Are we in a recession?

If you go by the technical definition that many economists and analysts use, yes.

Gross domestic product (GDP) shrank in both the first and second quarters. Output contracted 1.6% in the first quarter and 0.9% in the second quarter.

Without a sharp revision (which is unusual), we are in a recession.

Good to know!

As investors what does that mean?

Recessions Vary to a Great Degree

We get scared when we hear the “R” word. It’s a natural response.

Recessions are associated with high unemployment, failing businesses and lousy corporate earnings, which in turn lead to nasty stock market returns.

But not all recessions are equal. Some are mild … and some are devastating.

We all remember 2008. That now carries the title “Great Recession,” and it resulted in the near total destruction of the banking and housing sectors. Recovery took years.

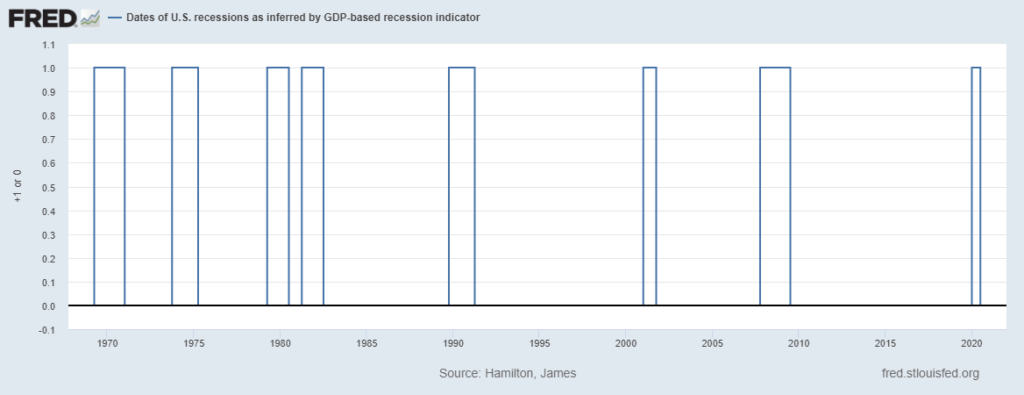

There were also recessions in 1980, 1990 and 2001. You may not even remember them. They each lasted two to three quarters, and GDP contraction was slight.

Looking back, we tend to get some kind of recession every five to 10 years, and often even more frequently…

America’s Recession History

Most tend to be pretty limited, affect only a handful of industries and don’t do long-term damage.

So how will the recession of 2022 stack up?

Where Is This Recession Headed?

I’m a trader, not an economist.

I won’t even bother trying to give an estimate of GDP contraction or predict a spike in the unemployment rate. I focus on the data that’s relevant to my trading.

But I did find this little nugget interesting. The University of Michigan tracks consumer sentiment. And its recent July data confirms what I’ve noticed anecdotally: Consumer sentiment is awful right now.

The one-year outlook fell to its lowest levels since 2009. July numbers are 36% lower than they were a year ago!

Whether it’s due to inflation, a toxic media environment, leftover COVID fatigue or all of the above, consumers have a dreary view of the world right now.

We see the same in our own data. We recently polled you all to see where (if anywhere) you were cutting back on expenses.

A full 51% reported spending less in restaurants due to rising prices. (Click here if you’d like to vote in this or any of our recent polls.)

Consumer sentiment data is more of a lagging indicator rather than a leading indicator. In other words, bad attitudes in consumers tend to reflect lousy economic news as it’s happening or recently already happened. It doesn’t predict it.

The stock market, however, tends to be a leading indicator. The stock market moves before the economic data reflects what is happening.

And the stock market may reflect a shift away from the dreary consumer outlook.

What My Systems Say About the Consumer Discretionary Sector

Consumer discretionary stocks — which include industries like restaurants, durable goods, high-end apparel and automobiles — have been one of the strongest-performing sectors of late.

I’m not buying the sector just yet. It’s not in a “buy-qualified uptrend” that I track, and it’s unclear whether we’re seeing short covering or the beginnings of a new bull market.

But I do find this divergence interesting. I’ll have my eye on the consumer discretionary sector going forward.

In the meantime, I’ll follow my model.

The beauty of my Stock Power Ratings system is that it is adaptive. Because it utilizes a momentum factor, it pivots to whatever is working at the time.

And there’s a lot of momentum in renewable energy right now. This is a durable mega trend that won’t be derailed by a recession.

In my most recent issue of Green Zone Fortunes, my premium stock research service, I recommended a stock in the space that is up more than 50% in 2022, even with the strong sell-off that dominated the first half of the year.

To find out more about one of my highest-conviction mega trends for 2022 and beyond, click here to watch my “Infinite Energy” presentation.

My July recommendation is just one way we’re playing renewable energy. We have six other positions in the portfolio and a plan for each of them as this mega trend takes hold.

Click here to watch and join. I can’t wait for you to see how we’re finding opportunities — even as others scream: “Recession!”

To good profits,

Adam O’Dell

Chief Investment Strategist