When I’m done with my day at work, I have a routine.

I open my phone and play three different games:

- Star Wars: Galaxy of Heroes.

- Infinite Galaxy.

- FIFA Mobile (soccer).

It’s not because I’m competitive or addicted to gaming … but more of a way to wind down from the day.

Millions do the exact same thing.

The chart below shows the revenue growth of the mobile video game market in the U.S. from 2017 to 2027:

As you can see, the mobile video game market is booming.

From 2021 to 2027, revenue from the mobile video game market will grow 65%.

Today’s Power Stock develops and publishes video games for your phone, tablet and computer: SciPlay Corp. (Nasdaq: SCPL).

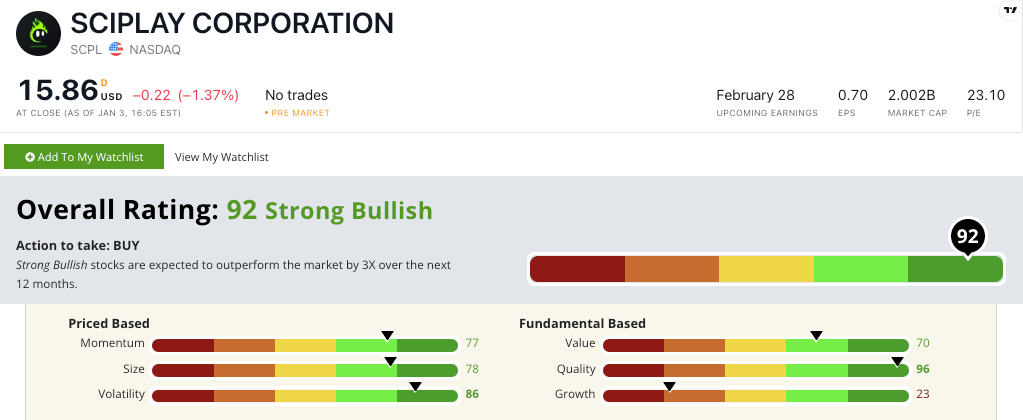

SCPL’s Stock Power Ratings in January 2023.

SCPL develops social casino games like:

- Jackpot Party Casino.

- Gold Fish Casino.

- Hot Shot Casino.

- Monopoly Slots.

The company touts 2.2 million average daily active users and 5.9 million active monthly users.

SciPlay Corp. stock scores a “Strong Bullish” 92 out of 100 on our Stock Power Ratings system. We expect it to beat the broader market by 3X in the next 12 months.

SCPL Stock: Great Quality With Low Volatility

Here’s what stood out from SCPL’s most recent earnings report:

- Quarterly revenue was $170.8 million, up more than 17% over the same quarter last year.

- The company’s average monthly revenue per user was $95.45 for the quarter — a $1.78-per-user jump year over year!

In addition to its strong growth numbers, SCPL is a strong quality stock … earning a 96 on that factor.

Its return on equity is 16.9%, compared to the software industry average of negative 28%.

SCPL’s operating margin is 22.8%, while its peers average a margin of negative 29.8%.

This tells us SCPL’s management does an excellent job converting users into revenue.

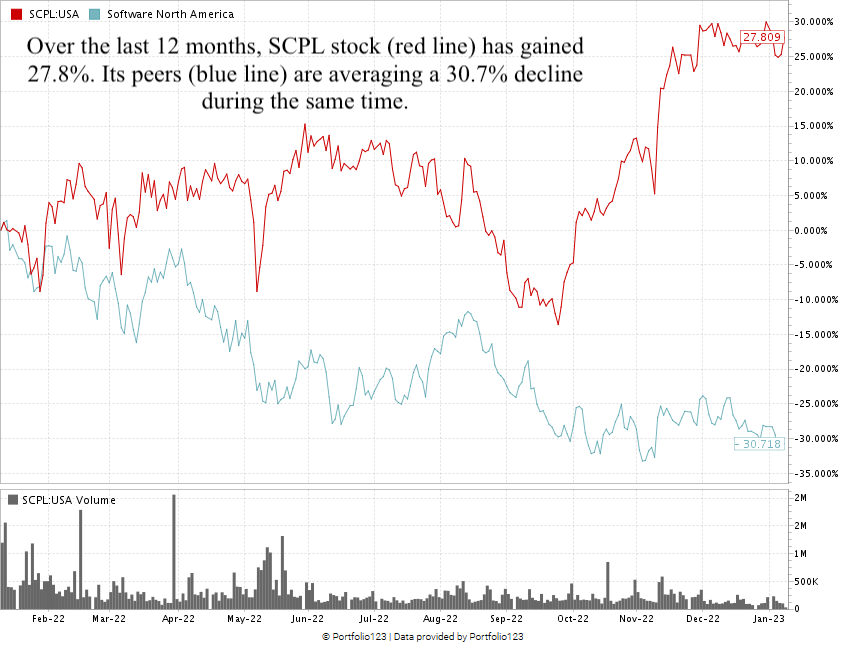

SCPL stock was relatively flat from January 2022 to August 2022:

Created in January 2023.

After a drop in September 2022, the stock rallied 48% into 2023 … showing the “maximum momentum” we love to see in stocks.

SciPlay Corp. stock scores a 92 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least 3X in the next 12 months.

Millions of people around the world log on to their phones every day to play some kind of game.

For me, it’s a great way to wind down after a day in the office.

With a robust presence in the sector, you can see why SCPL is a strong candidate for your portfolio.

Stay Tuned: Cybersecurity Growth Can’t Lift This Failing Tech Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Tomorrow, I’ll share all the details on a tech stock that’s sinking despite a strong cybersecurity market.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets