I like value stocks. I love dividend stocks. And I don’t think you can go wrong with some energy and international stocks for diversification’s sake.

So, what happens when a stock checks all those boxes? It makes my dividend stock shortlist.

Tack on the prospect of capital gains, and we’re talking about an even more exclusive list.

That’s the case with the company I highlight today: Spanish oil major Repsol S.A. (OTC: REPYY). Repsol trades primarily in Europe, but its shares trade in the United States on the over-the-counter market.

When it comes to energy, Repsol does it all. It explores and produces, it transports, it refines into gasoline and it even sells in retail gas stations.

For our purposes, the stock sports a juicy 5.1% dividend, paid every six months. The next dividend should be paid in July.

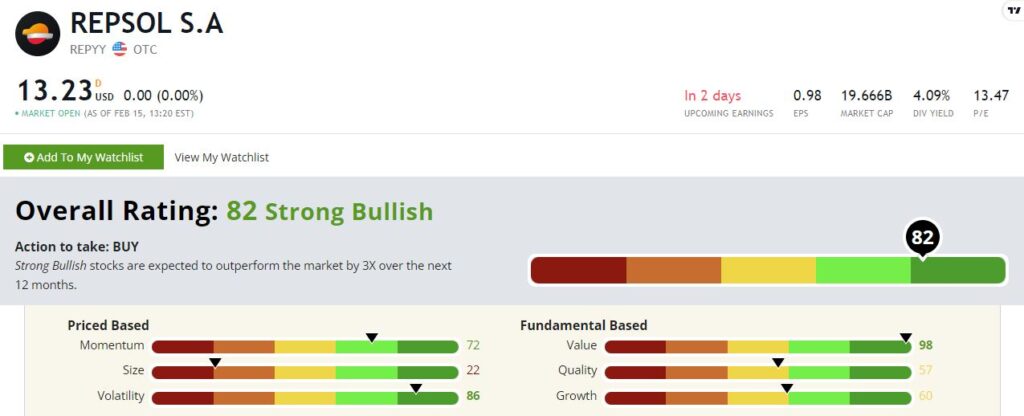

What’s even better is that Repsol rates a “Strong Bullish” 83 on our Green Zone Ratings system. Strong Bullish stocks in Adam O’Dell’s proprietary system are set to outperform the overall market by three times over the next 12 months.

Let’s dig deeper into the data to see what’s driving Repsol’s score.

Repsol Stock’s Green Zone Ratings Breakdown

Value — It’s no surprise that Repsol’s highest-rated factor is value. Energy stocks are one of the last remaining cheap pockets of the market, and European stocks are cheaper than their American counterparts in most cases. Repsol is a cheap stock in a cheap sector in a cheap part of the world. It rates a near-perfect 98 on value here.

Volatility — Energy stocks, as a group, have been volatile since the energy bust in 2015. It’s been a tough operating environment, and energy investors have stomached some wild swings. Yet Repsol rates in the top tier with a volatility factor rating of 86.

The higher the score here, the lower the volatility. In dividend stocks, in particular, I favor low volatility. It doesn’t make much sense to suffer through massive price swings for a 5% dividend. Repsol’s high score suggests that REPYY won’t give us a lot of drama.

Momentum — Repsol also rates well with a 76 on our momentum factor. Energy is one of the few sectors working right now, as many high-momentum sectors of recent years have cooled off. Repsol is up more than 9% year to date. For comparison, the S&P 500 index is down 7% since the start of 2022.

We don’t know if the broader market correction has further to go, but I expect energy to pull ahead regardless.

Growth — Energy has been a tough business for the better part of a decade now. Yet Repsol has still expanded its businesses and enjoys a growth factor rating of 60. That’s no easy task and speaks volumes about the company’s management.

Quality — Our quality factor is based on profitability and balance sheet strength. Quality metrics favor high-margin, capital-lite businesses like software… not gritty old-economy stocks in the oil and gas sector. Yet again, Repsol scores above average here with a quality rating of 57.

Size — The integrated oil majors are giant companies, and Repsol is no exception. This is a $20 billion company by market cap. That said, Repsol is smaller than many of its competitors and sports a size rating of 22.

Bottom line: If you believe that energy will continue to lead, Repsol is a solid way to play that trend. It should also benefit from any renewed interest from investors in overseas markets, which have been all but ignored for years.

So, with one stock, we get access to both of these trends while collecting a solid 5.1% dividend. Not too shabby!

To safe profits,

Charles Sizemore Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.