You know the old adage, “Sell in May, and go away.”

It’s based on the idea of seasonality since stocks tend to produce higher average returns during the six-month period between November and May and muted average returns between May and November.

We believe in the power of seasonality — heck, we even have an entire service dedicated to harvesting the edge in this concept.

But we do it tactically there … and would never recommend you simply sit on the sidelines for a full six months of the year.

Case in point … you’d have missed out on the 6.1% gain in the S&P 500, or the 9.3% gain in the Nasdaq 100, had you sat out last month.

Point is: Stay invested … stay involved!

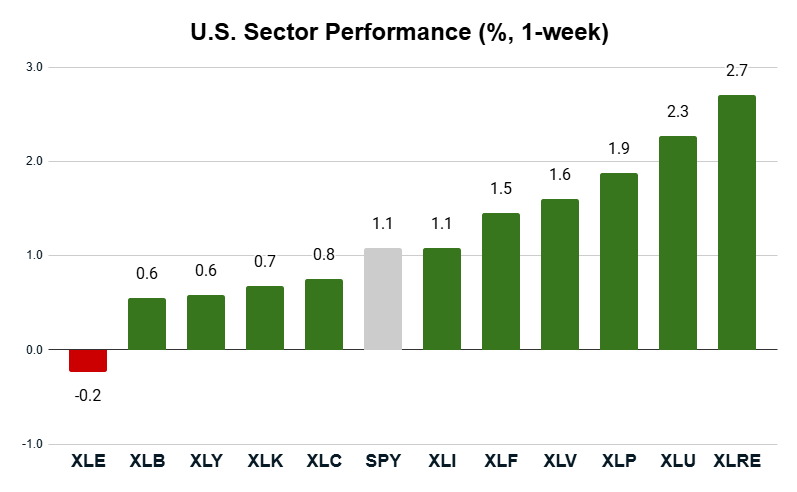

Now let’s look at how each of the major U.S. stock sectors fared as we closed out the last week of May:

Key Insights:

- The S&P 500 (SPY) closed the week 1.1% higher.

- 10 of 11 major sectors showed a positive gain for the week.

- Five sectors underperformed the broader S&P 500.

- The real estate sector (XLRE) led the market with a 2.7% gain.

- Energy (XLE) was the only sector to post a slight loss at -0.2%.

We haven’t seen Real Estate (XLRE) top the sector performance chart since we revamped this newsletter with our signature data-driven approach.

So let’s dig deeper…

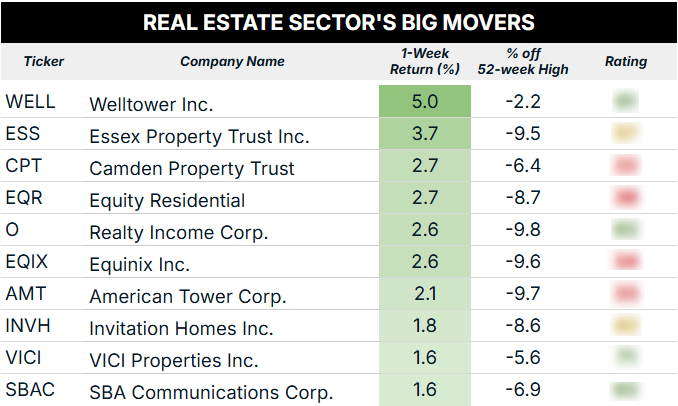

The Best Performer: Real Estate Sector

Tech, industrials and consumer discretionary stocks have pulled a lot of the weight in recent weeks, so it’s refreshing to see a new sector top the charts.

It gives us a chance to poke around and see if a new investable trend is developing.

After screening for all S&P 500 real estate sector stocks that closed last week within 10% of their 52-week highs, you can see the top performers from last week in the table below:

Right off the bat, this looks like a rather measured and broad-based rally in real estate stocks. We don’t see any huge, double-digit moves in a single ticker. Positive breadth within a sector is usually a good thing as it typically means that investors are confident in the sector overall, rather than just betting on one or two companies.

However, looking at my Green Zone Power Rating system:

- 4 stocks fall into the “Bullish” zone (60-rated or higher).

- 2 stocks are “Neutral” rated and should track the S&P 500’s performance.

- 4 stocks are “Bearish,” meaning they should underperform.

This tells me that while it’s great to see a new sector gaining some bullish sentiment, using a tool like Green Zone Power Ratings will help you weed out stocks likely to lag the market. For full access to my system, click here to see how you can join Green Zone Fortunes now.

Now let’s see which stocks pulled the energy sector lower last week…

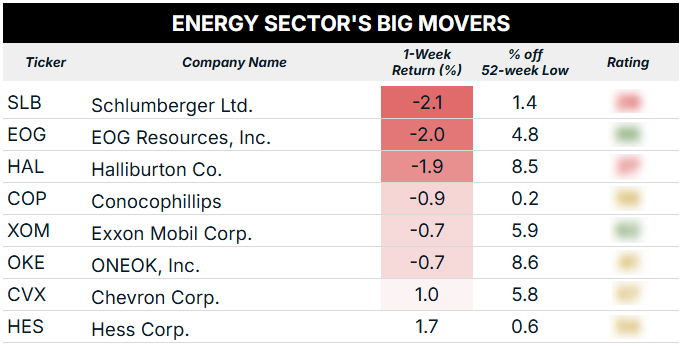

Last Week’s Laggard: Energy

Here’s what my screen of the weakest energy sector stocks revealed:

Not too much to report on here…

First, the broader energy sector only edged lower by 0.2%. And you can see in the table above how two large energy stocks (CVX and HES) managed decent weekly gains.

All told, the energy sector has been out of favor for a while now … but it’s still home to a handful of highly-rated stocks that are poised to perk up nicely once oil prices rise.

To good profits,

Editor, What My System Says Today