Last Christmas, my wife surprised me with a PlayStation 5.

I was beyond excited.

That said, I don’t have a ton of time to actually sit down and play video games on it — but I’m an exception to that rule.

Millions of people of all ages flock to gaming in many different formats, including consoles like the PS5, or even their phones or tablets.

And it’s turned into a booming business.

Statista found that global revenue from video games will reach $298.2 billion by 2027 — a 50% increase from 2021.

While video game sales are strong, our Stock Power Ratings system shows that not all companies involved are great investments.

This is the case with Roblox Corp. (NYSE: RBLX).

RBLX’s Post-IPO Crash

If you have kids or grandkids, there’s a good chance you’ve heard of Roblox.

Roblox is a developer made popular by its signature video game that carries the same name. It’s an innovative digital platform that allows users to create and play games in a 3D world.

And it boasts more than 58 million users right now!

In 2021, I penned a piece about RBLX’s first earnings report after its initial public offering (IPO).

The stock soared 93.8% from its IPO in March 2021 to November 2021. That’s almost double in only eight months!

Since then, RBLX has tumbled back to earth… It’s down 71.6% from its all-time high as I write and is sitting well below its IPO launch price.

And that’s reflected in its Stock Power Ratings…

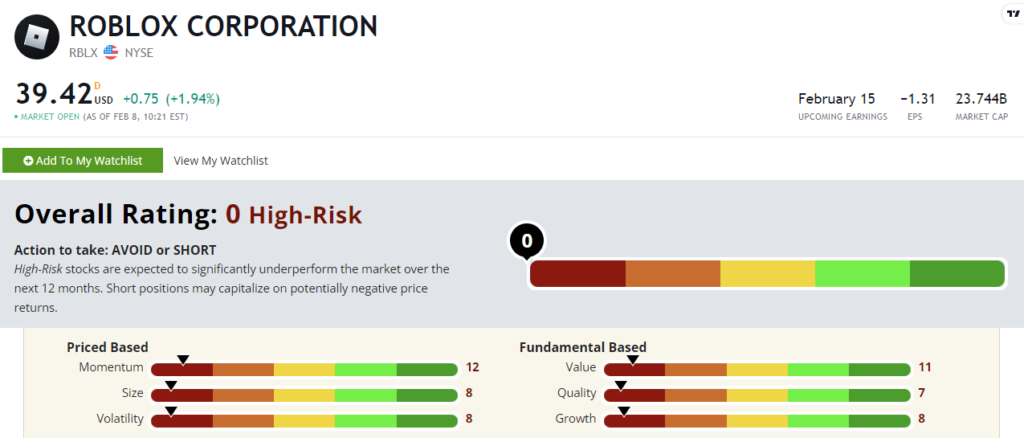

RBLX stock scores a “High-Risk” 0 out of 100 on our Stock Power Ratings system. We expect it to underperform the broader market over the next 12 months.

Roblox Stock: Red Ratings on All 6 Factors

I’m not going to mince hairs here.

Roblox is in a tight spot:

- In its recent quarterly report, the company reported a 2% increase in revenue but free cash flow was negative $67.7 million!

- The company also reported a $300 million loss from operations — a 287.6% greater loss than the previous quarter.

That shows why RBLX scores an 8 on growth.

It also scores in the red on our value and quality factors.

RBLX has negative price to earnings and price-to-cash flow, meaning it’s not generating any profit. It scores an abysmal 11 on value.

The company has a horrible return on equity of negative 152.9% and a return on investment of negative 54.6%, earning it a 7 on quality.

All of this tells us the stock is wildly overvalued, and its financial bottom line is simply not in a good place.

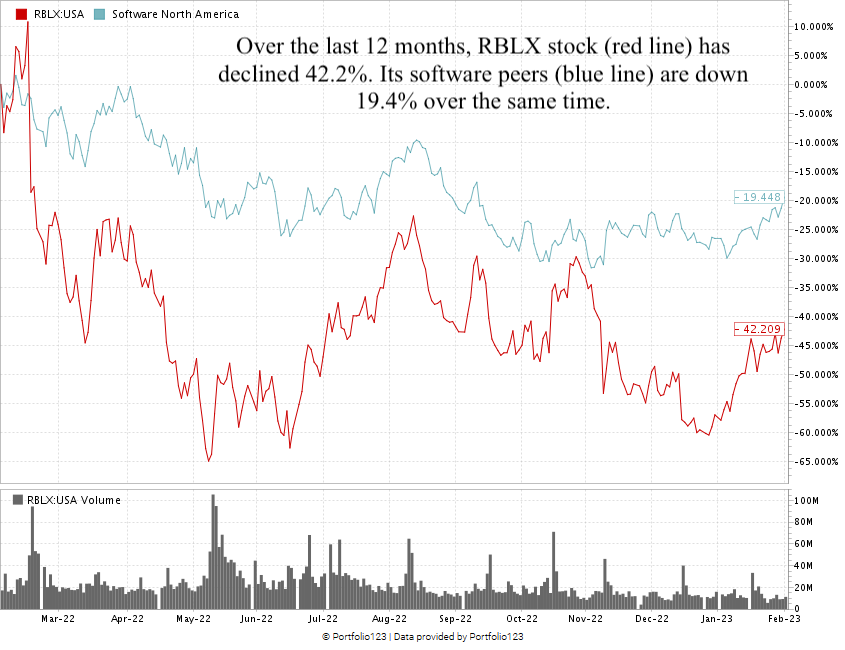

RBLX stock has had a rough 12 months. It’s dropped 42.2% in the last year and its stock price, around $38 as I write, is well below its $70 IPO launch price.

For comparison, its software industry peers have averaged a 19.4% loss over the same 12 months:

Created in February 2023.

Roblox stock scores a horrible 0 overall on our proprietary Stock Power Ratings system.

That means we consider it “High-Risk” and expect it to underperform the broader market over the next year.

The video game industry continues to boom.

Even I’m trying to get in on the hype.

But Roblox is a company struggling to find its way — with declining cash and an inability to capitalize on its 58.8 million users.

A quick look at our Stock Power Ratings system shows that the massive red ink in its ledger makes Roblox stock one to avoid.

Before I go: You may have noticed that Roblox stock has been on fire lately… It’s up almost 40% in 2023 alone!

But my colleague Adam O’Dell thinks this is part of a bigger “fake out” rally that’s about to leave a lot of investors holding the bag.

And RBLX isn’t the only stock that’s caught up in the frenzy.

Next week, Adam is going to tell you about what he’s calling “The Next Big Short,” and how you can take advantage as one of the biggest stocks falls again.

Click here to sign up for his free presentation now. It airs on Tuesday, February 14 at 1 p.m. Eastern.

Stay Tuned: Stock Power Ratings Exposes Another Fake Rally

Tomorrow, I’m going to show you another stock that’s participating in this fake rally. Its abysmal Stock Power Ratings tell you everything you need to know.

Stay tuned…

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. I’d love to hear what you thought about my “Stock to Avoid” article today. Was it valuable? Would you like us to continue sharing high-risk stocks on occasion, so you know what to stay away from?

Would you prefer that we only share “Bullish” and “Strong Bullish” stocks?