With inflation at levels not seen since the 1980s, investors are worried the runaway inflation that defined that era could return.

Economists are confident inflation will fall in the coming months, but these are the same economists who missed the surge in inflation. The same is true of the policymakers at the Federal Reserve. They failed to see how far inflation would rise and now express confidence they can beat inflation down.

Economists and the Fed are often wrong on inflation. Consumers are the one group that does “get” inflation fairly often, which reflects the fact that consumer decisions have more impact on the direction of the economy than policies from Washington.

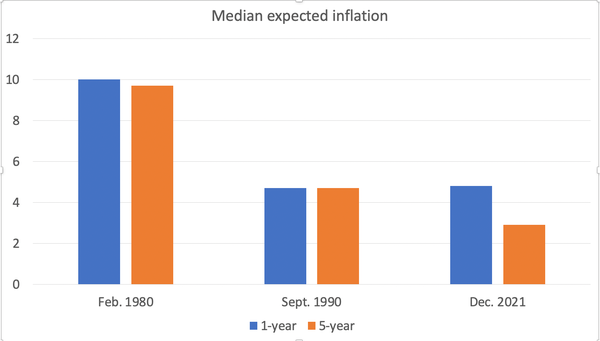

The University of Michigan has been surveying consumers to understand inflation expectations since 1979 (see chart below). The survey asks for the outlook over the next year and also the next three to five years.

Source: New York Times.

Inflation depends on expected inflation. Economic models forecasting inflation give a great deal of weight to inflation expectations.

For now, consumers expect inflation to ease, and that will drive their decisions.

Could Russia-Ukraine Spark Runaway Inflation Again?

Of course, inflation could spike because of the war in Ukraine. Many consumers will view that as another short-term factor as they continue to look for lower inflation next year.

From the chart, Nobel laureate Paul Krugman notes the previous instances of runaway inflation:

Back then, inflation was entrenched in the sense that the public expected it to remain high over the medium term…. This time, the public already expects inflation to subside to low levels within a year or so.

Unless that changes, we should look for the Fed to raise rates this year. It could start cutting them next year as the economy returns to the slow growth that prevailed for most of the past 20 years.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.

Click here to join True Options Masters.