I don’t trade crypto… and never have.

Not because I don’t see the value. The underlying technology, blockchain, is impressive and holds a lot of promise.

There’s also just a ton of volatility in the crypto market. More than I’m personally willing to tolerate with my money.

It’s also unregulated… making it a hotbed for scammers.

So, while I do believe there is money to be made in crypto, I don’t believe we’re at a point where trading cryptocurrencies is worth the risk.

But it’s clear that we’re inching closer to that point every single day.

Today, I’ll tell you about an exciting development for those deep into crypto trading, coming straight from the Commodity Futures Trading Commission (CFTC).

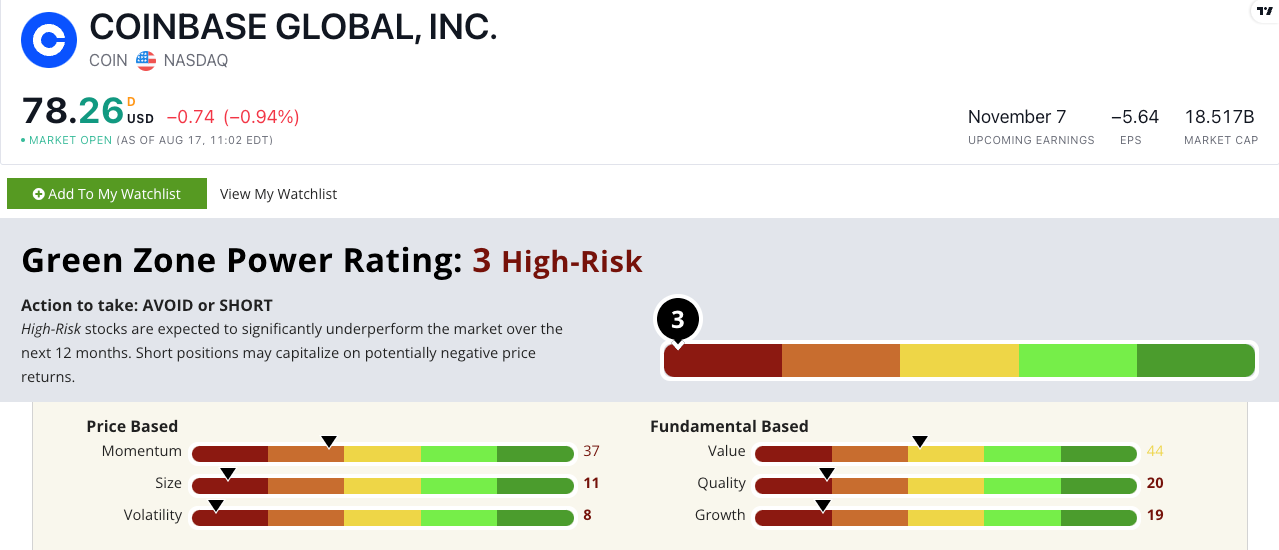

I’ll also share the results I found using Adam O’Dell’s proprietary Green Zone Power Ratings system on a stock directly impacted by this decision…

Opening Up the Cryptocurrency Market

This news broke on Thursday:

This means Coinbase Global Inc. (Nasdaq: COIN) can offer futures contracts in bitcoin and Ethereum to qualifying customers.

Futures contracts help investors manage risk on their underlying crypto assets by hedging against market moves. So this move opens the door to a more regulated crypto derivatives market.

The approval from the CFTC comes on the heels of some of the biggest fund managers on Wall Street seeking approval to offer crypto-based exchange-traded funds.

This marks a step towards the cryptocurrency trading market maturing. With this news, one would expect the price of Bitcoin to explode, right?

Wrong:

Over the last month, the price of bitcoin has fallen 14.6%. And it’s down 9.3% since the announcement from the CFTC on August 17.

That’s not necessarily the response you’d expect from positive cryptocurrency news. It’s a classic “sell the news” event.

But there are other pressures on cryptocurrency… like the Federal Reserve.

The Fed’s interest rate hikes are a strong headwind to cryptos right now. As interest rates rise, investors can more easily get a risk-free inflation-beating rate of return from Treasury bonds. This makes investing in risky assets like bitcoin less attractive.

Now, while I don’t trade cryptocurrencies, I do understand the stock market. And Coinbase (COIN) is a publicly traded stock that this decision impacts directly.

Using our Green Zone Power Ratings system, I analyzed Coinbase to see if it was a viable investment for your portfolio.

Here’s what I found out…

Coinbase Struggling to Find Its Legs

California-based Coinbase has turned into one of the most popular bitcoin wallets and trading platforms.

Despite having more than 100 million users of the platform, the company saw an 8% drop in quarterly revenue in the last quarter.

COIN rates 3 out of 100 on our proprietary Green Zone Power Ratings system. That means we consider it “High-Risk” and expect it to underperform the broader market over the next 12 months.

Short positions may capitalize on continued negative price returns.

The stock rates 19 on Growth due to its lackluster quarterly earnings and revenue report. The company has a one-year sales growth rate of -59.3% and an earnings-per-share growth rate of -183%. In other words, the company’s revenues are contracting.

It also rates poorly on our Quality factor (20). That’s due in part to the company’s net margin of -47.3% compared to the specialty finance industry average of -36.3%. Coinbase is spending a lot more money than it’s making… and is in worse shape than its peers in this regard.

Its returns on equity and investment also lag the industry averages.

This all tells me that Coinbase struggles to maintain a positive balance sheet and has a hard time growing revenue and earnings.

Bottom line: While the future of cryptocurrency trading remains up in the air, one thing is certain for now:

Coinbase may be a big player, but its numbers tell me growth and profits are a long way off.

Those are strong reasons to avoid COIN at all costs.

Stay Tuned: The Best Hope for Net Zero?

Tomorrow, Adam O’Dell has some thoughts about the grand net-zero ambitions of world leaders… and the one hated energy source they need to stay on track.

Until then…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets