While the overall real estate market may be trending down, investors can insulate themselves from the drop with these three REITs to buy for a recession.

Homebuilding has slowed and applications for new mortgages have fallen off.

Those signs point to a big decline in the real estate market.

However, investors do have a way to keep real estate in their portfolio and protect themselves from a drop in the market.

Real estate investment trusts or REITs offer you the ability to do just that (we’ll get into what REITs are in a sec).

But because a global economic slowdown is in the offing, it’s a good time to consider these REITs to buy for a recession.

What is a REIT?

REITs are companies that own or finance income-producing real estate across a broad range of sectors.

Most of them trade on major stock exchanges and, as opposed to some equities, they offer big benefits to investors.

The way they make money is simple. They lease space and collect rent on that real estate. The benefit comes to investors in the form of dividends. REITs are required to pay out 90% of their taxable income to shareholders.

According to Nareit — a REIT website — most REITs actually pay out 100% of their income as dividends.

There are also mortgage REITs, or mREITs, that don’t own real estate, but they finance real estate and generate income on the interest of those payments.

3 REITs to Buy For a Recession

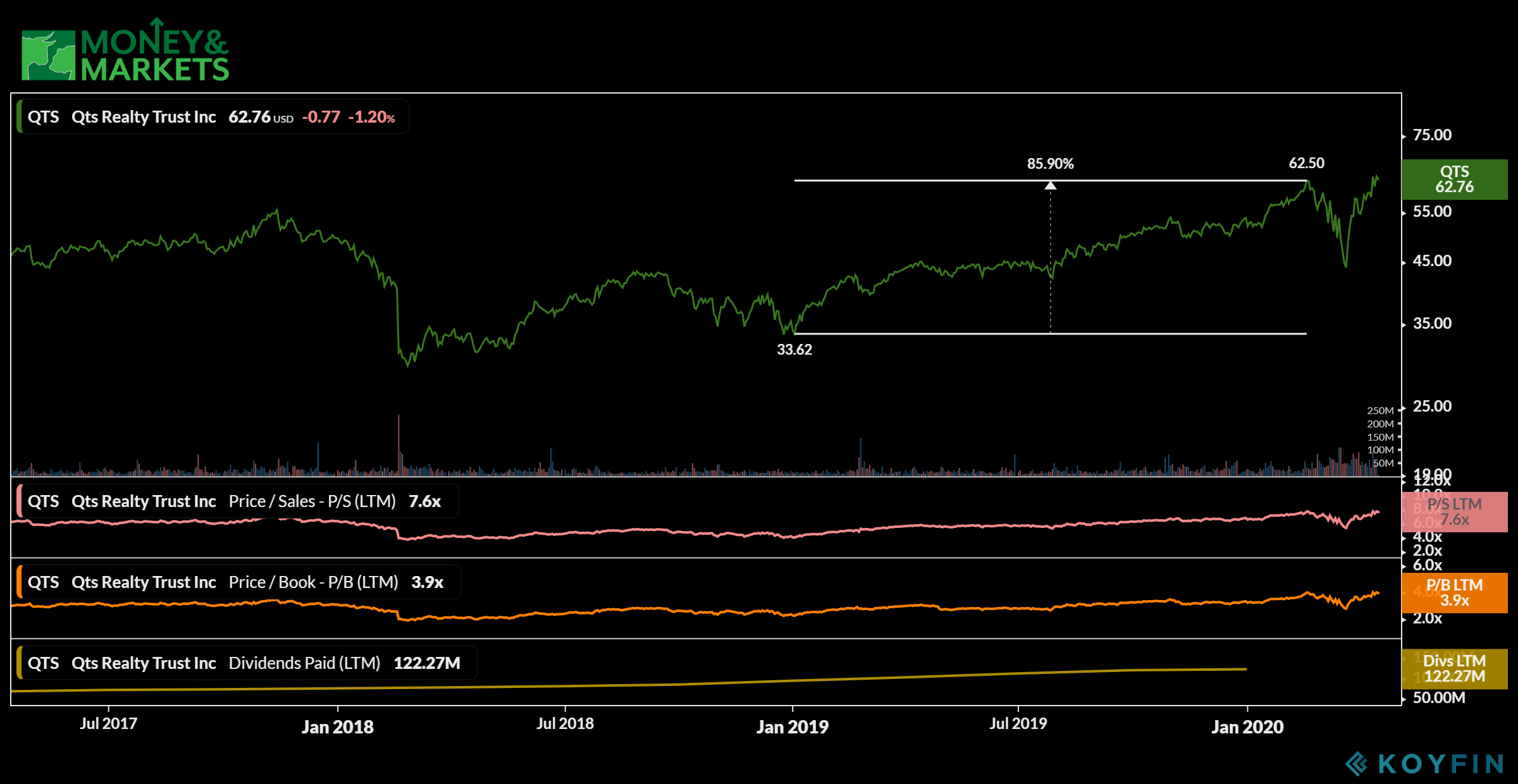

1. QTS Realty Trust Inc.

Market Capitalization: $3.6 billion

Annual Net Income (2019): $31.3 million

5-Year Revenue Growth: 120.7%

Annual Dividend Yield: 2.96%

One sector of real estate that is sheltered from a recession is data centers. Companies still need safe places to store data, no matter what the economic conditions are.

A big player in data center REITs is QTS Realty Trust Inc. (NYSE: QTS). The Kansas-based company has data center property in North America and Europe.

In 2019, QTS shares experienced an 85% jump in price. But, despite the market downturn, its stock has actually reached a new 52-week high in mid-April.

QTS also benefits from the current working situation for most Americans who are remote. Data centers help to make working from home possible. In fact, QTS recently said it had seen a 30% spike in customers because more and more people are working from home.

“Working remotely is a new challenge and opportunity that many in Corporate America are currently facing. The Internet and online workplace are now mission-critical in our daily lives,” QTS chief technology officer Jon Greaves said in a news release.

QTS recently paid a $0.47 dividend per share to shareholders and its 5-year earnings growth is more than 120%.

The bottom line is data centers are going to remain essential, no matter what the economy does. That’s why QTS Realty Trust Inc. is one of the three REITs to buy for a recession.

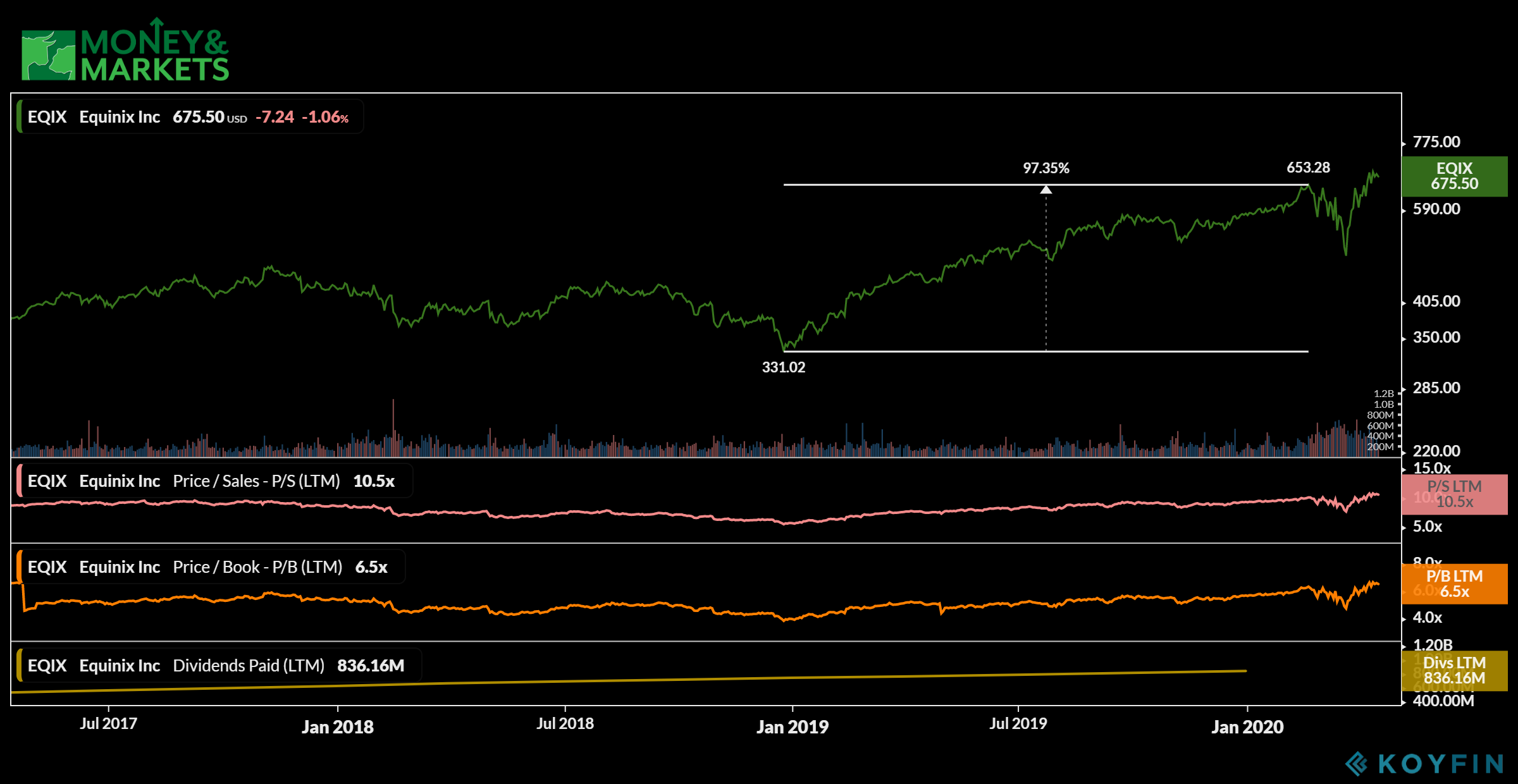

2. Equinix Inc.

Market Capitalization: $55.2 billion

Annual Net Income (2019): $507.4 million

5-Year Revenue Growth: 127.6%

Annual Dividend Yield: 1.56%

While QTS is strong in the data center real estate world, Equinix Inc. (Nasdaq: EQIX) is even stronger.

It boasts 205 data centers in 25 countries on five different continents and is the largest data center provider in the world.

Its growth in 2019 was even stronger than QTS — shares jumped more than 97% From December 2018 to February 2020.

We recommended Equinix as part of our four cloud software stocks to buy. It’s up 11% from the time we made the recommendation

When the market tanked, Equinix fell as well, but not nearly as hard. It also bounced to reach a new 52-week high in April.

It partners with cloud services such as Oracle Cloud, Amazon Web Services, Google Cloud and Microsoft Azure, meaning it is playing with the big boys when it comes to data storage.

What’s more, Equinix provides a massive dividend. Its annual dividend yield is 1.56%, but its most recent dividend payment in February 2020 was a staggering $2.66 per share. That was $0.20 more than it paid the quarter before.

The huge dividend and its position as a global leader in data centers makes Equinix Inc. one of the three REITs to buy for a recession.

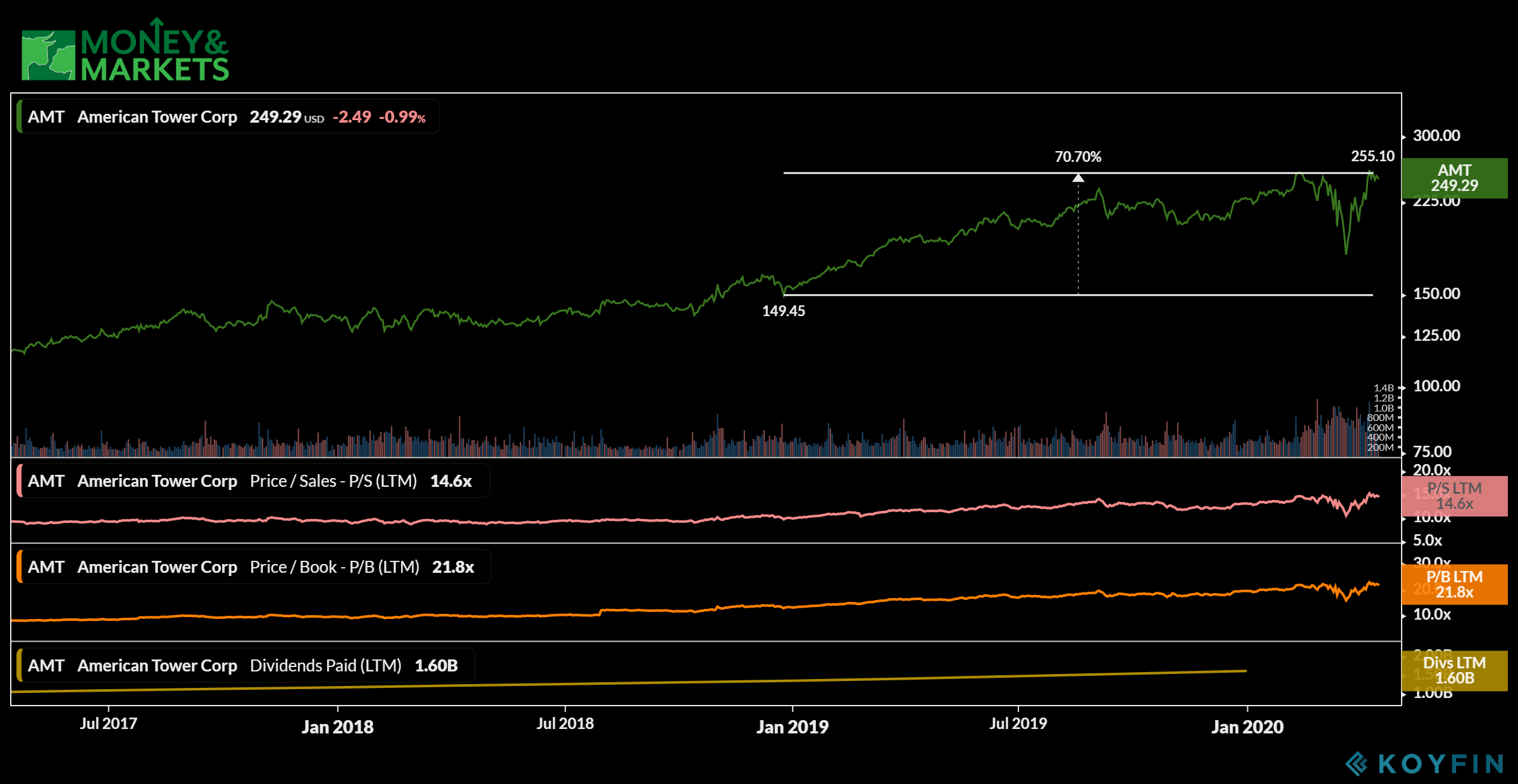

3. American Tower Corp.

Market Capitalization: $111.5 billion

Annual Net Income (2019): $1.1 billion

5-Year Revenue Growth: 84.8%

Annual Dividend Yield: 1.72%

Data Centers aren’t the only form of real estate that can weather a recession. Another avenue is communications.

American Tower Corp. (NYSE: AMT) specializes in leasing space on cellphone towers to larger companies to place communications equipment. A lot of the cellphone towers you see providing service to your smartphone are owned by AMT.

Just like the other companies on our list, American Tower experienced huge growth in 2019. From December 2018 to April 2020, the stock gained more than 70%. It’s March drop was not nearly as massive as other equities and it’s bounced to a new 52-week high.

It has since retreated somewhat but remains strong.

Like Equinix, American Tower is a bit pricey to jump into, but the reward is a strong dividend. While not as high as Equinix, AMT recently paid out a $1.08-per-share dividend to stockholders in April.

What’s more is that dividend has gone up each quarter since 2018.

That dividend stability along with it being a leading provider of cellphone tower space makes American Tower Corp. one of the three REITs to buy for a recession.

From data centers to cellphone towers, these three REITs have positioned themselves to protect their investors from an economic recession.

They are in markets that won’t struggle nearly as much as other sectors of the economy. And, because their income is based on lease payments and not on market fluctuations, their profits are solid.

That’s why these are the three REITs to buy for a market recession.