Jefferies Global Equity Strategist Sean Darby is rehashing an old economic theory: A massive wave of baby boomers retire and cash out their stocks, causing the markets to crater into a “dark period” for years until younger generations have enough to buy in.

Of course, Jefferies notes, the theory doesn’t necessarily mean the stock market will see, for instance, a decade of poor performances because foreign investors will likely be eager to step in and fill any voids created by baby boomers taking their money and going home.

“One of the main reasons that investors should not be gloomy about forced selling of retirement plans is that foreign ownership of the U.S. equity market is climbing,” Darby wrote in a note to clients, according to CNBC. “The growth of assets under Sovereign Wealth Funds has caused a marked shift towards global equities as capital controls have been relaxed.”

Another thing to consider is that most people are living a lot longer today than they did just a couple decades ago, so a large number of baby boomers will continue trading longer than ever before, even after retirement. But there’s no denying that retiring boomers cashing out will be a big market force and there’s just no telling what kind of effects the retirements could have.

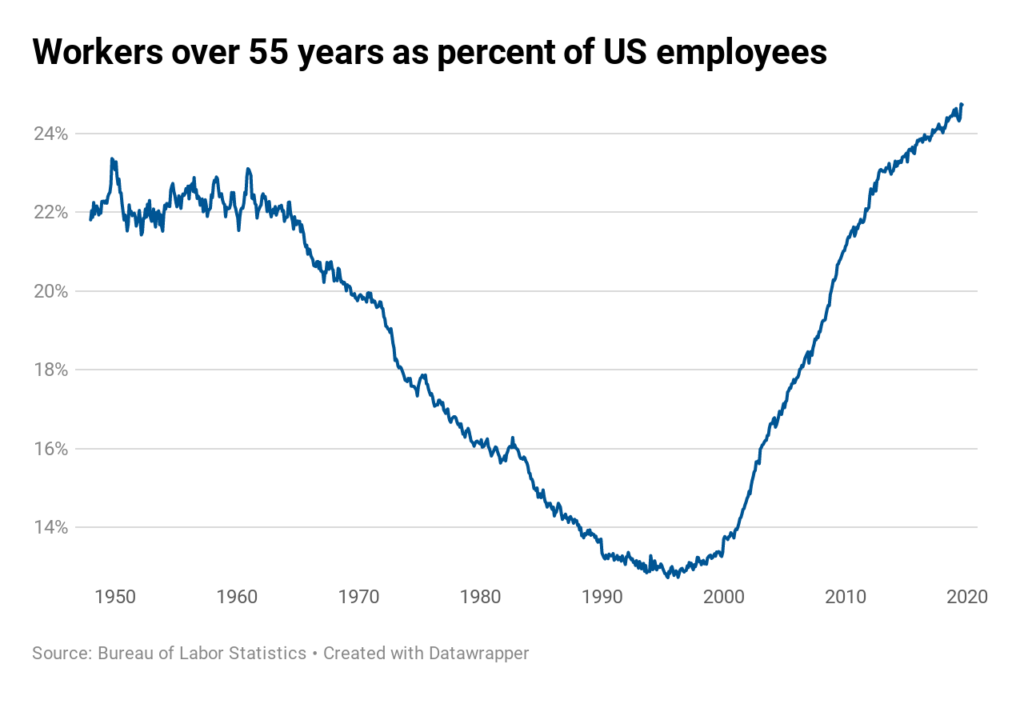

According to the BLS, workers over the age of 55 represent a massive 24% of all U.S. employees, effectively one quarter of the country’s entire workforce.

A 2011 study by the Federal Reserve Bank of San Francisco found evidence that stock prices are tied to the age distribution of a population. So, the study concludes, this type of relationship could mean that prices might slump until 2025, when millennials start buying what their parents and grandparents sold off.

“There has been a tight correlation between population dependency ratios … and the P/E ratio of the U.S. stock market,” the Fed researchers wrote in their report. “In the context of the impending retirement of baby boomers over the next two decades, this correlation portends poorly for equity values.

“Market participants may anticipate that equities will perform poorly in the future, an expectation that can potentially depress current stock prices.”

However, Darby notes that increased life expectancy will likely smooth the transition.

“The bottom line is that the 2006 GAO study suggests that retiring boomers are not likely to sell financial assets in such a way as to cause a sharp and sudden decline in prices,” Darby wrote.