The commercial real estate sector has been in the dumps for a while now…

While the S&P 500 has enjoyed a 17% rally over the last 12 months, the Real Estate Select Sector SPDR Fund (XLRE) is down 6.7% over the same time.

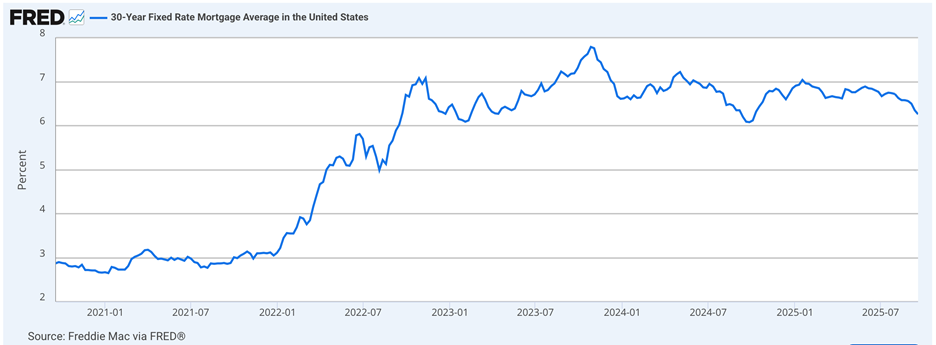

High interest rates certainly haven’t helped. While commercial real estate deals aren’t typically done at the 30-year mortgage rate individual homebuyers monitor, you can see in that rate how the price of borrowing has remained elevated since late 2022, when the Federal Reserve was cranking rates higher to fight inflation:

Now that the Fed has begun lowering rates, we should expect a more favorable environment for both commercial and residential real estate. But as you’ll see in today’s x-ray, a rosier outlook isn’t showing in the numbers yet…

The Most “Bearish” X-Ray Yet?

I’ve only run my Green Zone Power Rating X-ray on the real estate sector once in the last six months. It was early June, and I wanted to know if we were starting to see signs of a turnaround.

I warned that one week doesn’t make a trend, and the real estate sector has been in a steady drawdown since last September.

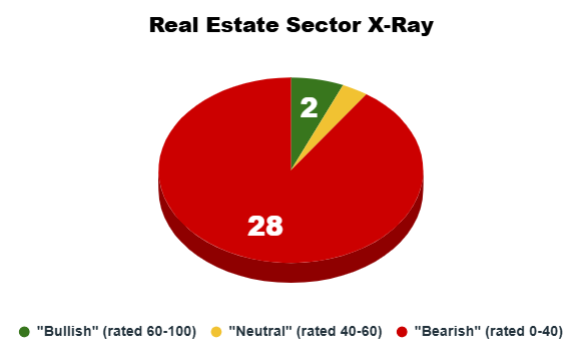

My X-ray showed that the sector was leaning “Bearish” in my system, and now, things look even worse for the 31 stocks in the sector:

With 90% of the sector rated “Bearish” or “High Risk,” I think this might be our most pessimistic screen to date.

Only 2 of 31 stocks rate “Bullish,” meaning they are set to outperform the S&P 500 by at least 2X over the next 12 months. The last stock is “Neutral,” meaning it is set to track the broader market’s performance.

All told, this is not a good setup for a sector that should benefit as interest rates come down…

Let’s see where these stocks stand on the individual factors of my system…

Real Estate Sector’s Individual Factors Don’t Look Good

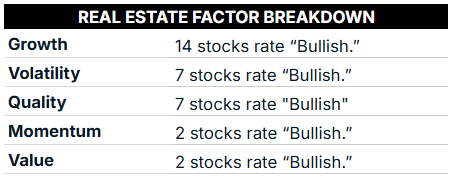

Things don’t look great on the more granular level, either…

Less than half of real estate sector stocks rate “Bullish” on the Growth factor, and it only gets worse after that:

- Less than 25% rate well on Volatility or Quality.

- Only 6% are “Bullish on Momentum or Value.

To further illustrate this point, here’s a closer look at the stocks that rate the lowest on my Momentum factor.

10 Real Estate Stocks to Avoid

For my last screen, I pulled the 10 real estate stocks that rate the worst on my Green Zone Power Rating Momentum factor. I’ve also included their four-week and three-month returns:

As you can see, these stocks have had a tough go over the last few months, while other sectors, such as tech and communications, have rocketed higher in the ongoing bull market.

Even stocks like Healthpeak Properties (DOC) and Federal Realty Investment Trust (FRT), which both have positive gains over the last three months, are playing catch-up. These stocks are still down -16.8% and -13.4%, respectively, in the previous 12 months.

And while I’ve blurred the overall ratings for these stocks, I’ll spill the beans slightly here. The highest-rated stock on this list comes in at a “Bearish” 34 out of 100. Six of these stocks are below a 15 out of 100 overall…

If you want to look these tickers up yourself to see what other factors are dragging those overall ratings down, click here to see how you can join up in Green Zone Fortunes now. After subscribing, you can run these and thousands of other stocks through my system to find the right stocks to buy — and avoid.

The Fed seems set to cut interest rates further in the coming months, and sentiment in the real estate sector should improve … but I’d rather trust the data I’m seeing today and use my hard-earned capital to invest in stocks that are already proving to be great investments in this market.

To good profits,

Editor, What My System Says Today