I don’t do market forecasts. I build trading systems and look for profitable (and durable) trends to follow.

And speaking of trends…

Any hopes that inflation might break soon got thrown out the window this week. The Consumer Price Index (CPI) for August was much hotter than expected at 8.3% year over year. Even the core number, which excludes energy and food, came in at 6.3%.

Inflation wreaks havoc on the market in a couple of ways.

It forces the Federal Reserve to raise interest rates much quicker than intended. That in turn pulls liquidity out of the market.

You can liken liquidity to an ocean tide. The old saying goes: “A rising tide lifts all boats.” But the exact opposite happens when the tide goes out. When liquidity drains out of the market, the price of everything falls.

Inflation, and the Fed’s higher interest rates that accompany it as it tries to settle prices down, also tends to punish growth stocks in particular.

Here’s why.

How Higher Rates Hammer Growth Stocks

You don’t buy a growth stock because of the earnings it generates today. You’re buying it because you want a piece of its future growth that may not materialize for years or even decades.

The lower interest rates go, the more valuable future profits are in today’s dollars. The opposite is true when interest rates turn higher. That dollar of earnings you hope to enjoy 10 years from now is worth a lot less in today’s dollars when inflation is running at 8%.

This is why it’s been a rough year for certain tech stocks. In a year with high inflation and rising interest rates, investors have stayed away from growth-centered tech and instead have focused on what’s working today — in the here and now.

I analyze all 11 sectors of the S&P 500 every week to look for trends, and the only two that are in buy-confirmed uptrends are utilities (traditionally the slowest-growth sector) and energy, which is enjoying an immediate profit windfall.

Technology has spent almost the entire year as a laggard.

Inflation Sector to Avoid: Pain for 2 Former Tech Darlings

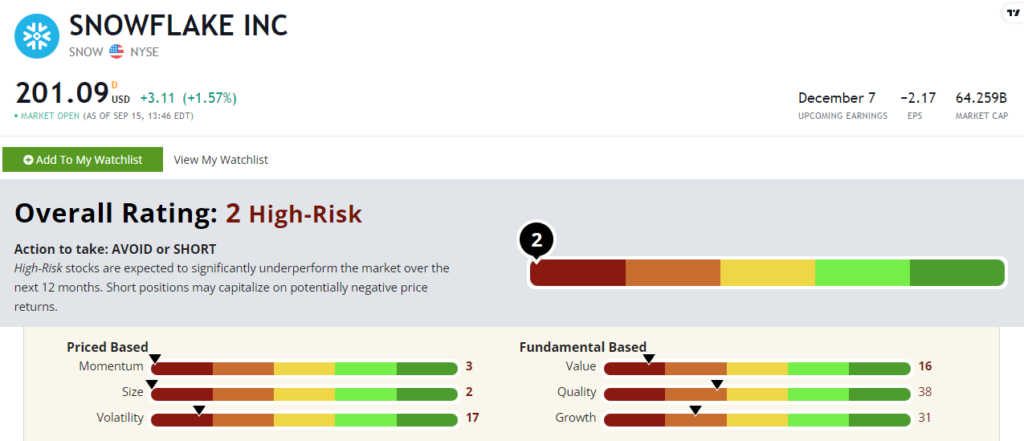

Let me give you an example. Snowflake Inc. (NYSE: SNOW) was one of the growth darlings of recent years. As a cloud database software company, it was a big name among growth and momentum investors leading up to this year.

Well today on my Stock Power Ratings system, it rates a 2 out of 100, making it one of the worst ranked stocks in our entire universe.

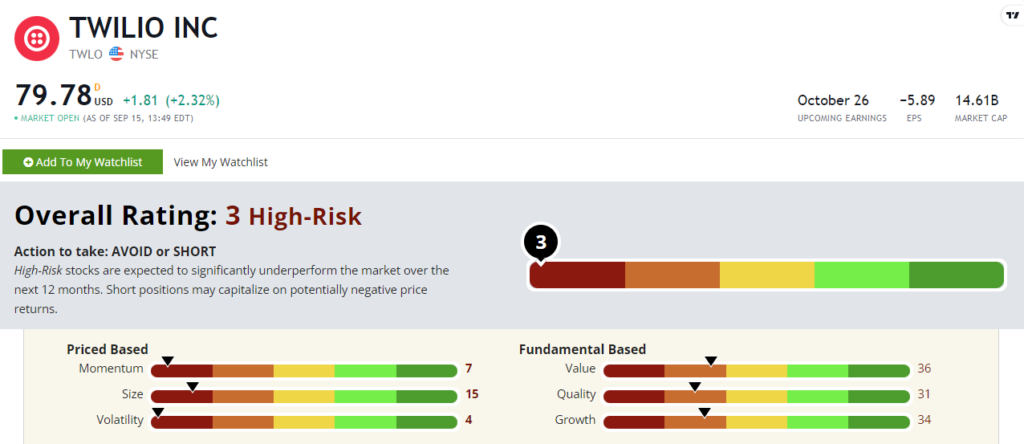

Twilio (NYSE: TWLO), another popular cloud stock of the last bull market, looks just as bad today. It rates a 3 out of 100.

TWLO is now down more than 70% in 2022 alone! The company is cutting 11% of its workforce as it aims to boost margins.

To be fair, as younger companies, these two get penalized on my growth factor score, which rates stocks based on their sales and earnings growth over various time horizons, some going out as far as 10 years. Snowflake and Twilio rate at 31 and 34 on my growth factor, respectively.

But their volatility and momentum scores are the real drag. Snowflake rates a 17 on volatility and a 3 on momentum. Twilio rates a 4 and a 7 on those two factors.

Now, I’m not here to bash either company. I may find a great opportunity to trade either or both in the months ahead. It happens all the time.

But my point here is simple: As long as inflation runs hot and the Fed stays aggressive in an effort to cool it down, growth stocks will face some significant headwinds. Caution is wise here.

Of course, as I said earlier this week, I know there’s always a bull market in something … and we’ll cover that on Monday!

To good profits,

Adam O’Dell

Chief Investment Strategist