26 And with surging inflation making us more mindful of price tags, demand for the original white meat won’t subside any time soon.

That sounds like an investable trend to me.

I love chicken. I don’t know if it’s healthier, but I do know it’s cheaper. (And I can do a lot more in the kitchen with it compared to beef.)

It looks like I’m not alone. Since 2010, chicken has become the meat of choice in the U.S.

So why don’t we find a way to follow this trend with a top-rated stock?

Using Chief Investment Strategist Adam O’Dell’s proprietary six-factor Stock Power Ratings system, I found a “Strong Bullish” stock that capitalizes on our increased demand for poultry:

- It is the third-largest poultry producer in the United States.

- Since hitting a 52-week low in June 2021, this stock quickly climbed 24.6% and has maintained that level since.

- It’s in the top 1% of all stocks we rate.

Here’s why this poultry producer will be a strong performer this year and beyond.

More and More People Love Chicken

For more than 100 years, beef was the meat of choice in the U.S.

In 1976, beef accounted for nearly half of all meat consumed, while chicken had just a 20% share.

Chicken finally caught up to beef in 2010. And in 2018 chicken’s share of consumption in the U.S. was 36% — almost 20% higher than beef.

And if we look at the entire world, chicken’s growth in popularity shows little signs of slowing down:

Globally, we consumed 133.4 metric kilotons of poultry in 2021.

By 2030, its estimated that consumption will reach 151.8 metric kilotons — a 13% increase from 2021.

Bottom line: We are eating more and more chicken.

A Chicken Stock Giant: Sanderson Farms Inc.

In 2014, chicken did something it had never done before: It surpassed beef as the most popular meat in the U.S.

Since then, poultry has become the dominant meat in American markets.

Sanderson Farms Inc. (Nasdaq: SAFM) is one of the largest poultry producers in the U.S. — ranking No. 3 in 2020.

The Mississippi-based company processed more than 4.8 billion pounds of meat in 2020. It sells its processed chicken to retailers, distributors and restaurants all over the U.S.

Look at SAFM’s massive growth since the height of the COVID-19 pandemic in 2020:

The chart above shows the actual and estimated total revenue for SAFM. In 2020, the company generated $3.56 billion in total annual revenue.

By 2022, the company is projected to hit $5.4 billion in total annual revenue — a 51.6% increase from its 2020 numbers.

Now, let’s look at how the stock has performed.

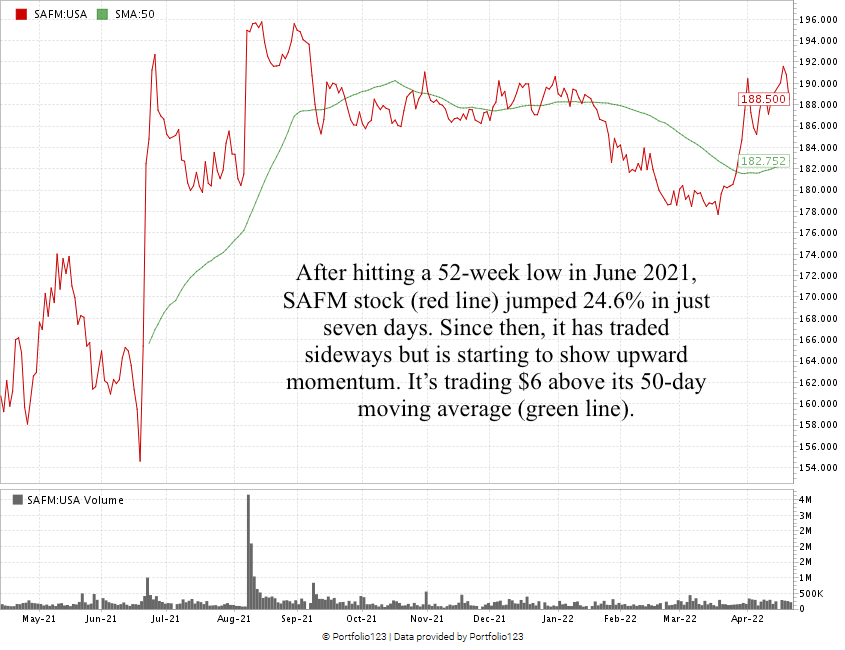

SAFM Rebounds After Hitting 52-Week Low

SAFM hit a 52-week low in mid-June 2021. But the stock gained 24.6% over the next seven trading days and has traded sideways since.

Now the stock is showing strong signs of another move upward.

Sanderson Farms Inc. Stock Rating

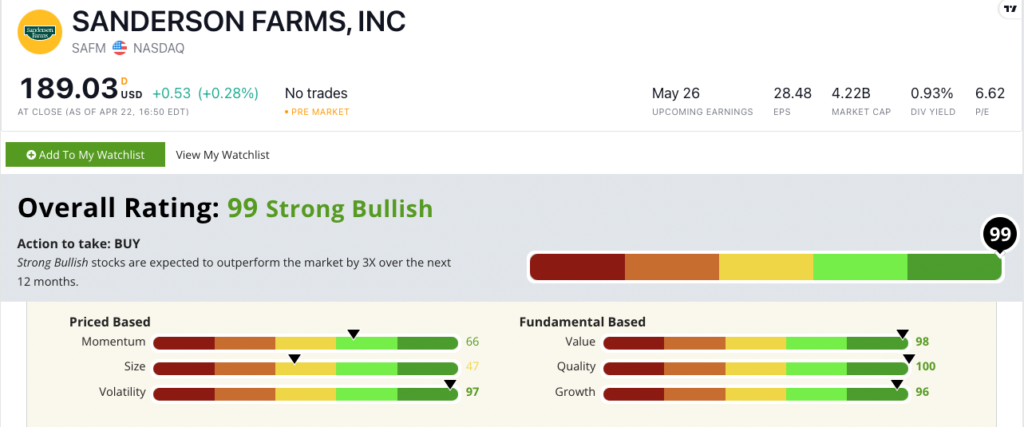

Using Adam’s six-factor Stock Power Ratings system, Sanderson Farms Inc. stock scores a 99 overall.

That means we’re “Strong Bullish” on the stock and expect it to beat the broader market by at least three times over the next 12 months.

SAFM rates in the green on five of our six rating factors:

- Quality — Sanderson Farms has some of the best return-on percentages in the agriculture sector. It’s return on assets is 28.1% compared to the industry average of negative 33.23%. SAFM scores a 100 on quality.

- Value — SAFM scores a 98 on value, with a price-to-earnings ratio of 6.64 compared to its sector peer average of 34.31. Sanderson’s price-to-sales ratio is 0.8, while the agriculture industry average is 7.76.

- Volatility — After the stock jumped 24.6% in seven days last year, it has traded with little long-term volatility. SAFM scores a 97 on volatility.

- Growth — Sanderson Farms has a one-year earnings-per-share (EPS) growth rate of more than 999% and a one-year annual sales growth rate of 34.6%. In the last 12 months, its EPS has jumped 734%, and its sales are up 42.9%. Sanderson scores a 96 on growth.

- Momentum — After some sideways price action since June 2021, shares are starting to move up again. Sanderson scores a 66 on momentum.

SAFM earns a ”Neutral” 47 on size — due to its $4.2 billion market cap. However, the outstanding fundamental metrics for this stock offset this lower metric.

Bottom line: The debate over whether chicken is healthier than beef isn’t going away.

However, the fact remains that we are eating more and more chicken every year.

This increased demand puts companies like Sanderson Farms in a great position for strong profits in the years to come.

It’s why SAFM is a must-have for your portfolio.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. He’s also a certified Capital Markets and Securities Analyst through the Corporate Finance Institute. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.