In the latest Marijuana Market Update, I discuss:

- Where cannabis legalization stands and how stocks have performed.

- A recent cannabis special purpose acquisition company (SPAC) that fell through.

Watch the video below.

Cannabis Legalization and the SAFE Act

Anyone who’s been following cannabis legalization moves in Congress must be feeling whiplash.

On one hand, the House of Representatives has approved the Secure and Fair Enforcement Banking (SAFE) Act five times already. They tacked it on to a defense spending bill and sent it to the Senate two weeks ago.

This act drops the penalties that banks incur by working with cannabis companies. It opens up traditional corporate banking to cannabis outfits.

Now, it has already run into a roadblock in the Senate. Majority Leader Chuck Schumer of New York said the chamber has an agreement in place to halt action on the SAFE Act until stronger cannabis reform moves forward.

By stronger cannabis reform, he means more than just legalization. Schumer is looking at social justice reform — for instance, expunging previous cannabis-related convictions.

So the Senate has agreed to hold the SAFE Act until cannabis social justice reform takes shape.

Schumer suggested in a podcast that the SAFE Act could advance if they add those social justice measures.

Welcome to the Potomac two-step of Washington politics.

I was curious to see what, if any, impact this latest development had on cannabis stocks.

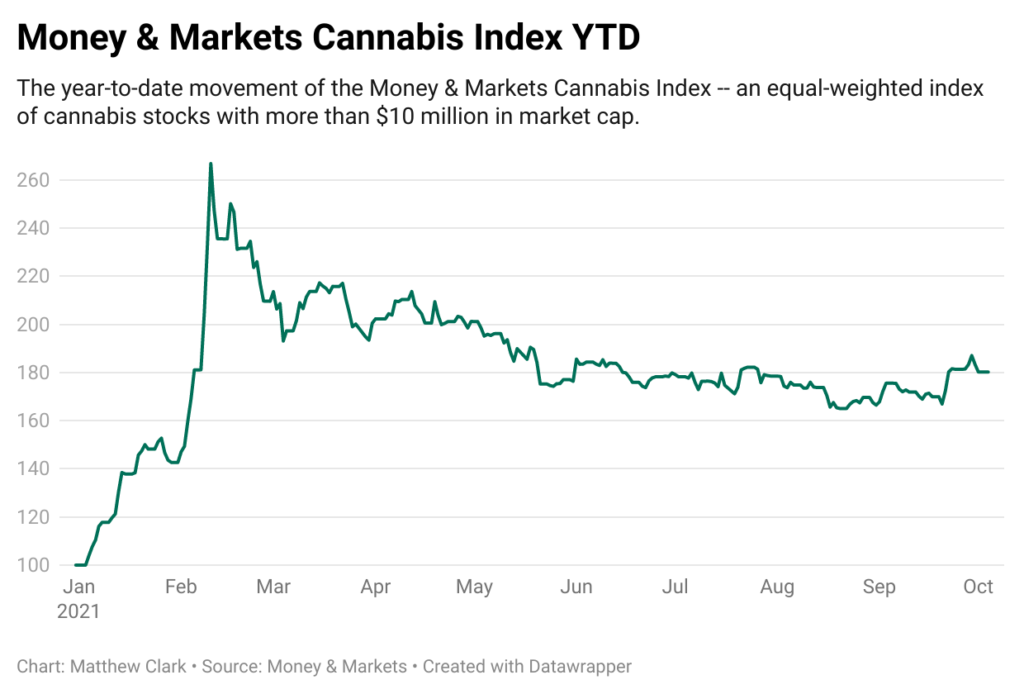

So, I started with the Money & Markets Cannabis Index — an equal-weighted index covering cannabis companies with at least a $10 million market cap.

As you can see, the index had a massive run-up in February but trended down into September. It’s still up about 80% since the first of January.

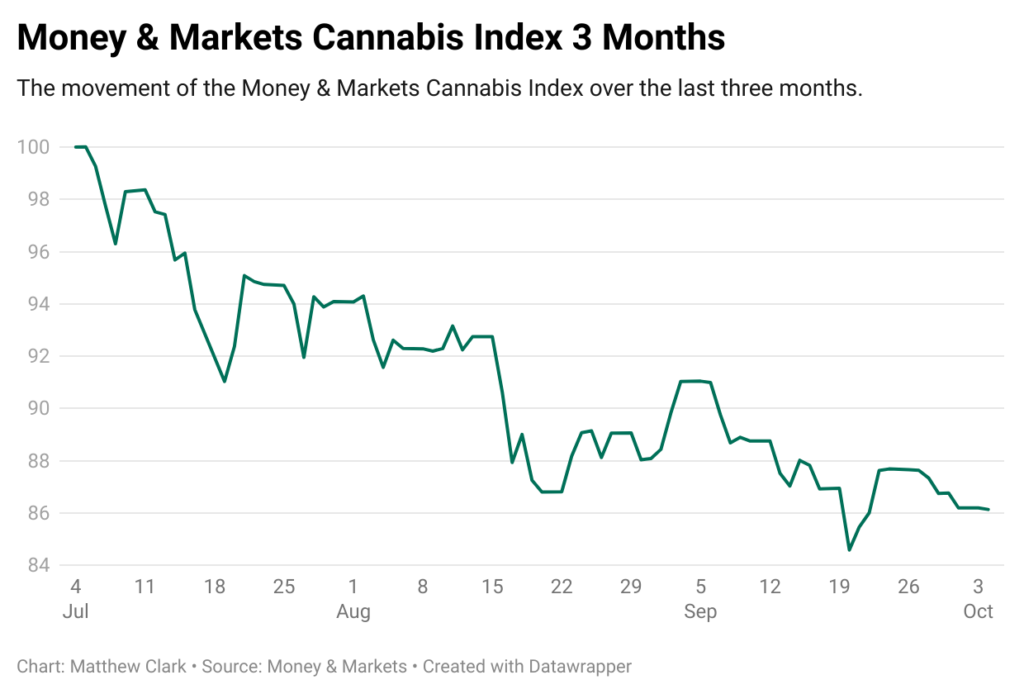

I also wanted to look at a shorter time frame.

So, I looked at the index performance over the last three months.

Here, you get a sharper look at how cannabis stocks suffered during the middle and later stages of the summer.

Overall, the index dropped around 14% as the industry faced headwinds.

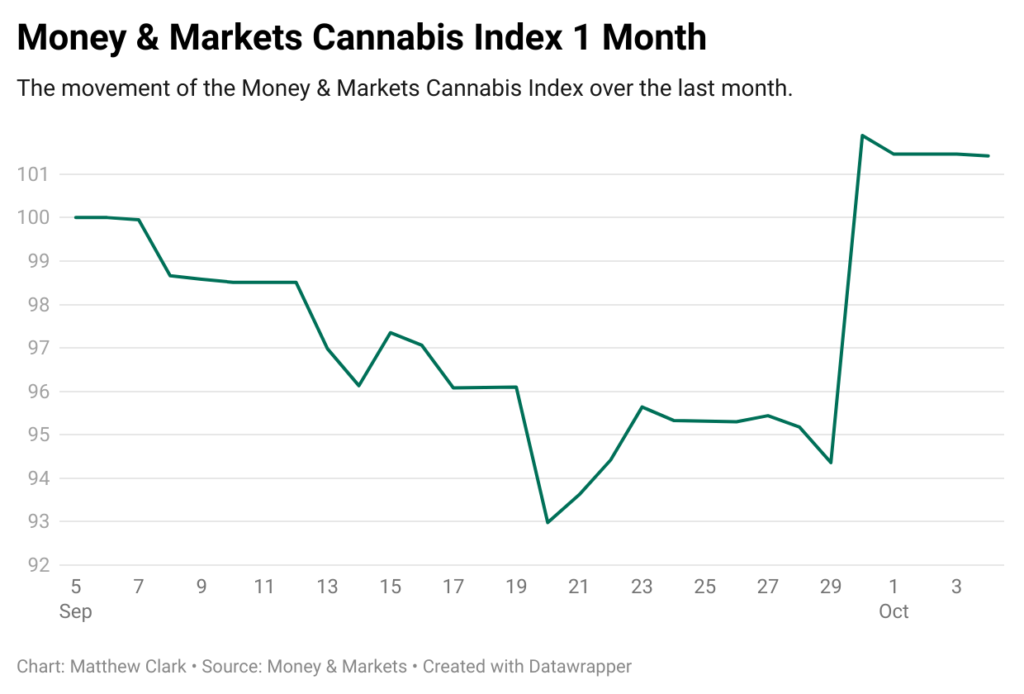

What happens if we zero in closer and track cannabis stocks more closely related to news out of Washington?

You can see that, around the time the House rolled the SAFE Act into defense authorization, cannabis stocks started to bounce higher.

The index gained about 1.43% over the last month.

Takeaway: This tells me that this industry is starved for a small catalyst to push stocks higher.

A “good news” headline related to legalization can move cannabis stocks, collectively, 7% to 8% higher in a matter of days.

I think that if the Senate can advance the SAFE Act in some form, we’ll see a strong run on the cannabis market. That will be far stronger if they throw legalization or decriminalization into the mix.

Cannabis SPAC Merger Fails

Something else grabbed my attention in the news: a potential SPAC merger in cannabis that got called off.

Last week, Marijuana Business Daily (MJ Biz) reported the $1.9 billion merger between Parallel — which chewing gum heir William Wrigley Jr. runs — and Ceres Acquisition Corp. was halted.

The reverse merger would have Parallel trade publicly on Canada’s NEO Exchange.

In February, Parallel — which operates as Surterra Wellness in the U.S. — announced plans to expand from 42 retail outlets in the U.S. across five markets to 86 stores in eight markets within the next two years.

Separate reporting from Reuters suggested that potential investors didn’t have confidence in Parallel to meet its high financial projections, so the deal with Ceres was called off.

According to MJ Biz, Parallel projected revenue of $447 million for 2021, but investors cooled on the idea that it was even possible.

Parallel posted net losses of $263 million in 2019 and $140 million in 2020, so it seems investors’ fears were justified.

For now, Parallel remains a private company while Ceres has until March 2022 to make a transaction or for shareholders to extend that date.

It’s important to point out that this isn’t the only SPAC deal in the cannabis space.

Multistate operator (MSO) Verano Holdings plans to go public on the Canadian Securities Exchange with a value of $2.8 billion through a reverse takeover that it announced in December 2020.

Cannabis advertising company Weedmaps also expects to go public through SPAC Silver Spike Acquisition Corp. with a potential valuation of $1.5 billion.

SPACs were popular in 2020, with 248 SPAC initial public offerings (IPOs) bringing gross proceeds to $83.3 billion. That was even higher this year, with 450 SPAC IPOs bringing gross proceeds of $129.3 billion.

However, the market tightened after 109 SPAC deals were announced in March alone. In April, the Securities and Exchange Commission announced guidance classifying SPAC warrants as liabilities rather than equity.

According to CNBC’s SPAC Post Deal Index, all its gains in 2021 got wiped out — and the index dropped more than 20% from January to April.

Takeaway: This doesn’t mean SPACs in the cannabis space are dead — but it suggests that investors will take a much sharper look at the companies that SPACs propose to merge with.

If the numbers don’t add up — as with Parallel — investors seem content with walking away.

Where to Find Us

Coming up this week, we’ll have more on The Bull & The Bear podcast, so stay tuned.

And check out our Ask Adam Anything video series, where we ask any question to chief investment strategist Adam O’Dell, as well as our Investing With Charles series, in which our expert Charles Sizemore and I discuss the trends you write in to ask about.

Also, you can follow me on Twitter (@InvestWithMattC), where I’ll give you even more insights, not just in the cannabis market.

Remember, you can email my team and me at feedback@moneyandmarkets.com — or leave a comment on YouTube. We love to hear from you!

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.