Stocks are a risky investment. Every investor knows that. That’s why experts advise holding a diversified portfolio that includes bonds.

Bonds provide income and safety, in theory. But with rates at all-time lows, the risk in bonds rose to an all-time high.

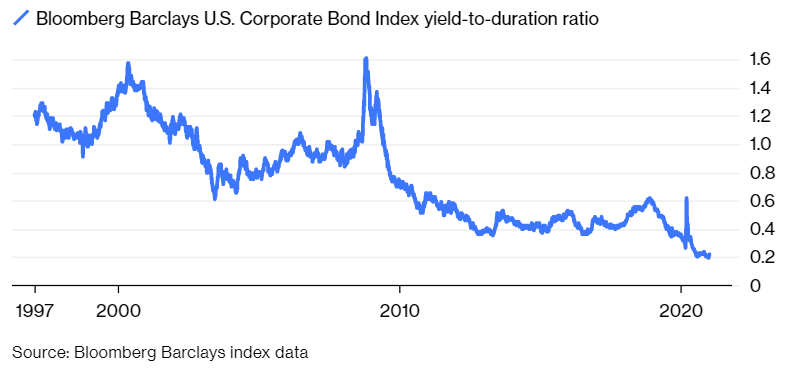

One of the simplest measures of the risk in bonds is the Sherman Ratio. This little-known metric shows how much interest rates need to rise to destroy one year’s worth of income.

As rates dropped last year, the Sherman ratio on high-quality corporate bonds stands at 0.20. That’s the lowest reading since 1997, and lower values are riskier than higher values.

Sherman Ratio Shows High Risk for Bonds

Source: Bloomberg.

If Rates Rise a Quarter Point, Over $7 Trillion Could Be Destroyed

This chart shows that corporations are behaving rationally. As rates fell, they issued bonds with more time to maturity. This mirrors the behavior of many consumers who have locked in 30-year mortgages at low rates.

But, based on the Sherman Ratio, it is possible to argue that investors are behaving irrationally. They are taking on more and more risk for less and less income.

The current trend in rates indicates these irrational buyers may be in for more pain.

Yields on 10-year Treasury notes recently topped 1.1%, more than double August’s low of 0.52%. Corporate bonds generally move in the same direction as Treasurys, and yields on corporates have risen over that same time.

The increase in rates has cost investors dearly. As rates rise, the price of bonds decline. This relationship exists because once bonds are issued, they trade in the secondary market providing liquidity for investors who might not want to hold the bonds to maturity. But it means that old bonds must be priced competitively against newly issued bonds.

If new bonds are being issued at higher rates, older bonds must drop in price so that investors can pay less and receive an amount of income equivalent to the new bonds.

According to Bloomberg, with the Sherman Ratio at 0.2, investors will lose $6.75 trillion when rates rise 0.2%.

A quarter-point move by the Federal Reserve would destroy more than $7 trillion in wealth in corporate bonds along with trillions more in the Treasury market. Those losses could spark a sell-off in stocks, destroying trillions more in wealth.

The Fed doesn’t want to spark panic and is unlikely to act soon. But rates can still rise as traders worry about inflation in the face of the Fed’s inaction.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.