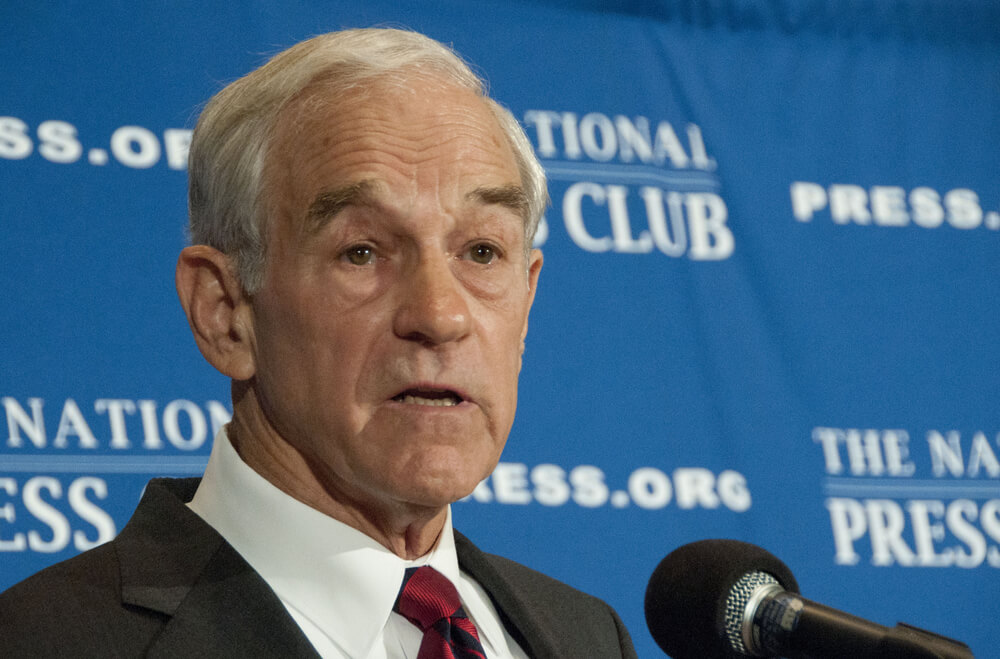

Former Texas Republican and Libertarian Congressman Ron Paul addressed the recent comments by Donald Trump that the Fed is “crazy” with its rising interest rates in his weekly column on Monday, saying “he is right that ‘crazy’ is a good way to describe the Federal Reserve.”

Paul has been a frequent critic of the Fed over the years, so his assessment comes as no surprise. Paul wrote a book, “End the Fed,” in 2009, and it debuted at No. 6 on the New York Time’s best-seller list.

Per his latest column, Paul advocates for precious metals like gold and silver as the standard of currency because they retain their value, which means they “accurately convey the true value of goods and services.”

Government-created fiat currency, on the other hand, does not accurately convey the true price of money, which is the interest rate, Paul says.

If the interest rate reflects the manipulation of central bankers and not true market conditions, individuals will be unable to properly allocate resources between savings and current consumption.

In contrast to market money, government-created fiat currency is anything but stable. Central banks constantly increase and decrease the money supply in an attempt to control the economy by controlling the interest rates. This causes individuals to misread market conditions, leading to a misallocation of resources. This can create an illusion of prosperity. But eventually reality catches up to the Federal Reserve-created fantasies. When that happens, there is a recession or worse, leading the Fed to start the whole boom-and-bust cycle over again.

When central banks create money, those who first get the new money enjoy an increase in purchasing power before the new money causes a real increase in prices. Those who receive the money first are members of the banking and financial elite. By the time the new money reaches the middle class and working class, inflation has set in, so any gain in purchasing power is more than offset by the increase in inflation. Thus, central banking causes income inequality.

Since its creation in 1913, Paul argues, the Fed has caused the U.S. dollar to lose most of its value, punishing savers and rewarding those who pile up massive debt.

The very act of creating money and manipulating interest rates distorts the market. Therefore, the Federal Reserve System cannot be fixed with a “rules-based” monetary policy or even with “tying” the Fed-created money supply to the price of gold. It is amazing how many economists who oppose price controls on all other goods support allowing a secretive central bank to control the price of money.

Trusting the Federal Reserve to produce permanent prosperity instead of a boom-and-bust cycle is a textbook example of a popular definition of insanity being repeating the same action in hope of getting different results. The Federal Reserve System is as unworkable and doomed to failure as every other form of central planning.

It is likely that the next Fed-created recession will come sooner rather than later. This could be the major catastrophe that leads to the end of fiat currency. The only way to avoid crisis is to force Congress to end our monetary madness. The first steps are passing the Audit the Fed bill, allowing people to use alternative currencies, and exempting all transactions in precious metals and cryptocurrencies from capital gains taxes and other taxes.