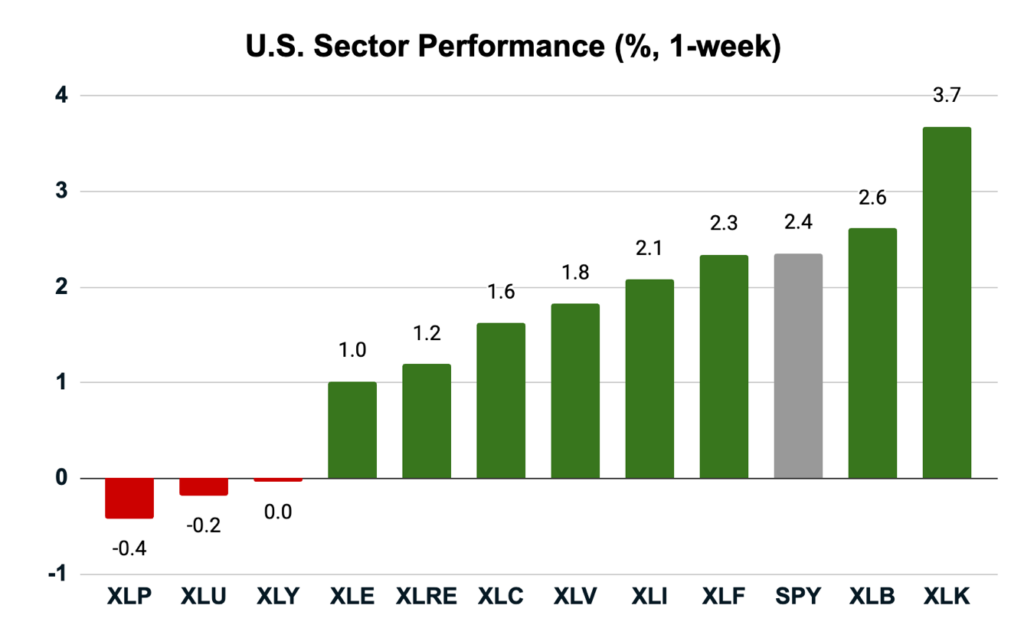

Last week might have been shortened by the Christmas holiday, but it certainly didn’t disappoint. Eight out of eleven sectors finished the week positive, and even the laggards were barely in negative territory.

The State Street Technology Select SPDR ETF (XLK) was up 3.7%, and the State Street Materials Select SPDR ETF (XLB) was close behind at 2.6%.

The S&P 500 finished up a very solid 2.4%.

At the bottom of the heap last week were the two most traditionally defensive sectors, consumer staples and utilities. The State Street Consumer Staples Select SPDR ETF was down 0.4%, and the State Street Utilities Select SPDR ETF was down 0.2%.

We shouldn’t read too deeply into a single week of trading, particularly given that it was a shortened holiday week with thin trading. But one point is abundantly clear. The animal spirits are alive and well in these last days of 2025. Investors are ending the year much as they started it: hungry for growth and willing to take risk.

Is that a sign of things to come in 2026?

Probably not. As I have been writing for months, I expect to see a rotation in the coming months away from the expensive megacap Mag 7 and into smaller and more value oriented sectors.

But at least for the time being, this remains a market dominated by the biggest tech names.

Key Insights:

- Tech is finishing the year strongly.

- Growth and cyclical sectors in general are leading.

- Defensive sectors are lagging.

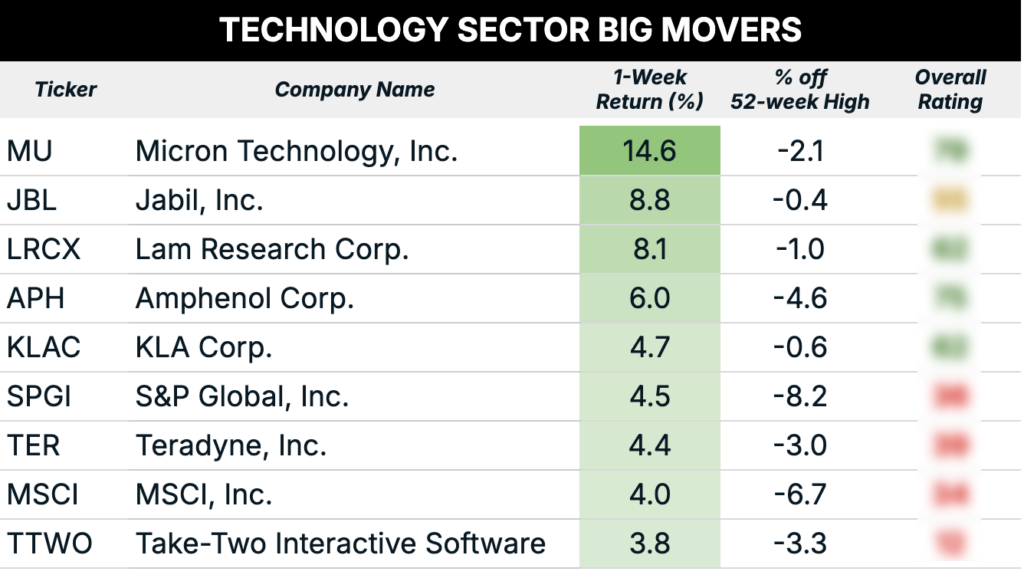

Biggest Movers in Tech

Some of the moves in tech this past week were truly off the charts. Nvidia (NVDA) – the largest company in history by market cap – was up 9.4%. At Nvidia’s current market value, that represents a move of $450 billion.

Thin trading week or not, that’s still a big move. And it certainly wasn’t the only big mover.

I screened the tech sector for the biggest winners of the week that are now trading within 10% of their 52-week highs. We’re looking for strong stocks in a strong sector that are trending higher. (Nvidia failed to make the cut because it’s down just over 10% from its 52-week highs.)

There are several big movers sporting “Bullish” Green Zone Power Ratings. Memory and storage company Micron Technology (MU) was up close to 15% last week after reporting record earnings. It’s within spitting distance of its 52-week high and it rates a very “Bullish” 79.

Lam Research (LRCX), Amphenol (APH) and KLA Corp (KLAC) also sport “Bullish” ratings.

The Mag 7 trade may be wildly overdone, but there are still plenty of gems left to be found in the tech sector.

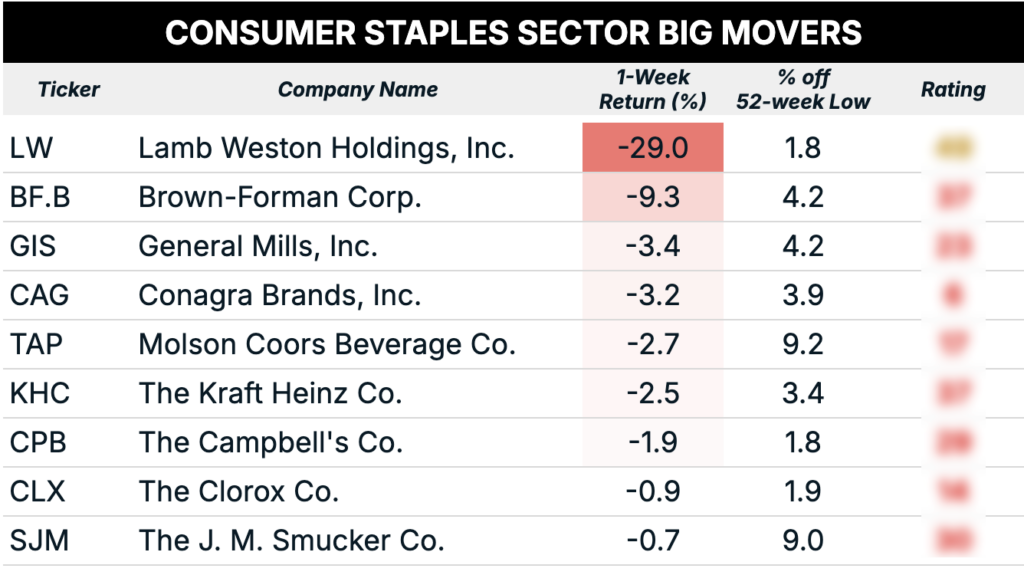

Bottom Fishing in Consumer Staples?

Let’s now take a deeper look at the worst-performing sector last week, consumer staples.

This sector has a reputation for being “boring,” and understandably so. By definition, these are not exciting companies. They produce basic necessities, and their products tend to be mature.

That said…

Some of Warren Buffett’s greatest successes were in the staid world of consumer staples, and to this day Coca-Cola (KO) remains one of its largest holdings. The disposable nature of the products is actually one of their greatest selling points. Consumers have to restock their pantries and medicine cabinets, so there is constant demand.

So, might there be some bargains here?

Let’s take a look.

I screened the tech sector for the biggest losers of the week that were within 10% of their 52-week lows. The idea is to find beaten-down stocks that have bottomed out and may be poised to rally.

Alas, there’s not much to get excited about in this list. Not a single one of the beaten up staples stocks rates as “Bullish,” and only one rates as high as “Neutral.”

All the same, if we are looking at the very real and likely possibility of a major leadership change in 2026, consumer staples are worth a deeper look. Be sure to check your inbox tomorrow because I’ll be doing a sector X-ray of the consumer staples sector. We’ll see if we can find some gems in the rough to start 2026.

To good profits,

Adam O’Dell

Editor, What My System Says Today