There are no “sure things” when investing. But I’d consider this trend about as close to a sure thing as you can get.

Last week, I mentioned some of the major investment themes I’m watching for 2022. The continued explosive growth of renewable energy made my shortlist.

As I mentioned on Friday, close to a quarter of all electricity generated in the United States is from renewable sources. In about 20 years, it will be the majority.

The transition is slow and steady. Winding down old power plants and bringing new ones online takes time. But the trend here is established and is all but unstoppable.

This has nothing to do with a “green new deal” or “building back better.”

It’s basic economics.

Renewable Energy Is Way Cheaper Now

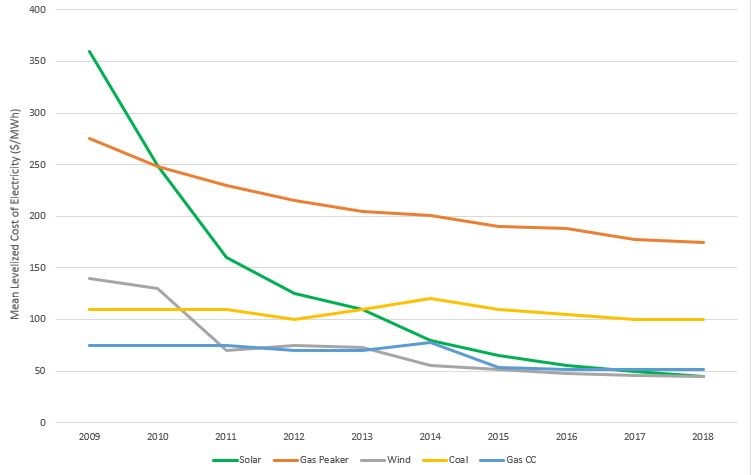

The prices of wind and solar energy have dropped fast. Both are now cheaper than coal and are competitive with natural gas.

Renewables (Green and Gray Lines) Are Getting Cheaper

Source: Canadian Solar investor report.

Without any nudging from politicians, renewable energy sources will dominate efforts to increase capacity because it’s cheaper to deliver.

There’s just one big problem.

You can burn coal or gas 24 hours per day to meet demand. But solar and wind energy only work when the sun shines, and the wind blows.

For these power sources to compete with fossil fuels, you need abundant and affordable battery storage on an industrial scale.

It took time for the technology to catch up, but that’s happening now.

Batteries Are the Key to a Renewable Future

Cumulative additions to battery storage capacity shot up from 11 gigawatt (GW) hours last year to 39 this year… and by 2027, market intelligence firm Guidehouse Insights projects that it will hit 534 GW hours of capacity. You’re talking about 43% compound annual growth — that’s massive!

Lithium is integral to the battery-manufacturing industry … but it has drawbacks:

- It can be dangerous. Maybe you’ve seen videos of smartphones exploding or a Tesla catching on fire.

- Global supplies are concentrated in a small number of countries, not all of which are friends of the United States. We don’t want a repeat of the OPEC oil embargoes of the 1970s.

That’s not to say we should avoid investing in lithium-based companies. We just need to find the right ones.

Of course, we could just avoid lithium altogether.

In the December issue of Green Zone Fortunes, I dig into a company does just that.

This company created industrial-scale batteries for utility companies, factories and other commercial users. These batteries can store energy generated from wind turbines or solar panels for as long as 12 hours at a time. And the company doesn’t use lithium to produce them.

This is a company with the potential to change the world… or at the very least, massively accelerate that change.

To find out more, join us in Green Zone Fortunes today! The December issue of our newsletter will hit subscribers’ later this week. By joining my premium research service now, you can be one of the first to learn about my latest stock recommendation.

You’ll also gain access to our model portfolio, where we’re recommending stocks within some of the top mega trends for the coming years. Click here to learn about one of these trends now.

To good profits,

Adam O’Dell

Chief Investment Strategist