Spyware … malware … bots…

These terms were hardly mainstream just 10 years ago.

Now, almost everyone with a computer and internet connection is aware of what these words mean.

U.S. businesses used just 15% of their IT budgets on cybersecurity measures in 2020.

In 2022, that percentage jumped to 24%.

People are taking cybersecurity more seriously as attacks on individuals and companies increase by the day.

But with our Stock Power Ratings system, you can see that while the cybersecurity market is growing, some cybersecurity stocks are not.

A Strong Cybersecurity Market Isn’t Helping This Stock

One such stock is Radware Ltd. (Nasdaq: RDWR).

Our system helps you see the real story behind a company.

Radware was launched in 1996 in Tel Aviv, Israel.

It provides infrastructure, application and corporate IT protection against cybersecurity threats.

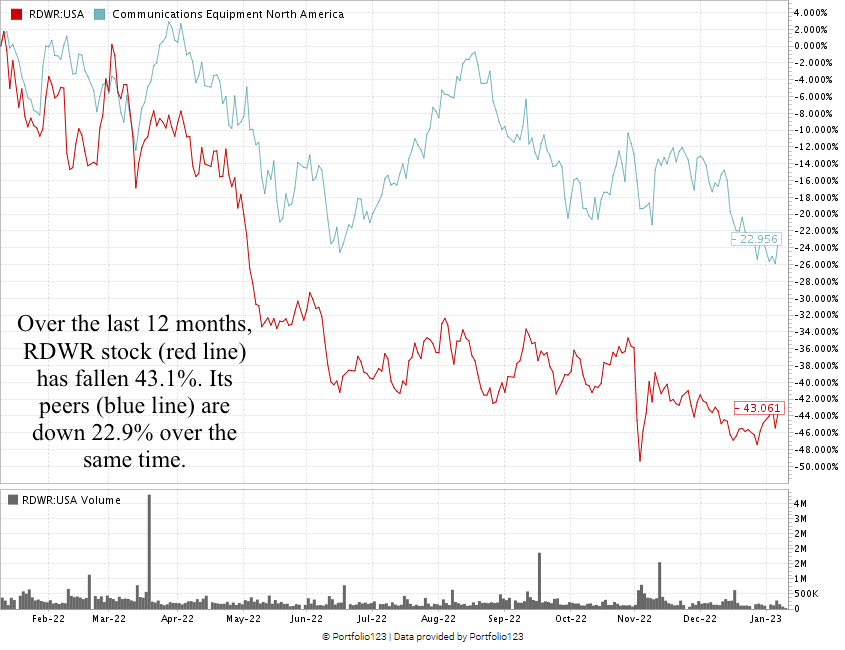

Despite the popularity, the company’s stock has struggled over the last 12 months.

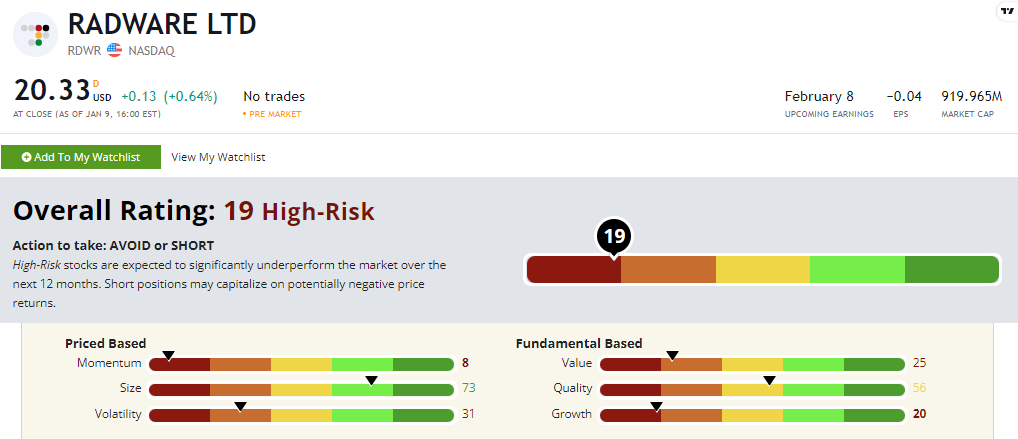

RDWR’s Stock Power Ratings in January 2023.

RDWR stock scores a “High-Risk” 19 out of 100 on our Stock Power Ratings system. We expect it to underperform the broader market over the next 12 months.

RDWR Stock: Weak Value, Momentum and Growth

I love to highlight a company’s positive company financials.

RDWR, on the other hand, has struggled:

- In its most recent quarterly report, the company reported a 4% year-over-year drop in total revenue.

- The company also lost $0.07 in earnings per share over the same quarter a year ago.

That shows why RDWR scores a 20 on growth.

It also scores in the red on our value factor.

RDWR has negative price to earnings, meaning it’s not making any profit.

Its price/earnings to growth (PEG) is 20 times higher than the communication equipment industry average. Remember: You want a company’s PEG to be lower than the average.

It scores a 25 on value.

It means the stock is overvalued, and the company isn’t turning a profit — these are red flags for investors.

Created in January 2023.

RDWR stock is down 43.1% over the last 12 months.

Its communication equipment peers averaged a 23% decline over the same time.

Radware stock scores a 19 overall on our proprietary Stock Power Ratings system.

That means we consider it “High-Risk” and expect it to underperform the broader market.

The world is taking cyber threats very seriously.

These threats can cost you money, peace of mind and even your identity.

While Radware may have an impressive list of cybersecurity services, it’s not enough to save RDWR stock.

Stay Tuned: Cybersecurity Shakeouts

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned: Tomorrow, I’ll share all the details on another cybersecurity stock that you should avoid … despite the growth in this sector.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. I’d love to hear what you thought about my “Stock to Avoid” article today. Was it valuable? Would you like us to continue sharing high-risk stocks on occasion, so you know what to stay away from?

Would you prefer that we only share “Bullish” and “Strong Bullish” stocks?