Semiconductor companies were the “it” thing for investors before the recent market downturn, but not all companies in the sector are worth the risk as illustrated in the three semiconductor stocks to avoid in a market panic.

Before February 2020, companies building technology for the 5G revolution were hot (Pro tip: Check out our free report on the 5G revolution here).

Companies that build components, like semiconductors, used in 5G products were seeing very nice gains in their share price.

But while the sector was on fire, the recent market panic has pushed some of those companies into territory investors need to stay away from.

These are companies that have high price-to-earnings ratios, high price-to-cash flow and have become more volatile with a high 60-month beta. That indicates higher-than-usual price swings.

Those are the factors we looked at to find the three semiconductor stocks to avoid in a market panic.

3 Semiconductor Stocks to Avoid in a Market Panic

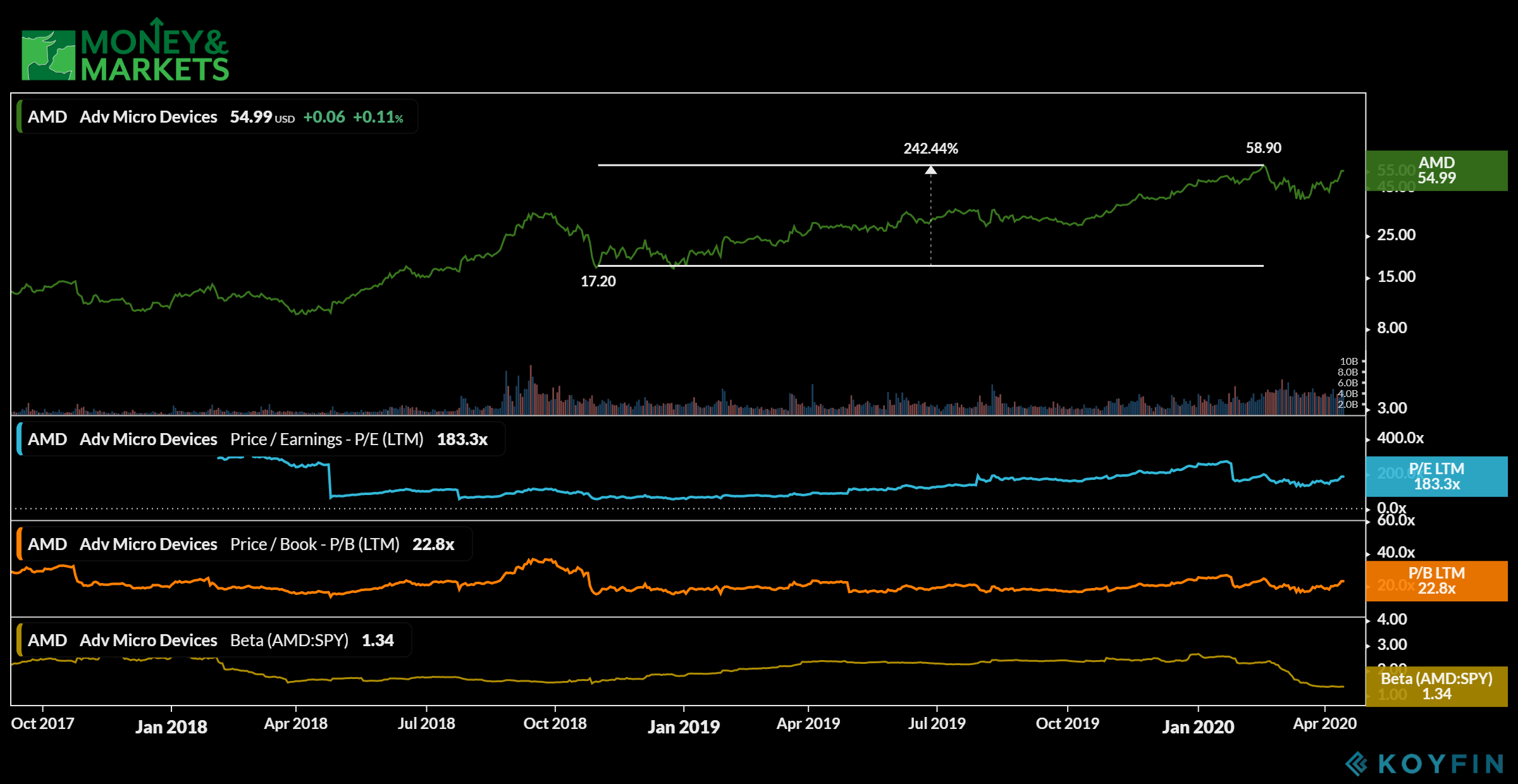

1. Advanced Micro Devices

Market Capitalization: $64.3 billion

Annual Sales (2019): $6.7 billion

Price-to-Earnings Ratio: 183.3

60-Month Beta: 1.34

One company that rode the 5G revolution wave to a high point was Advanced Micro Devices (Nasdaq: AMD).

It provides microprocessors, chipsets and graphics processing units for a wide range of computing products — from desktops to smartphones.

Advanced Micro Devices saw a 242% jump in its share price in 2019 to reach a new 52-week high of around $58. It retreated somewhat in the market crash of March 2020 but has moved back to within $4 of that high.

While that seems all well and good, the bounce has seriously overvalued AMD shares.

It has a price-to-earnings ratio of 183.3, which is very high. The company’s price to book is at 22.8, which is also very high.

On top of that, it carries a price to cash flow of 72 — anything under 20 is considered good.

At one point, AMD shares had a 60-month beta of 2.4, but that has been pared back to around 1.3, which is still a little high.

It’s not a bad company to invest in but now is really not the time. That’s why Advanced Micro Devices is one of the three semiconductor stocks to avoid in a market panic.

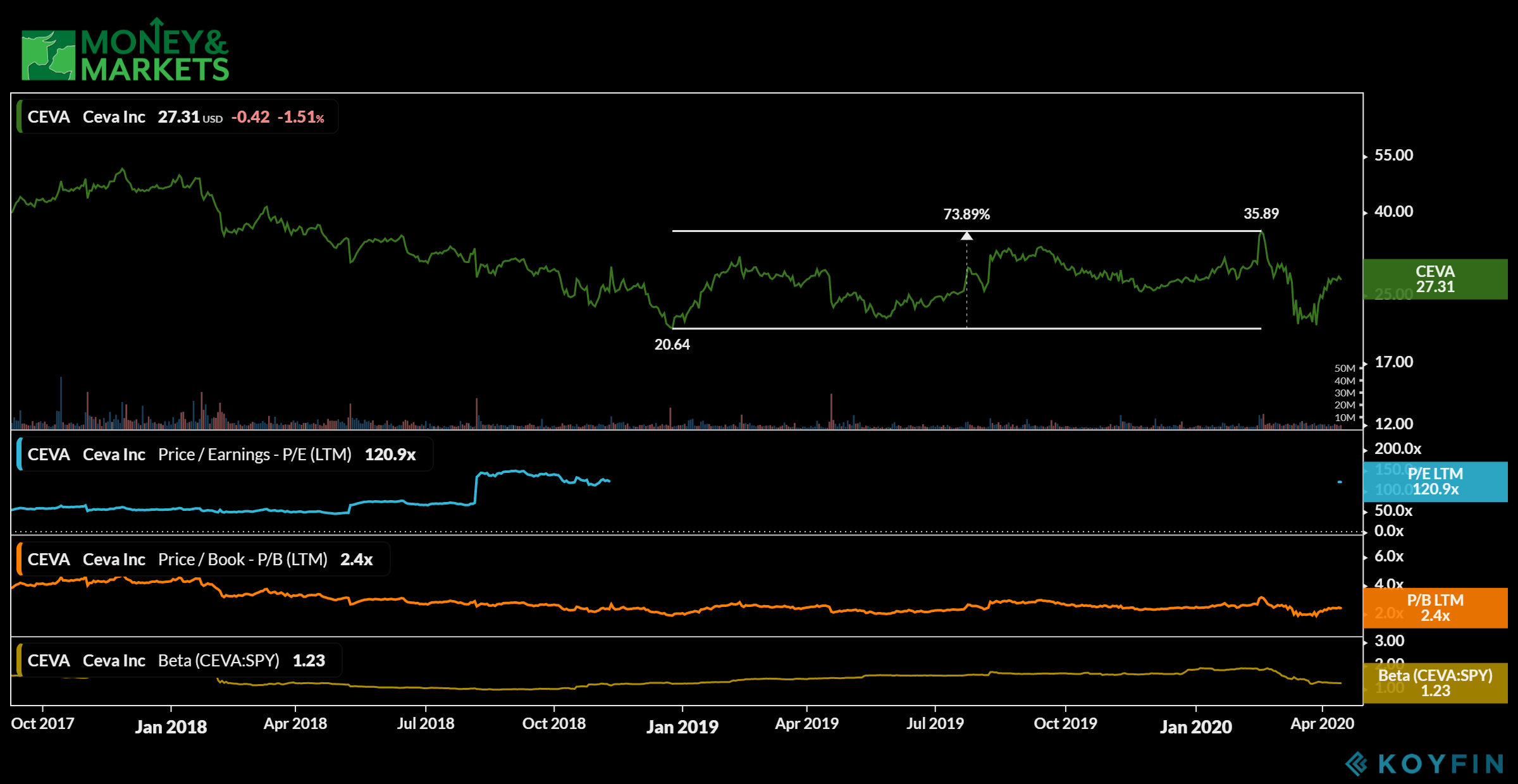

2. Ceva Inc.

Market Capitalization: $606 million

Annual Sales (2019): $87 million

Price-to-Earnings Ratio: 120.9

60-Month Beta: 1.23

The next company on our list is one of the leading developers for signal processing equipment.

Ceva Inc. (Nasdaq: CEVA) works with semiconductor companies to help create technologies for products like smartphones, automobiles and industrial machines.

Ceva also had a very good 2019, as its shares climbed more than 73%. However, the bottom fell out of the stock in March 2020 as it reached a 52-week low of around $21 per share.

Like other companies, it gained some of that back in late March into April, but it still remains a stock that is overvalued.

The company has a price-to-earnings ratio of 120.9 and a price to book of 2.4. Both are high for the market.

Its volatility is also a little high at 1.23.

But the biggest concern is Ceva’s price to cash flow. At 65.5, it is not as high as Advanced Micro Devices, but it is still very high.

Like ADV, it may be a good company to get into at a later time, but now isn’t it. The high price to cash flow makes Ceva Inc. one of the three semiconductor stocks to avoid in a market panic.

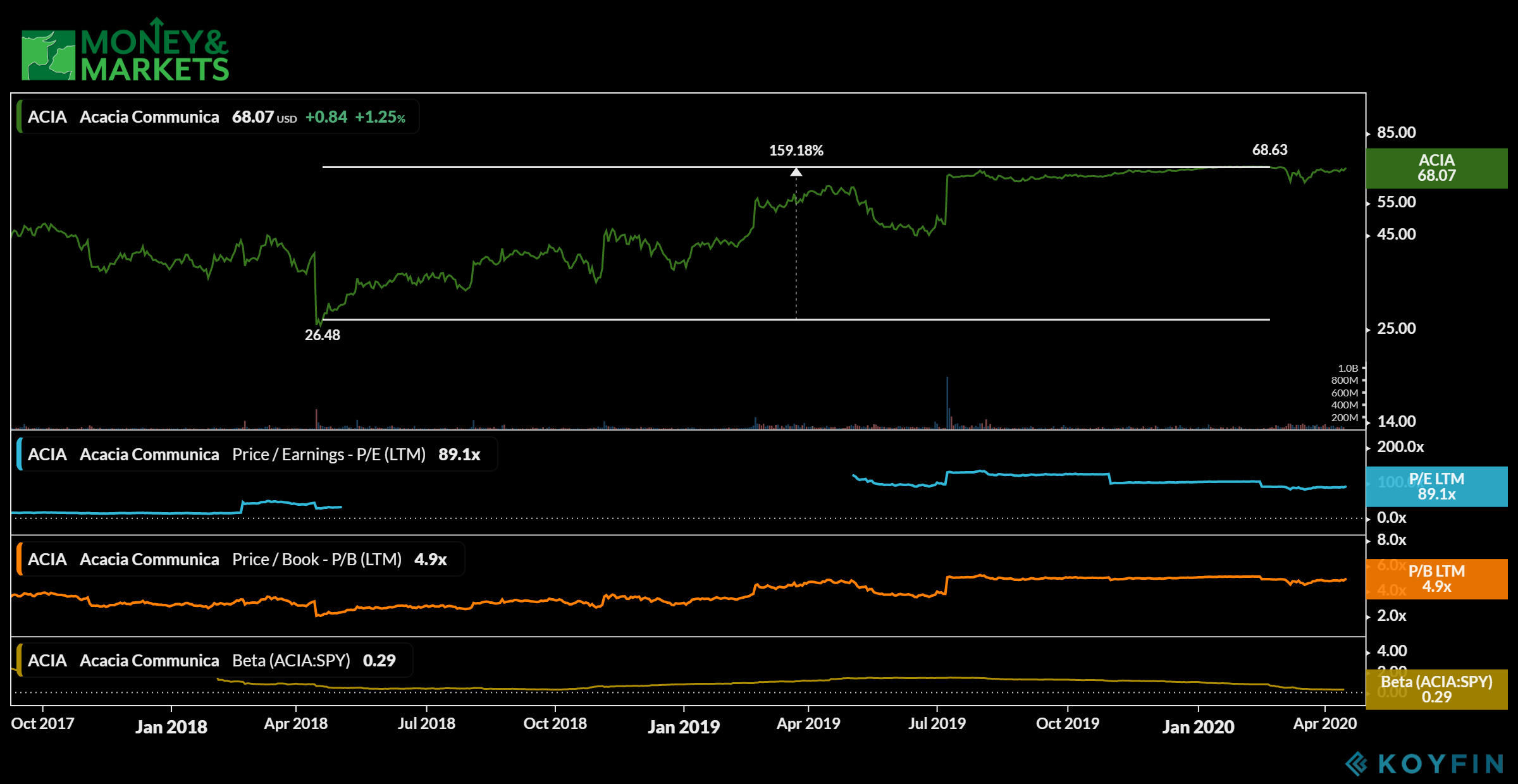

3. Acacia Communications

Market Capitalization: $2.8 billion

Annual Sales (2019): $464 million

Price-to-Earnings Ratio: 89.1

60-Month Beta: 0.29

Acacia Communications (Nasdaq: ACIA) is a company in a similar position as Ceva Inc.

The Massachusetts-based outfit designs, develops, manufactures and markets communication equipment.

From April 2018 to February 2020, Acacia stock jumped more than 159%. Remarkably, its March drop was nearly unnoticeable.

But the big issue with Acacia is that since it reached a high in late 2019, it really hasn’t gone anywhere — up or down. It’s basically trading flat and has for some time.

Being flat has put the company is a precarious position of being overvalued. Its price-to-earnings ratio is at 89.1 and its price to book is close to 5.

Because it’s traded flat for so long, it does have low volatility — its 60-month beta is 0.29 — but it also doesn’t provide much in the way of upside for investors either.

That lack of upside potential is why Acacia Communications is one of the three semiconductor stocks to avoid in a market panic.

With the 5G revolution stalling because of the coronavirus lockdown, these companies are likely to continue to struggle.

It’s not to say that things won’t pick back up, but while the markets are still struggling to find a bottom, these are three semiconductor stocks to avoid in a market panic.

Editor’s note: Lancaster also wrote a story discussing 30 semiconductor chip stocks to buy now. Click here to check it out on BanyanHill.com.