Money & Markets Week Ahead for March 7, 2021: The Roblox IPO is launching, and I do a deep dive into DocuSign Inc’s earnings.

An IPO many investors have been waiting for comes to the market.

And we get a forward snapshot of energy prices and consumption.

Here’s more of what to look for in the week ahead on Wall Street:

The Roblox IPO

It’s one of the initial public offerings (IPOs) investors have been waiting on for a long time now.

Roblox Corp. is scheduled to go public via a direct listing on the New York Stock Exchange on Wednesday. The ticker symbol will be RBLX.

What it is: The company is fairly straight-forward.

Roblox a gaming platform that allows its users to create video games using a block-based system. Creators don’t need coding experience to build out their games.

Once created, a game can be shared and monetized using Robux for in-game features.

In its S-1 filing with the Securities and Exchange Commission, Roblox said it has 31.1 million daily active users and an engagement time of more than 22.2 billion hours.

The company’s revenue increased 56% from $312.8 million in 2018 to $488.2 million in 2019. It surpassed the 2019 total in the first nine months of 2020 by generating $588.7 million.

For all of 2020, Roblox brought in $924 million in sales.

The offering: The California-based company is going public as a direct listing.

According to Renaissance Capital, there is no firm commitment offering on the Roblox IPO deal.

However, registered shareholders are selling around 199 million Class A shares. The company sold 12 million shares in January 2021 in a Series H round of funding.

Those shares sold at $45 per share. If the Roblox IPO is listed at $45 per share, the company would see a market value of around $29.1 billion.

There are no underwriters on the deal, but Goldman Sachs, Morgan Stanley and Bank of America Securities are financial advisors.

The skinny: This platform has exploded, thanks in no small part to the COVID-19 pandemic keeping its target audience … kids … at home.

Roblox had $301.5 million in cash and equivalents in 2019. They upped that to $893.9 million in 2020 — a 197% increase.

However, the company reported losses of around $253 million in 2020. These losses are attributed to higher costs for infrastructure, research and development and marketing.

Another cost factor is the conversion from Robux to U.S. dollars. The company sells Robux for around $0.01, but the return exchange rate is $00035. That conversion rate cost Roblox $328 million in 2020 — 36% of its revenue.

Deeper Dive: DocuSign Inc. (DOCU) Earnings

Several companies were beneficiaries of the COVID-19 pandemic.

Especially companies that provide services built around remote working.

One such company — DocuSign Inc. (Nasdaq: DOCU) — is reporting its quarterly earnings on Thursday this week.

DocuSign is a cloud-based software company specializing in providing e-signature solutions for documents.

A perfect company to help businesses with hundreds of employees working out of the office.

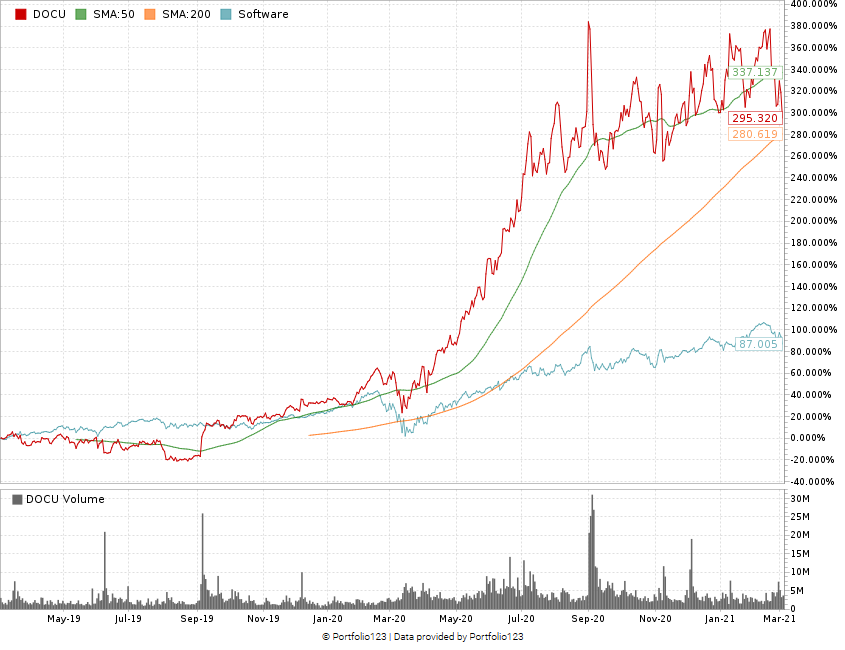

DocuSign Stock Jumped 303% Off March Low

The company’s stock went from a low of $66.68 in March 2020 to a new 52-week high of $268.80 in September. That’s a 303% jump in seven months.

Since then, the stock has bounced between $200 and $250 per share. It’s currently priced at around $216.

DocuSign Revenue Up 114% Over Last 2 Years

Its quarterly sales figures have steadily increased since the fourth quarter of 2017.

The company has a one-year annual sales growth rate of 44.3%

DocuSign has also done a good job raising its earnings per share.

It went from an EPS of $0.00 for the quarter ending October 2018 to $0.22 per share for the quarter ending October 2020.

DocuSign Earnings Rise 266% Over Last 8 Quarters

The Wall Street consensus forecast for this quarter is for Docusign to report earnings of $0.2227 per share on revenue of $407.96 million.

What’s more, second-quarter forecasts call for earnings of $0.2163 on revenue of $418.68 million.

DocuSign has been a strong performer thanks to millions of workers working from home. They have carved out a niche in regards to e-signature documents.

Pro tip: I recommended DocuSign Inc. as one of my five tech stocks to buy in December 2019. It has grown 191% since I made that recommendation.

Money & Markets Week Ahead: Data Dump

Energy investors will keep a close eye to Tuesday when the U.S. Energy Information Administration releases its latest Short-Term Energy Outlook.

In February, the outlook remained somewhat uncertain as the COVID-19 pandemic caused changes in energy supply and demand over the last year.

The report indicated those changes were likely to continue for the foreseeable future.

The EIA forecasted the price of Brent crude oil to average $55 per barrel in the first quarter of 2021 and drop to $52 per barrel for the rest of the year.

West Texas Crude Spot Price Jumps in 2021

West Texas Intermediate crude oil prices are expected to average $50 per barrel in 2021 — up considerably from the $39 per barrel average in 2020.

Wednesday’s report will forecast energy price and consumption forecasts — including crude oil, natural gas and petroleum — through the end of the next calendar year.

Earnings Reports

To finish off the Money & Markets Week Ahead, here’s a look at some of the key earnings reports due out this week:

Monday

Casey’s General Store Inc. (Nasdaq: CASY)

Stitch Fix Inc. (Nasdaq: SFIX)

Magic Software Enterprises Ltd. (Nasdaq: MGIC)

Tuesday

Curaleaf Holdings Inc. (OTC: CURLF)

Daqo New Energy Corp. (NYSE: DQ)

Dicks Sporting Goods Inc. (NYSE: DKS)

Wednesday

Oracle Corp. (NYSE: ORCL)

Franco-Nevada Corp. (NYSE: FNV)

Vivint Solar Inc. (NYSE: VSLR)

Cloudera Inc. (NYSE: CLDR)

Thursday

JD.com Inc. (Nasdaq: JD)

DocuSign Inc. (Nasdaq: DOCU)

Ulta Beauty Inc. (Nasdaq: ULTA)

Friday

Citi Trends Inc. (Nasdaq: CTRN)

Applied Therapeutics Inc. (Nasdaq: APLT)

That’s all for this week.

Until next time…

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.