“You’re on mute.”

Tell me if you’ve heard that one after the COVID pandemic changed our lives.

Not only did it change how we approach our health, but it also brought our work closer to home.

According to the U.S. Census Bureau, between 2019 and 2021, the percentage of Americans working from home tripled to 17.9%.

That means more than 27 million people were working from home last year!

Companies with products designed specifically to help people work from home boomed:

- Cloud services.

- Video conferencing.

- Chat programs.

But with our Stock Power Ratings system, you can see that, while software as a service is popular, many of the stocks within this industry are not.

This is the case with RingCentral Inc. (NYSE: RNG) stock.

RingCentral Stock: From Pandemic Darling to “High-Risk”

Companies like RNG blew up during COVID, but their popularity has subsided as more Americans return to the office.

RingCentral was started in 1999 and grew into a $3.6 billion company focused on video, messaging and high-definition voice communication.

The platform is available on phones, tablets and computers.

But the company’s stock has fared poorly coming out of the pandemic.

RingCentral stock scores a “High-Risk” 2 out of 100 on our Stock Power Ratings system, and we expect it to underperform the broader market over the next 12 months.

RNG Stock: Poor Momentum + Lackluster Value

Here is where I usually tell you about positive company financials.

Not so for RingCentral:

- Its one-year annual earnings-per-share growth rate is negative 338.2%!

- The company’s trailing 12-month income is negative $576 million.

That shows why RNG scores a 39 on growth.

It also scores in the red on our other five factors.

RNG stock has negative price-to-earnings, price-to-cash flow and price-to-book value ratios, meaning it’s not making any money. It scores a 19 on value.

The company’s return on equity is an astounding negative 2,108.5% and its net margin is negative 31.7%, earning it a 20 on quality.

This stock is overvalued and, despite increasing sales in every quarter since 2018, isn’t generating any profit.

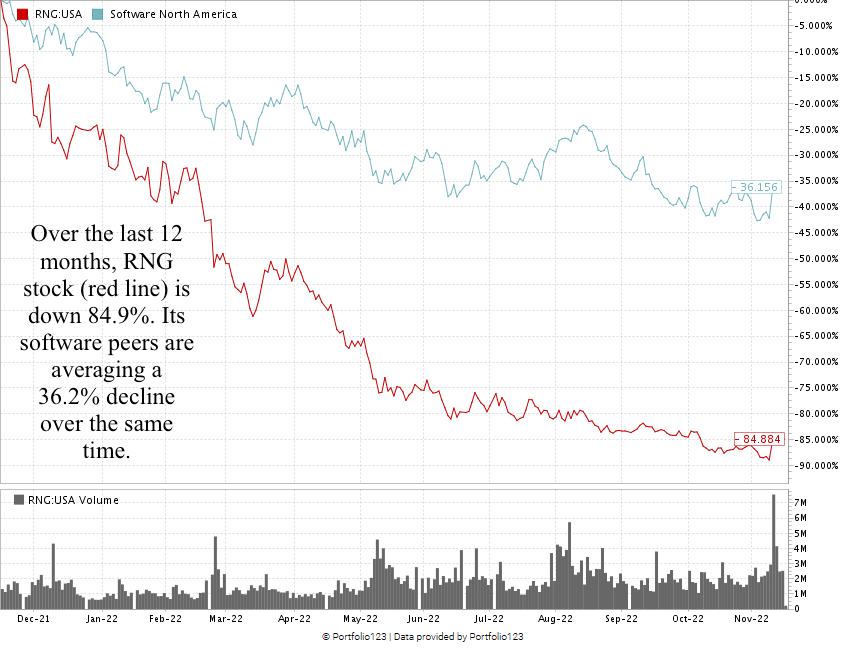

Chart created in November 2022.

Over the last 12 months, RNG stock has dropped 84.9%.

Its software peers dropped an average of 36.2% over the same time.

RNG stock scores a horrendous 2 overall on our proprietary Stock Power Ratings system.

That means we consider it “High-Risk” and expect it to underperform the broader market.

Bottom line: Products focused on helping people work from home were boosted during the height of the COVID pandemic.

Work-from-home prospects are starting to subside along with the virus.

With no profit and negative margins, RingCentral stock is one you should stay away from.

Stay Tuned: 3 Energy Power Stocks

Tomorrow, we’re returning to our original Stock Power Daily form with a little twist.

Stay tuned — I’ll share all the details on three energy stocks that rate well in our Stock Power Ratings system!

This is the perfect chance to get into the energy sector, so stay tuned.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. I’d love to hear what you thought about my “Stock to Avoid” article today. Was it valuable? Would you like us to continue sharing high-risk stocks on occasion, so you know what to stay away from?

Would you prefer that we only share “Bullish” and “Strong Bullish” stocks?