If you’re looking for a tax-saving strategy to cut your tax bill in retirement, a Roth 401(k) could be exactly what you’re looking for — if your employer offers it.

Most people are familiar with traditional 401(k) plans, which is a workplace retirement savings plan that lets you put away pretax dollars from each paycheck to let the money grow on a tax-deferred basis.

But what many people don’t know is that more and more companies are offering Roth 401(k) plans as well.

A Roth 401(k) lets you stash after-tax dollars, where the money accumulates free of taxes and lets you take tax-free withdrawals in retirement so long as you meet a set of conditions.

A recent poll by investment consultancy firm Callan said about 85 percent of the 106 employers it polled offered Roth 401(k) plans in 2018.

Per CNBC:

“What drives employers’ interest is that it gives participants the opportunity to save,” said Jana Steele, senior vice president of the defined contribution consulting group at Callan.

“It’s more beneficial for higher-compensated employees who may not be able to make Roth deferrals outside of the plan and are capped by income limits,” she said.

Here’s what you need to know about Roth 401(k) accounts at work.

No income caps

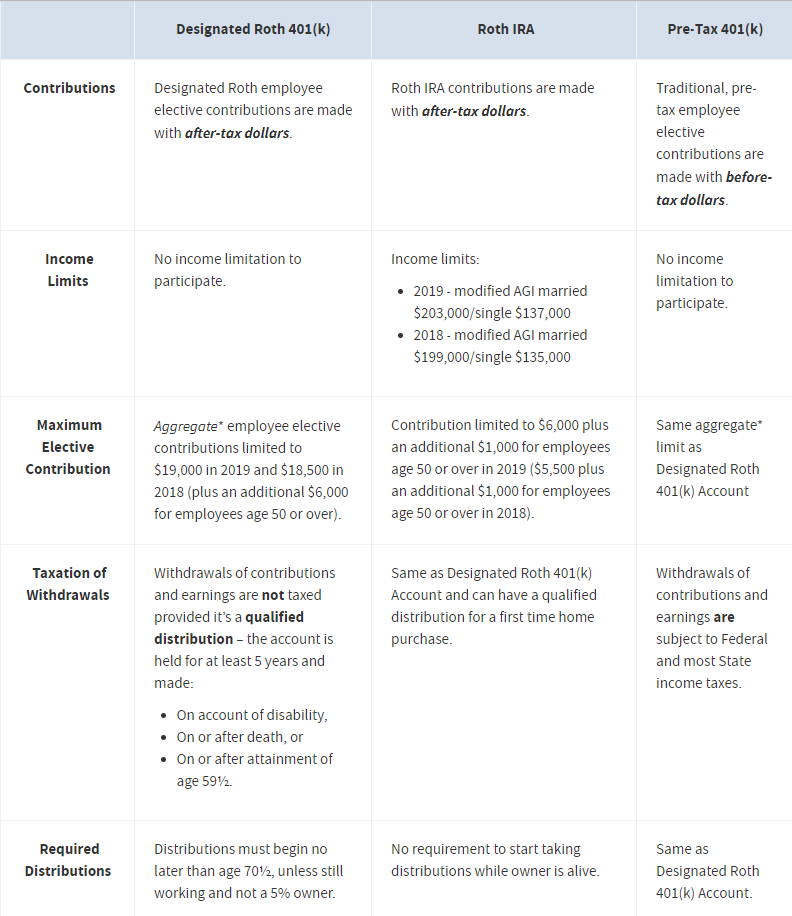

Roth 401(k) plans offer high-income savers a benefit they couldn’t otherwise get with a Roth IRA.

You’re barred from making a direct contribution to a Roth IRA if your modified adjusted gross income exceeds $137,000 and you’re single ($203,000 if married).

However, income caps don’t apply to people saving in Roth 401(k) accounts.

Roth 401(k) accounts also have higher contribution limits: You can put away up to $19,000 in total in your Roth and traditional 401(k) plans, plus $6,000 if you’re 50 and over.

Meanwhile, Roth IRAs are subject to an annual contribution limit of $6,000 this year, plus $1,000 for people age 50 and over.

Conversion opportunities

If you have both a traditional and a Roth 401(k) plan at work, you might also be able to convert some of those pretax dollars into after-tax savings.

That’s where the in-plan Roth conversion comes in.

You would pay taxes on any pretax money that you convert to the Roth 401(k). The amount that’s converted is included in your gross income for that year.

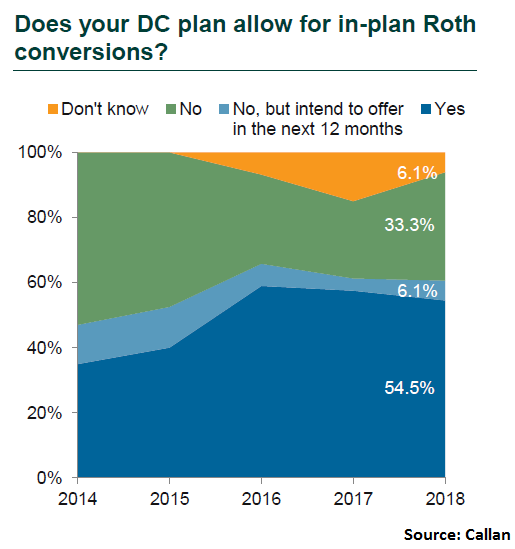

Be aware that even if you have a Roth 401(k) plan at work, it doesn’t mean that the in-plan conversion is available to you.

Though more than 8 out of 10 of the respondents in Callan’s study offer the after-tax retirement account to their workers, only about half of them allow in-plan Roth conversions.

“The conversation is very technical and requires a fair understanding of the employee’s tax position at the end of the year and where they can anticipate it will be in future years,” said Steele at Callan.

Indeed, a conversion isn’t right for everyone.

For instance, it might make sense if you’re in a low tax bracket now, but you expect to be in a higher bracket once you’ve retired.

On the other hand, the move might be a bad idea if you think your taxes will be lower after you’ve stopped working.

Further, the amount you’ve converted is considered income, and it’s subject to taxes.

“Look at your tax return and your taxable income, and ask ‘If I layer another $10,000 of income on top of it by doing a Roth conversion, will that put me into the next tax bracket?'” asked Yvonne Marsh, a certified financial planner and CPA at Marsh Wealth Management in Knoxville, Tennessee.

Where to begin

If you have both a traditional and a Roth 401(k) at work, here’s what you should consider.

Ask about your match: Even if your employer offers both the Roth and traditional 401(k), any matching contributions will likely wind up in the traditional plan. That means it’s subject to taxes if you withdraw it.

Embrace tax flexibility: By contributing some of your money to the Roth, some to the traditional 401(k) and some in a taxable account, you can adjust your income in retirement and manage your tax bracket.

This way, you can even keep your taxable income low enough to avoid paying higher Medicare premiums.

Know your taxes: Work with your accountant to determine the best way to make an in-plan Roth conversion — as well as whether it makes sense for you. You may need to do it in steps over time to avoid a big tax bite.

“Don’t do it all in one year; it creates a huge taxable event,” said Marsh.