy items bought on credit, and c) producing a positive wealth effect. As explained earlier, when short-term interest rates hit 0%, central banks go to quantitative easing (Monetary Policy 2), in which they buy bonds by “printing money.” This form of monetary policy works by both injecting liquidity into the system (which can reduce actual risks), as well as by pushing down the spreads on bonds relative to cash, which can drive investors/savers into riskier assets and produce a wealth effect. Monetary Policy 2 is most effective when risk and liquidity premia are large, but its effectiveness is diminished when spreads between assets are low, because at that point they cannot be pushed down much further so as to produce a wealth effect and induce people to spend. At that point, central banks can target stimulation at spenders directly instead of investors/savers (Monetary Policy 3), by providing money to spenders with incentives for them to spend it. For a more complete explanation of this, see “Principles for Navigating Big Debt Crises.”

- Fiscal policy: Governments can impact the economy through their spending on goods and services, taxation, and legal structural reforms (by affecting regulations). While central banks determine the total amount of money and credit in the system, central and local governments influence how it is distributed. They get their money by taxing and borrowing, and they spend and redistribute it through their programs. How much they tax, borrow, and spend, and how they do it (e.g., what gets taxed how much and how they spend their money) also affects the economy. When they spend more and/or tax less, that is stimulative to the economy, and when they do the reverse, that subdues the economy. For example, the Trump administration’s big corporate tax cuts had a big effect on market prices and through it economic activity. Governments also make laws that affect behavior (e.g., create regulations that affect safety and efficiency, create rules that govern labor markets). When structural reforms remove impediments and improve a country’s competitiveness, it helps improve long-term productivity growth. Fiscal policies can either help or hurt economic activity.

In the short term, policy makers’ use of these levers can either keep economies away from these equilibria (if they act too slowly or inappropriately) or can help speed up the adjustments (if their actions are timely and appropriate). Understanding these equilibria and levers is important to understanding the market and economic cycles. By seeing which equilibria are out of whack, one can anticipate what monetary and fiscal policy shifts will occur, and by watching these shifts one can anticipate what the changes in these conditions will be.

I hope this explanation of my template and what is happening now in light of it has helped you to put things in perspective and, more importantly, will help you independently put things in perspective in the future.