It’s time to get on the fast track to stock profits — with the five things you need to make money this week … in just five minutes.

Let’s get started!

Market Losses Continue…

Last week was the worst week for the market since September.

The S&P 500 slid more than 3%, the Nasdaq dropped 3.5%, and the Dow fell 2.4%.

Today isn’t looking any better, as all three indexes were trading lower after the market opened. As I write, the Nasdaq is down 2.2%.

This week will be laden with economic and inflation data, from the release of February’s consumer price index on Wednesday to the University of Michigan’s consumer sentiment rating on Friday.

The market drop to start the week was spurred by President Donald Trump’s comments over the weekend that the economy was in “a period of transition.”

In addition to the market continuing to decline, 10-year Treasury bonds dropped six basis points lower.

All of this signals a potential stall in the U.S. economy.

One of the biggest decliners since Trump took office is Tesla Inc. (TSLA). The electric automaker has fallen for seven straight weeks — its longest losing streak in its 15 years as a public company.

Big banks are also falling amid the economic uncertainty, with JPMorgan Chase (JPM), Citigroup (C), Wells Fargo (WFC) and Morgan Stanley (MS) dropping in early Monday trading.

What Our Moneyball Economist Sees

Have you had a chance to check out Andrew Zatlin’s Moneyball Economics yet?

On Friday, he released a 7-minute video that’s a must-watch. (You can also read the transcript by following that link.) He breaks down what’s going on on both Wall Street and Main Street and how President Trump can respond.

While Andrew knows the future will not be all roses, he also sees massive opportunities emerging within this turbulent market.

So go ahead and watch the video, and then make sure you are subscribed to Moneyball Economics for more no-BS insights from Andrew.

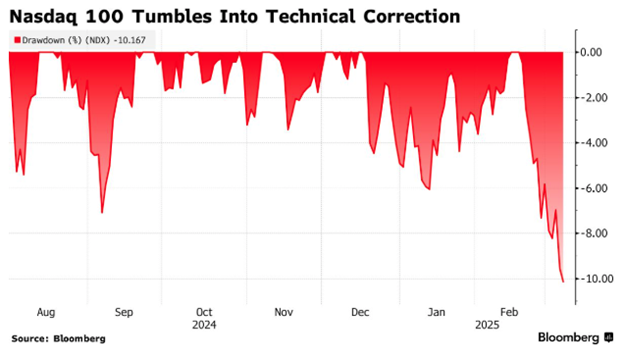

Nasdaq Enters Correction Zone

On Friday, the Nasdaq Composite index officially entered correction territory as mega and large-cap tech stocks continued to slide.

Led by drops in Nvidia Corp. (NVDA), Amazon.com Inc. (AMZN) and Microsoft Corp. (MSFT), the Nasdaq was down more than 10% from its peak hit in February.

Most of the drop can be tied to an unwinding of the artificial intelligence trade, despite monthly visits to OpenAI’s web-based chatbot ChatGPT climbing 83% year on year.

The Nasdaq extended the losses to kick off trading this morning.

AI Comes to the Battlefield

Amid all of the bad news surrounding tech stocks and the unwinding of the artificial intelligence trade, Palantir Tech. (PLTR), did have some good news last week.

The AI company rolled out the first two AI-enabled systems to the U.S. Army last week as part of a $178 million contract with the military.

According to Palantir, the Tactical Intelligence Targeting Access Node (TITAN) is a mobile ground station that uses AI to collect data from space sensors. This data will assist soldiers with warfare strategy and improve strike targeting and accuracy.

Palantir beat out RTX Corp. (RTX) for the contract last month to become the first software company to work as a primary contractor for a hardware program.

The contract with the military calls for a total of 10 TITAN systems to be deployed.

You Want More…

Thank you to everyone who participated in our latest survey!

We wanted to know what you all want more of in Money & Markets Daily, and two things led the pack in a big way. According to the poll, you all want more:

- Green Zone Power Ratings.

- And analysis from our experts.

Unique investing strategies and systems rounded out the Top 3.

It’s clear we have some enthusiastic investors! Everyone on the team is excited to address these topics in everything we do at Money & Markets.

Thank you again to everyone taking the time to participate in our surveys.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets